Insurance Broker Valuation Multiples: Q3 2024 Projections

Sica Fletcher

JUNE 11, 2024

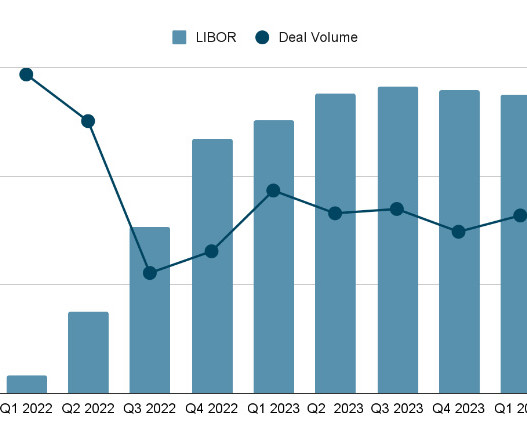

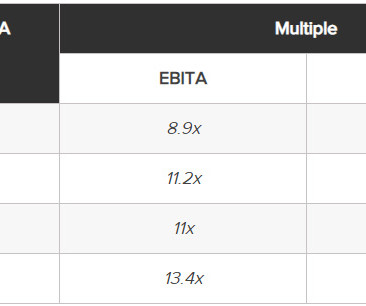

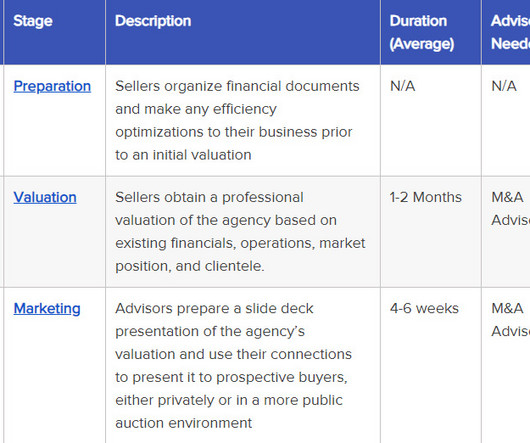

The following report contains our projections for Q3 2024 insurance broker valuation multiples. In addition, we categorize this data according to insurance industry specialization and by brokerage size, as measured by their annual revenue. the mandatory nature of insurance in general, b.)

Let's personalize your content