Growth Strategies for ServiceNow Boutiques | Equiteq Insights

Equiteq

JULY 22, 2024

Jerome Glynn-Smith, the Head of Europe for Equiteq in London, recently shared highlights from our webinar, co-hosted with iconica.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Equiteq

JULY 22, 2024

Jerome Glynn-Smith, the Head of Europe for Equiteq in London, recently shared highlights from our webinar, co-hosted with iconica.

H. Friedman Search

APRIL 11, 2024

There seems to be a common pattern among public finance firms, whether they be investment banks, regional banks, boutiques, or large and small law firms. I can share that the hiring process is and will occur – but not in the expected time you may be used to. What’s the pattern? The common thread is no one is hiring quickly.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Mergers and Inquisitions

FEBRUARY 2, 2022

Benefits: Finally, you’ll get health insurance, vacation days, and potential participation in the firm’s profit-sharing or 401(k) retirement plans. Meanwhile, some elite boutique banks , such as Centerview, went up to $130K for Year 1 Analysts (!). These are useful in the U.S. Investment Banker Salary and Bonus Levels: Analysts.

How2Exit

JULY 29, 2024

E234: Helping Business Owners Achieve Successful Exits: Proven Strategies for a Smooth Transition - Watch Here About the Guest(s): Christine McDannell is the founder and principal intermediary of The Magnolia Firm, a boutique business brokerage firm.

OfficeHours

OCTOBER 31, 2023

small boutique) “ Last thing you want to be is STUCK in a DOWN-CYCLE being a banking analyst thinking I should’ve recruited before when there were more opportunities.” Watch this clip, in which Anthony, one of our former mentees, talks about and shares his viewpoint on PE in general (the hiring process, the experiences he had, etc.),

How2Exit

OCTOBER 9, 2023

Ron rn rn rn About The Guest(s): Simon Bedard is the founder and CEO of Exit Advisory Group, a boutique M&A firm in Australia. rn Summary: Simon Bedard is the founder and CEO of Exit Advisory Group, a boutique M&A firm in Australia. He is also the host of the Buy, Grow, Sell podcast.

OfficeHours

JUNE 2, 2023

If we are specifically talking about highly coveted firms such as elite boutiques and bulge bracket investment banks, the success rate of interviews is in the single digits, even for target school candidates. With all the great options out there – what is the best one to choose? Are you preparing for the buyside?

OfficeHours

JUNE 30, 2023

this buyout will be a private takeover), you may instead be given (or have asked for) the share price and number of shares outstanding. small boutique) “ Last thing you want to be is STUCK in a DOWN-CYCLE being a banking analyst thinking I should’ve recruited before when there were more opportunities.” WHY CHOOSE US?

Growth Business

OCTOBER 25, 2024

To determine the value of the shares specifically, you need to adjust for the debt and cash in the business. Where you end up in the range (or if you are on outlier outside that) depends on the nuances of your business and the investment process you are running.

Razorpay

SEPTEMBER 27, 2024

Streamlined Store Sharing Share your products effortlessly using direct links, making it easy to promote items through WhatsApp, social media, or email. Add rich text, images, and media to showcase your products, and use social sharing features to promote your store easily across platforms like WhatsApp, social media, and email.

The TRADE

DECEMBER 29, 2023

The Group said the move will help it to reap the benefits of a “global multi-boutique model” as well as a global distribution team in asset management. Among the asset management bands that were merged were Perpetual, Pendal, Barrow Hanley, J O Hambro, Regnan, Trillium and TSW.

Mergers and Inquisitions

MARCH 22, 2023

per share when it was trading above $8.00 Before this deal, I had expected that “CS First Boston” would become another elite boutique and a strong competitor to the likes of Evercore, Lazard, and Moelis. With the retreat of both CS and UBS, these firms’ market shares in Europe and Asia will continue to grow. a year ago?

Chesapeake Corporate Advisors

JULY 10, 2023

This acquisition brings together two highly respected firms with a shared commitment to delivering innovative solutions to our clients,” said WBCM President Marco Legaluppi. “We With 225 dedicated employees, WBCM will join the TranSystems national 1,500-person workforce. “We

Peak Frameworks

MAY 2, 2024

For example, a boutique seamstress may consign their goods to a clothing store to sell their goods in order to reach more customers. This arrangement is governed by a consignment agreement, a crucial document that outlines the terms of the relationship, including inventory management, revenue sharing, and responsibilities of each party.

Razorpay

FEBRUARY 22, 2024

Whether you’re a small boutique or a multi-store retail chain, auto fetch offers very tangible benefits that translate into real results. This cool new feature eliminates the need for the cashier to manually ask for the customer’s phone number and ensures that the digital bill is sent to the correct phone number.

Chesapeake Corporate Advisors

OCTOBER 24, 2022

The company’s comprehensive suite of interactive patient engagement tools promotes shared decision making and improves health outcomes for patients. To learn more, visit www.rendia.com. About PatientPoint PatientPoint ® is the patient engagement platform for every point of care. Learn more at www.patientpoint.com.

Software Equity Group

MARCH 21, 2023

There is a wide variety of early-stage lenders: large institutional investors, boutique specialist lenders, and high-net-worth individuals are common sources of debt financing. In contrast, others are interested in liquidating 100% of shares in a sale and exiting the company.

Mergers and Inquisitions

JULY 12, 2023

This startup claims that its service can boost Analyst productivity by 30% and generate millions in extra fees for the average bank, and it plans to sell it to boutique banks for $2,000 per month. They want a $2 million seed investment at a $20 million post-money valuation, meaning that we (the VCs) will own 10% if we invest.

Peak Frameworks

MAY 22, 2023

Condominiums Individual units within a larger building or complex, where owners share common areas and amenities. Townhouses Row houses, often with multiple stories and shared walls, like the historic Painted Ladies in San Francisco. For example, the luxury high-rise condominiums in Miami's Brickell neighborhood.

Wizenius

MARCH 25, 2023

If the company is not an FX boutique or exchange, FX gains and losses typically are not part of the company's EBITDA. 10) Share-based compensation Share-based compensation refers to stock options or other equity awards given to employees as part of their compensation package. billion.

Mergers and Inquisitions

OCTOBER 18, 2023

so you may look up stats on recent issuances and share them with the lead team – but you are not heavily involved in the process. If this same $1 billion company went public in an IPO, it might sell 10 – 20% of its shares to investors. If it’s a 5-person regional boutique , take the BB capital markets offer.

Mergers and Inquisitions

SEPTEMBER 13, 2023

Distressed Debt Non-Control – Buy Debt to gain influence in the restructuring or bankruptcy process and earn a huge gain upon repayment – or get common shares in a debt-for-equity swap and sell the shares at a profit. Two relevant internships in 1L and 2L, such as at a restructuring boutique bank and a PE or credit-related one.

Chesapeake Corporate Advisors

JUNE 2, 2023

And private equity (PE) groups still have a great deal of dry powder to deploy, leading them in search of quality companies. The challenge for lower and middle market government contractors is how to capture their share of this market interest.

How2Exit

MAY 23, 2023

Richard grew up in the suburbs of New York City and went to college, later working for a boutique investment bank. Ron Concept 1: Adapt To Uncertain Times. In today's world, uncertainty is a constant. It can be difficult to navigate the ever-changing landscape of the business world, but it is possible to adapt to uncertain times.

Growth Business

APRIL 16, 2024

Event: Independent Hotel Show Date: 15-16 October 2024 Location: Olympia, London, W14 8UX Website: www.independenthotelshow.co.uk/ Brief: An event dedicated entirely to the sector of luxury and boutique hoteliers. It will features over 350 hotel-focused exhibitors, suppliers, designers and industry experts.

Chesapeake Corporate Advisors

MAY 24, 2024

The transition is most effective when the investor and the business owner share a common vision for the company’s future. These investors acquire a majority or full stake in the business, facilitate the transition to a new or expanded management team, and implement strategies to drive growth and sustainability.

The TRADE

OCTOBER 26, 2023

UK-based boutique fixed income trading desk BlueBay Asset Management is beginning a new chapter in its life. Banks are always looking to win market share and employ the best people, so if needs be they will pay up for the right person and that can cause a kneejerk reaction and a merry go round of trader moves.”

Cleary M&A and Corporate Governance Watch

MARCH 4, 2024

Factual Background At the center of the case is boutique investment bank Moelis & Company and the stockholder agreement that it entered into with its eponymous founder (the “Founder”) just prior to its IPO in 2007. shall be managed by or under the direction of a board of directors, except as may be otherwise provided in. its charter.”

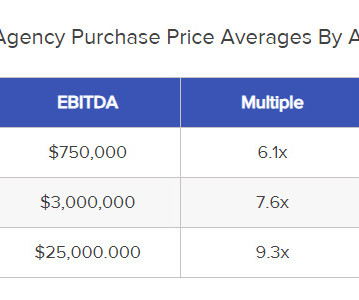

Sica Fletcher

JUNE 14, 2024

new technology, active competitors, regulatory/compliance changes) can affect the market shares of all participants. Sica | Fletcher is the #1 M&A advisory firm for insurance agencies on the market today, representing everything from boutique agencies to $1B deals. Developments within the insurance industry (e.g., Interest Rates.

Mergers and Inquisitions

MARCH 13, 2024

the Founders sell some shares to take money off the table, but “the company” doesn’t get any of that cash). Also, you can get in more easily from a middle-market or boutique bank. Most companies are already profitable, the potential returns are lower, and there’s usually a large secondary component (i.e.,

Mergers and Inquisitions

AUGUST 16, 2023

Working at the bulge brackets or elite boutiques is better for international funds, while IB experience at the top Chinese banks (CICC, CITIC, Huatai, Haitong, etc.) Investment Banking Experience at Bulge Bracket or Top Domestic Banks – As with PE anywhere, you need a few years of IB experience to be competitive in most cases.

How2Exit

JUNE 26, 2023

12 Concepts We Can Learn About __ From How2Exit's Interview W/ Kison Patel - Watch Here Here is what my team and I learned from this interview: (These are notes from team members, writers, sometimes AI, and even listeners who submitted what i learned loosely edited and shared here) - If it seems a bit unrefined, you're reading our notes, so.

Mergers and Inquisitions

SEPTEMBER 11, 2024

The key drivers for wind turbine manufacturers are raw material and labor costs, demand for new wind farms, and overall competition and market share. Among the elite boutiques , Evercore and Lazard have traditionally been strong, but Moelis and Guggenheim also have significant deal flow. but they are less consistent than those above.

The TRADE

OCTOBER 9, 2023

Beginning her career on the buy-side at boutique asset manager Credit Suisse First Boston as an investment portfolio analyst in London in 1986, Ruffles has seen the markets through several highs and lows. A novel concept to greener traders.

Sica Fletcher

MAY 8, 2024

Other times, they are hoping to use their share of the sale to alleviate personal debt. Sica | Fletcher is the first and only boutique M&A firm to manage deals over $1B and consistently outrank our competitors as the top insurance M&A advisory firm every year. Are looking for a career change.

Mergers and Inquisitions

APRIL 19, 2023

Precious metals miners earn much less revenue than companies that focus on copper or steel, but the sector gets a disproportionate share of M&A activity because of the factors above. The elite boutiques do not have a huge presence in mining, but you’ll sometimes see Rothschild or Perella Weinberg on the list. Anglo-American (U.K.),

The TRADE

JANUARY 3, 2024

Boutique independents and the largest financial services providers co-exist in this burgeoning space which has some elements of comradery and others of fierce rivalry. The service provider landscape for outsourced trading is made up of an eclectic mix of firms.

Mergers and Inquisitions

DECEMBER 4, 2024

Among the bulge brackets , Goldman Sachs and JP Morgan should be at the top of this list now that they have dedicated teams (plus their existing reputations and market shares). Outside the bulge brackets, many elite boutiques also advise on sports deals: PJT, Moelis, Evercore, and Rothschild (more so in Europe) are all examples.

OfficeHours

SEPTEMBER 2, 2023

I learned a lot about myself but then also pursuing the opportunity and prioritizing my career was my #1 priority which is clearly paying off with the opportunities people are sharing with me now.” Why San Francisco Was The Best Decision Of My Life Explore the city by the bay!

How2Exit

APRIL 29, 2024

rn Justin shares valuable insights into the challenges and opportunities that come with buying, scaling, and selling online businesses. rn rn rn He reflects on the experience of scaling a business and later selling his shares to step into mergers and acquisitions. rn rn rn Notable Quotes: rn rn rn "Put yourself in their shoes.

How2Exit

JANUARY 13, 2025

Further embedding himself in the market, he gained experience at a boutique M&A advisory firm where he honed his skills in B2B lead origination. He shares insights on generating leads for private equity and how DealGen Partners earns from such transactions, emphasizing their success-fee-based approach over pre-arranged retainers.

Razorpay

DECEMBER 23, 2024

As we celebrate this milestone, were thrilled to share this success with the folks who made all of this possible. This initiative embodies our commitment to sharing the success weve built together. Heres to the next chapter of shared success and boundless opportunities. From our first ESOP buyback in 2018 to the Rs.75

Growth Business

OCTOBER 31, 2024

Use LinkedIn to identify connections that are shared with target investors. Equally important are shared values. Michael Goodwin is co-founder at boutique recruitment investors, Jigsaw Equity More on investment How much equity should you give away when taking investment for growth?

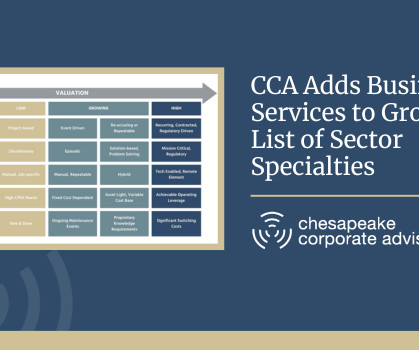

Chesapeake Corporate Advisors

MARCH 11, 2025

CCA recognizes that middle-market Business Services companies face formidable growth obstacles, including difficulty attracting top talent and keeping up with the technology and other resources required to remain competitive and grow market share.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content