Market Moments That Matter | Pack Early for Your Next Capital Raise Excursion

Intrepid Banker Insights

SEPTEMBER 18, 2024

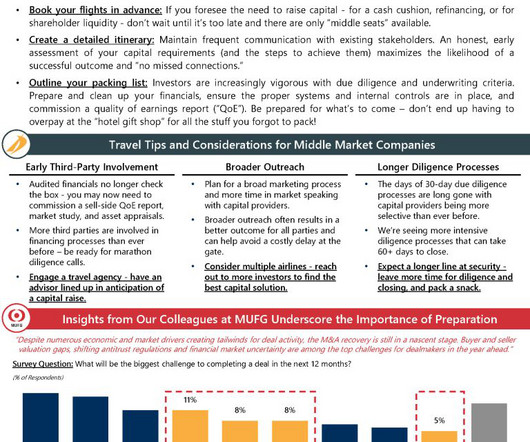

Intrepid Investment Bankers Market Moments That Matter | Pack Early for Your Next Capital Raise Excursion Intrepid Capital Advisory MARKET MOMENTS THAT MATTER Planning and preparation are just as important in raising capital as they are in travel. Read more in our monthly Market Moments That Matter.

Let's personalize your content