How M&A boutique Evercore became ‘Goldman North’

Financial Times - Banking

MARCH 12, 2024

The New York investment bank is narrowing the gap with its downtown Wall Street rival

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Financial Times - Banking

MARCH 12, 2024

The New York investment bank is narrowing the gap with its downtown Wall Street rival

iMerge Advisors

APRIL 10, 2025

Summary of: Who Are the Best M&A Advisors for Tech Companies? This article explores what makes an M&A advisor truly effective in the tech sector, highlights key players across different deal sizes, and offers guidance on how to evaluate the best fit for your companys unique goals.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

iMerge Advisors

APRIL 9, 2025

Summary of: Who Are the Best M&A Advisors for Tech Companies? This article explores what makes an M&A advisor truly effective in the tech sector, highlights key players across different deal sizes, and offers guidance on how to evaluate the best fit for your companys unique goals.

Financial Times - Banking

MAY 22, 2023

Boutique investment bank’s independence ends after 27 years

Financial Times - Banking

JANUARY 5, 2025

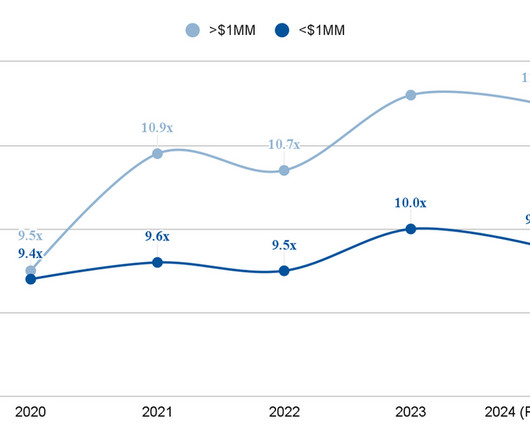

Boutiques counting on M&A rebound to support elevated valuations and star hires

How2Exit

JUNE 26, 2023

Kison Patel, CEO and founder of M&A Science, is an expert in the M&A industry. He provides the best crowdsource-based educational resource and technology solutions to the M&A industry. According to Kison, the M&A industry has traditionally been finance-focused.

Global Newswire by Notified: M&A

SEPTEMBER 9, 2024

SMC Entertainment Enters Letter of Intent to Acquire Boutique Investment Manager, Bateau Asset Management.

Focus Investment Banking

JULY 17, 2024

2Q 2024 M&A Report : This quarter there was a noticeable increase in demand for specialized business services within middle market M&A transactions. This period also saw a rise in competition, with boutique consulting firms focusing on specific niches and providing innovative strategies to adapt to changing market conditions.

Focus Investment Banking

APRIL 30, 2024

1Q 2024 M&A Report : In the first quarter of 2024, middle market M&A transactions saw a surge in demand for specialized business services, ranging from due diligence to post-merger integration strategies. Download the full report here.

Wizenius

JULY 9, 2023

The choice between working in a bulge bracket investment bank or a boutique investment bank depends on individual preferences and career goals. Specialization and Niche Expertise: Boutique IB Firms specialize in specific industries or sectors, offering in-depth knowledge and tailored advice.

Global Newswire by Notified: M&A

JANUARY 8, 2025

SMC Entertainment Closes Acquisition of Boutique Investment Manager, Bateau Asset Management.

Peak Frameworks

OCTOBER 4, 2023

Texas A&M is a public, land-grant research university located in College Station, Texas. Texas A&M is the largest school in the U.S. Texas A&M also has a highly-renowned athletics program and student life. Texas A&M has a respectable Presence score of 41% and an Elite Firm Hires % of 48%. Welsh III U.S.

Sica Fletcher

MAY 29, 2024

M&A transactions for insurance companies are part of a robust but complicated market that requires ingesting a great deal of data in order to fully understand. While insurance M&A did see slight dips in deal volume and average value (Fig.2)

Sun Acquisitions

AUGUST 21, 2024

This is where mergers and acquisitions (M&A) come into play. This is where mergers and acquisitions (M&A) come into play. For instance, a general sign manufacturer acquiring a boutique firm known for bespoke signage can leverage the acquired talent to deliver more creative and customized solutions.

Solganick & Co.

MAY 13, 2024

May 13, 2024 – Los Angeles Business Journal – by Taylor Mills Solganick Says M&A is Back Los Angeles-based boutique investment banking firm Solganick & Co. We continue to see a stronger M&A environment this year and continuing into next year, regardless of any interest rate movement by the Federal Reserve.

Sica Fletcher

JULY 31, 2024

The 2024 insurance M&A market has changed substantially from just a few years ago, with potentially staggering implications for the future of insurance M&A transactions. Insurance M&A Transactions in 2024 The insurance M&A transactions we have observed thus far in 2024 indicate larger trends in the sector.

Focus Investment Banking

SEPTEMBER 3, 2024

Simplifying the M&A process with a well-vetted team When it comes to mergers and acquisitions, your investment banker shouldn’t be the only member of your team you are closely vetting. A great M&A team should also be made up of a great set of attorneys—both inside and outside your organization. in the winter of 2024.

Mergers and Inquisitions

NOVEMBER 22, 2023

Bulge Bracket Bank Definition: The “bulge brackets” are the largest global banks that operate in all regions and offer all services – M&A, equity, debt, and others – to clients; they work on the biggest deals (usually $1 billion+) and have divisions for sales & trading , equity research , wealth management , corporate banking , and more.

Chesapeake Corporate Advisors

APRIL 8, 2024

The Bad News Is Not So Bad Rising interest rates and economic uncertainty have tamped down the M&A frenzy that peaked in 2021. The Bad News Is Not So Bad Rising interest rates and economic uncertainty have tamped down the M&A frenzy that peaked in 2021. The fact is that great deals are still happening for A+ companies.

Global Newswire by Notified: M&A

OCTOBER 7, 2024

ProductLife Group (PLG) is pleased to announce the acquisition of IntiQuan AG, a premier Swiss boutique specializing in pharmacometric services.

Chesapeake Corporate Advisors

OCTOBER 31, 2023

However, when it comes to M&A, cash alone does not tell the full story. In M&A transactions, the focus shifts from cash to a broader view of a company’s financial health. Here’s the intriguing part: NWC in M&A typically doesn’t include cash in the calculation. For many entrepreneurs, cash is king.

Mergers and Inquisitions

FEBRUARY 2, 2022

I did not expect to revisit investment banker salary and bonus data for a while, but the banks ruined my plans by changing base salaries multiple times in less than a year. Unfortunately, that has made it difficult to determine the “average ranges.”. As a result, I am listing below the new base salary ranges for U.S.-based Is it $80K + $85K = $165K?

Benchmark International

APRIL 19, 2023

Our managing partner, Kendall Stafford, has been awarded the SHE for SHE Leader award by the Global M&A Network's Fifth Annual Top USA Women Dealmakers awards. The SHE for SHE Woman Leader award honors an influential woman from the private equity, venture capital, M&A, and restructuring transactional communities.

Equiteq

JANUARY 15, 2025

As we prepare to celebrate our 20th anniversary, we have not only achieved record-breaking results but also strengthened our position as the leading global sector boutique, delivering exceptional M&A outcomes in the tech services and consulting industries across all our regions.

OfficeHours

JANUARY 15, 2024

Results stay anonymous Yes, I’m hoping there are many opportunities available Open to seeing opportunities but I don’t need to move Not really looking to recruit Wall Street banks want to forget about 2023. Let’s be honest, 2023 went by in a flash and it wasn’t the most exciting year in the market. But 2024 may not be much better.

Solganick & Co.

FEBRUARY 2, 2024

– Quoted in the Los Angeles Business Journal M&A Hesitation: Banker Fears ‘Rose-Colored Glasses’ Syndrome BY STEVE CRIGHTON FEBRUARY 2, 2024 – Los Angeles, CA – Aaron Solganick, CEO and Founder of Solganick & Co. And they’re realizing they need to do an M&A transaction,’” he added.

Growth Business

OCTOBER 25, 2024

In my experience, with eight years as a mid-market M&A advisor, SMEs traditionally trade for between four and seven times their profitability. In my experience, with eight years as a mid-market M&A advisor, SMEs traditionally trade for between four and seven times their profitability.

Global Newswire by Notified: M&A

MARCH 14, 2024

NEW YORK, March 14, 2024 (GLOBE NEWSWIRE) -- ZRG , one of the world’s most rapidly growing global talent advisory firms, today announced its acquisition of Wiser Partners , a retained executive search firm headquartered in Cincinnati, OH, with offices across the U.S.

Global Newswire by Notified: M&A

FEBRUARY 18, 2025

Luxury boutique brokerage moves 50 agents to the eXp Luxury division with plans to expand within eXps innovative model BELLINGHAM, Wash.,

OfficeHours

FEBRUARY 9, 2024

Not only did the groups do completely different things (RX/bankruptcy vs. tech M&A), but even the deal processes ran differently. Intention to Lateral? How To Navigate Multiple Offers and Move ASAP Coming from a non-target school, investment banking jobs were coveted roles that were few and far between.

Mergers and Inquisitions

OCTOBER 16, 2024

a summer internship that converts into a full-time offer vs. a boutique internship in your 1 st or 2 nd year of university). a summer internship that converts into a full-time offer vs. a boutique internship in your 1 st or 2 nd year of university). They don’t reflect market changes over time.

OfficeHours

OCTOBER 16, 2023

If you’re a ‘ new kid on the block ’ in the world of finance, you might have thought about what it’s really like to work on the Buyside and if all the excitement is true. People often say not to mess up an interview because it could affect your chances for more opportunities in the future. Take advantage of our October Promotion! Just do it.

Sica Fletcher

AUGUST 21, 2024

Sica | Fletcher has been providing M&A advisory services to agencies and brokerages of all sizes for a decade. In that time, we’ve represented thousands of clients and quickly became one of the most active boutique M&A advisory firms in the market today. Do You Need An Insurance Agency Investment Bank?

Sun Acquisitions

JULY 6, 2022

Boutique brokerage firms like Sun Acquisitions pride themselves on providing one-on-one business broker services, dedicating as much time as needed to help you in your endeavor. Selling a business is tough. It’s not for the faint of heart. But just how do you go about finding the right broker? What are the broker’s credentials?

Chesapeake Corporate Advisors

MAY 6, 2024

Baltimore, MD, May 7, 2024 – Chesapeake Corporate Advisors (CCA), a boutique investment banking and corporate advisory firm in the Mid-Atlantic region, announced that Timothy Brasel has been named a Managing Director in the firm’s investment banking group. His track record of advising on more than 40 closed transactions totaling over $1.5

Mergers and Inquisitions

MAY 10, 2023

Asia-Pacific sees ~$1+ trillion of M&A deal activity per year , and SE Asia accounts for only ~10% of that (note that the first image below is only for 9 months of the year, so the full-year numbers are higher): $50 – $100 billion of M&A deal activity per year may seem like a lot, but it’s less than Canada in an average year.

How2Exit

OCTOBER 9, 2023

Ron rn rn rn About The Guest(s): Simon Bedard is the founder and CEO of Exit Advisory Group, a boutique M&A firm in Australia. rn Summary: Simon Bedard is the founder and CEO of Exit Advisory Group, a boutique M&A firm in Australia. He is also the host of the Buy, Grow, Sell podcast.

The TRADE

JUNE 19, 2023

Fixed income investment banking boutique KNG Securities appointed Fernando Ortega as its new head of emerging market sales. M&G’s global asset management arm appointed Manabu Fujita as head of M&A Investments Japan. He also spent several years at Goldman Sachs in a risk management and product control role.

How2Exit

JULY 29, 2024

E234: Helping Business Owners Achieve Successful Exits: Proven Strategies for a Smooth Transition - Watch Here About the Guest(s): Christine McDannell is the founder and principal intermediary of The Magnolia Firm, a boutique business brokerage firm. based clients. Notable Quotes: "It's still a super hot seller's market, which is amazing."

OfficeHours

JULY 4, 2023

Going to keep today rather simple — we want to celebrate and kick off the second half of the year with a simple offer for the first 10 people that take advantage of the below — PE Platform Access for $225 OFF = $74 out of pocket for lifetime access Our flagship program has placed mentees into most major private equity firms since launching in 2020.

The Deal

FEBRUARY 7, 2024

Katz’s comments come after the company on May 22 announced the acquisition of New York-based boutique investment bank Greenhill & Co. 33 on The Deal’s first-quarter M&A league tables, with Greenhill, which ranked No. 38 in M&A. 38 in M&A. Mizuho Financial Group Inc. has its eye on the U.S.

Mergers and Inquisitions

DECEMBER 20, 2023

Internships at regional boutique banks. If you want to know how to get an investment banking internship, it’s simple: Start very, very early and have a great “Plan B” if something goes wrong. By the time internship applications open in Year 2 of university – whether that’s in the middle or beginning (!) and ideally a bit higher.

Global Newswire by Notified: M&A

DECEMBER 21, 2023

a boutique self-storage and commercial real estate advisory firm, along with their client, Strategic Storage Growth Trust III, Inc. IRVINE, Calif., 21, 2023 (GLOBE NEWSWIRE) -- Talonvest Capital, Inc., SSGT III”), a private real estate investment trust sponsored by an affiliate of SmartStop Self Storage REIT, Inc.

Sica Fletcher

JUNE 11, 2024

The Insurance Brokerage M&A Market in 2024 On average, insurance brokerages are seeing the highest valuations they’ve had in a decade. Until this happens, we expect the insurance broker M&A market to remain active but complicated. Since H1 2023, the average insurance brokerage valuation multiple has hovered around 11.6x

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content