M&A Blog #10 – equity (accretion / dilution)

Francine Way

MAY 18, 2017

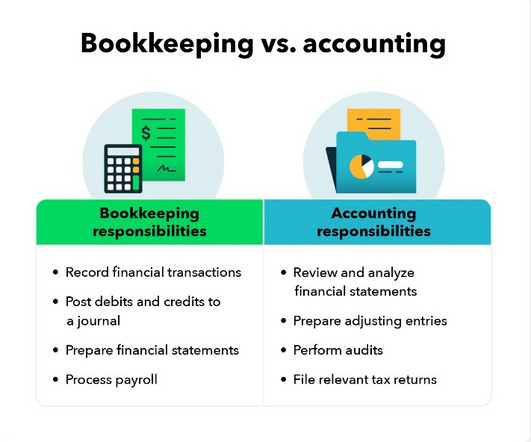

I chose a public company for this exercise because private company financial statements don’t immediately lend themselves to the accretion / dilution analysis that we are about to review. Public company audited financial statements typically receive a good deal of scrutiny from accountants, equity analysts, and regulatory agencies.

Let's personalize your content