Protect Pharmaceutical Corp. Issues Corporate Update

Global Newswire by Notified: M&A

JULY 1, 2024

Protect Pharmaceutical Corp. Issues Corporate Update.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Global Newswire by Notified: M&A

JULY 1, 2024

Protect Pharmaceutical Corp. Issues Corporate Update.

Global Newswire by Notified: M&A

SEPTEMBER 26, 2024

26, 2024 (GLOBE NEWSWIRE) -- Dundee Corporation (TSX: DC.A) (the “Company” or “Dundee”) announced today that it has sold to a private investor 8,000 of the 1,015,008 shares it holds in TauRX Pharmaceuticals Ltd. TORONTO, Sept. TauRx”) at a price of US$125 per share for proceeds to the Company of US$1,000,000.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Global Banking & Finance

OCTOBER 9, 2024

77% of UK business leaders consider the annual corporate Christmas party the most important work event of the year, emphasising its significance in the corporate calendar.

JD Supra: Mergers

JULY 10, 2024

30, 2024) - Stockholder representatives of an acquired corporation brought claims alleging that defendants had failed to use contractually-required commercially reasonable efforts to commercialize an acquired drug asset for a particular use. Cephalon, Inc., 2018-0075-SG (Del. By: Morris James LLP

JD Supra: Mergers

JANUARY 22, 2024

Boston Scientific Corporation (“Boston Scientific”) announced on January 8 that it has entered into a definitive agreement to acquire Axonics, Inc. Morgan Healthcare Conference in San Francisco, which also saw the announcement of major acquisitions by large players in the pharmaceutical space. By: Knobbe Martens

JD Supra: Mergers

DECEMBER 1, 2023

The Department of Justice continues to make clear that one of its principal corporate enforcement priorities is encouraging companies to voluntarily self-disclose misconduct.

Global Newswire by Notified: M&A

JULY 2, 2024

July 02, 2024 (GLOBE NEWSWIRE) -- Semnur Pharmaceuticals, Inc. a Cayman Islands corporation and special purpose acquisition company (Nasdaq: DECA, “SPAC”), today announced the signing of a letter of intent for a proposed business combination, which provides for a pre-transaction equity value of Semnur up to $2.0 PALO ALTO, Calif.,

Peak Frameworks

SEPTEMBER 19, 2023

In the world of finance and corporate responsibility, two terms frequently arise: "stakeholder" and "shareholder." A shareholder is an individual or entity that owns shares or stock in a corporation. What is a Shareholder? By virtue of their ownership, they possess a direct financial interest in the company's success.

Global Newswire by Notified: M&A

JULY 19, 2023

Ltd (“IPK”) (the “Transaction”).

Devensoft

MAY 25, 2023

Corporate restructuring can be a game-changer for any organization, whether it’s a merger, acquisition, or any other strategic move. We, at Devensoft, help companies with their end-to-end M&A and have worked with several clients in the corporate sector to navigate this complex process.

Global Newswire by Notified: M&A

MARCH 5, 2024

Formed through the combination of two legacy animal health providers (Fujita Pharmaceutical Co. under the stewardship of ORIX Corporation, Sasaeah generates annual revenues of about €75 million, of which 50% from vaccines. and Kyoto Biken Laboratories Inc.)

Global Newswire by Notified: M&A

JULY 16, 2023

Key companies covered in cannabis market are Aurora Cannabis, Aphria Inc, Canopy Growth Corporation, MedReleaf Corp., GW Pharmaceuticals. Tilray, and others Key companies covered in cannabis market are Aurora Cannabis, Aphria Inc, Canopy Growth Corporation, MedReleaf Corp., GW Pharmaceuticals. Cronos Group Inc.,

Global Newswire by Notified: M&A

JULY 31, 2023

July 31, 2023 (GLOBE NEWSWIRE) -- Monster Beverage Corporation (NASDAQ: MNST) today announced that its subsidiary, Blast Asset Acquisition LLC, completed its acquisition of substantially all of the assets of Vital Pharmaceuticals, Inc. CORONA, Calif.,

Global Newswire by Notified: M&A

SEPTEMBER 12, 2023

12, 2023 (GLOBE NEWSWIRE) -- Valarie Ney , an experienced corporate and M&A attorney, has joined Hunton Andrews Kurth LLP as a partner in Washington, D.C. Ney represents clients from a broad array of industries, including the government contracting, pharmaceutical, healthcare, energy, technology and manufacturing sectors.

Global Newswire by Notified: M&A

MARCH 5, 2024

Issue du regroupement de deux acteurs historiques de la santé animale (Fujita Pharmaceutical Co. sous l'égide d'ORIX Corporation, Sasaeah génère des revenus annuels d'environ 75 millions d'euros, dont 50 % proviennent des vaccins. et Kyoto Biken Laboratories Inc.)

Global Newswire by Notified: M&A

JULY 19, 2023

Tokyo, Japan and Cambridge , UK, 20 July 2023 – Sosei Group Corporation (“the Company”; TSE: 4565), will hold an investor and press conference on today’s announcement; “Sosei Heptares Acquires Idorsia’s Pharmaceuticals Business in Japan and APAC (ex-China), Accelerating its Transformation into a Fully Integrated Biopharmaceutical Company.”

The Harvard Law School Forum

JUNE 16, 2023

Related research from the Program on Corporate Governance includes Are M&A Contract Clauses Value Relevant to Target and Bidder Shareholders? Flanagan are Partners and Hannah M. Brown is an Associate at Sidley Austin LLP. This post is based on their Sidley Austin memorandum. discussed on the Forum here ) by John C.

The Harvard Law School Forum

JUNE 16, 2023

Related research from the Program on Corporate Governance includes Are M&A Contract Clauses Value Relevant to Target and Bidder Shareholders? Flanagan are Partners and Hannah M. Brown is an Associate at Sidley Austin LLP. This post is based on their Sidley Austin memorandum. discussed on the Forum here ) by John C.

Shearman & Sterling

JANUARY 12, 2023

Travis Laster of the Delaware Court of Chancery denied a motion to dismiss claims as untimely in a derivative action brought by stockholders against the officers and directors of AmerisourceBergen Corporation (the "Company"). Lebanon County Employees' Retirement Fund v. Collis, C.A. 2021-1118-JTL (Del.

The Risk Arbitrage Report

NOVEMBER 20, 2022

New Deals: • Indivior Plc Com (IZQVF) to acquire Opiant Pharmaceuticals Inc Com (OPNT). Washington Federal Inc Com (WAFD) to acquire Luther Burbank Corporation Com (LBC). First Community Bankshares Inc Com (FCBC) to acquire Surrey Bancorp Com (SRYB). Sh 11/15/22 (CSVI). Sh 11/15/22 (ECOM). Sh Cad 11/15/22 (NEXJF).

M&A Leadership Council

MARCH 27, 2024

Jerry has conducted exercises and threat briefings for C-suite members, senior leadership, and boards of directors at top financial, energy, technology, retail, and pharmaceutical corporations, including 16 on the Fortune 50. Jerry earned his Bachelor of Science in Civil Engineering from Virginia Military Institute.

The Risk Arbitrage Report

SEPTEMBER 18, 2022

. • Potlatchdeltic Corporation Com Usd1 (PCH) completes acquisition of Catchmark Timber Trust Inc.230:1 Syros Pharmaceuticals Inc 1:10 R/S 9/19/22 87184Q206 (SYRS) completes acquisition of Tyme Technologies Inc.04382:1 230:1 Exc 9/15/22 737630103 (CTT). 9/15/22 (MANT). • Sh 9/16/22 (USAK). 04382:1 Exc 9/19/22 87184Q206 (TYME).

Shearman & Sterling

JANUARY 12, 2023

Travis Laster of the Delaware Court of Chancery denied a motion to dismiss claims as untimely in a derivative action brought by stockholders against the officers and directors of AmerisourceBergen Corporation (the "Company"). Lebanon County Employees' Retirement Fund v. Collis, C.A. 2021-1118-JTL (Del.

Peak Frameworks

AUGUST 15, 2023

By owning a share, they own a slice of the corporation, entitling them to a claim on a part of the company's assets and earnings. Roles of a Shareholder Shareholders are pivotal to a corporation and their decisions can significantly shape the direction of the company.

Cooley M&A

OCTOBER 19, 2022

Biotech Company ViaCyte to Be Acquired by Vertex Pharmaceuticals. Lavoro to Become Publicly Traded Through Business Combination With TPB Acquisition Corporation I. DigitalOcean Agrees to Buy Cloudways. Sixth Street Invests in Blueprint Medicines. Notable public deals. Amazon to Acquire One Medical for $3.9

Peak Frameworks

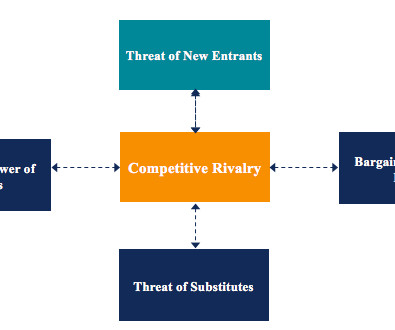

APRIL 29, 2024

This threat is pivotal for strategic planning, especially for professionals in finance, investment banking, and corporate finance sectors, as it directly impacts investment decisions and long-term profitability. Understanding this threat enables businesses to devise robust strategies to protect their market position.

Focus Investment Banking

OCTOBER 20, 2023

Washington, DC, (October 20, 2023) – FOCUS Investment Banking (“FOCUS”), a national middle market investment banking firm providing merger, acquisition, divestiture and corporate finance services, announced today that Bearing Distributors, Inc.

Peak Frameworks

SEPTEMBER 12, 2023

A prime example is the pharmaceutical industry. Covering High Initial Costs or R&D Investments The initial stages of product development often involve high costs, especially in sectors like biotechnology, pharmaceuticals, and technology. Setting a High Initial Price Why would a company opt for a high initial price?

Cooley M&A

JANUARY 25, 2023

But it wasn’t all carve outs and concerned investors – even with the headwinds in the industry and beyond, there were still several traditional public M&A deals involving biotechnology or medical device companies, as large pharmaceutical companies continued to have cash to deploy for acquisitions.

Shearman & Sterling

APRIL 3, 2018

Fundaro, No. 655205 (N.Y.

How2Exit

MARCH 31, 2024

This episode serves as a deep dive into Patrick's journey from a young accounting graduate to a M&A powerhouse, navigating transactions in industries as varied as HVAC and pharmaceuticals. Yet, many smaller businesses shy away from this path due to perceived complexities or resources required to execute such a strategy successfully.

Shearman & Sterling

APRIL 3, 2018

Fundaro, No. 655205 (N.Y.

M&A Leadership Council

SEPTEMBER 26, 2024

A strategic IMO Lead wouldn’t stop at Day 1 integration; they’d chart a multi-year plan for how the sales team’s merger contributes to larger corporate objectives, like boosting revenue in underperforming regions. The IMO Lead is responsible for ensuring that two distinct corporate cultures can co-exist—or better yet, blend.

The New York Times: Mergers, Acquisitions and Dive

OCTOBER 16, 2023

The pharmacy chain, one of the country’s largest, faces more than a thousand lawsuits that say it filled illegal prescriptions for painkillers.

Cooley M&A

OCTOBER 24, 2024

Alexion Pharmaceuticals (Del. Alexion Pharmaceuticals , arose out of Alexion’s 2018 acquisition of a company called Syntimmune. As pandemic restrictions eased, Alexion deprioritized development of ALXN1830 in favor of shifting its resources toward other Alexion programs as part of a corporate goal to launch 10 products by 2023.

Devensoft

AUGUST 24, 2023

Mastering Operations, Cross-Selling, and Cost Efficiencies for Maximizing Value from Integrated Ventures The Power of Synergy and Value Creation Amidst the dynamic and fiercely competitive modern business arena, corporations continually strive to secure a distinct market advantage while fostering expansion.

M&A Leadership Council

JUNE 12, 2023

Mark Herndon (MH): IT M&A leaders often talk about adding more strategic value throughout the M&A lifecycle for both corporate development and the enterprise integration lead. MH: Anna, how would you advise a company’s CISO to engage corporate development early in the strategic development and target selection process?

M&A Leadership Council

SEPTEMBER 9, 2021

MH: IT M&A leaders often talk about adding more strategic value throughout the M&A lifecycle for both corporate development and the enterprise integration lead. MH: Anna, how would you advise a company’s CISO to engage corporate development early in the strategic development and target selection process?

M&A Leadership Council

AUGUST 15, 2022

A sell-off, which is by far the most common type of divestiture (and the type usually referred to as such), is the sale of one or more company units to another company – for example, when BF Goodrich Corporation sold its JcAIR Test Systems business to Aeroflex Incorporated in 2005. What is a spin-off? .

Cooley M&A

JUNE 24, 2020

This relief-seeking exercise has been used regularly in our life sciences practice, where buyers have purchased or licensed single drug products or a line of drug products from large pharmaceutical sellers, who rarely maintain separate financials for those assets given the size of the assets compared to the overall size of the seller.

Devensoft

AUGUST 22, 2023

Consider a scenario where a startup with a nimble and agile structure seeks to merge with a larger, established corporation. Consider a merger between a pharmaceutical company and a biotech startup. Moreover, freelance modeling allows for creative approaches in situations where conventional methods may falter.

OfficeHours

JANUARY 26, 2024

Veterinary pharmaceuticals firm Dechra Pharmaceuticals Plc , which EQT agreed to buy for around £4.5 “If you want to get a deal done in the first half, you had better be starting conversations with buyers in February.” billion ($5.7

InvestmentBank.com

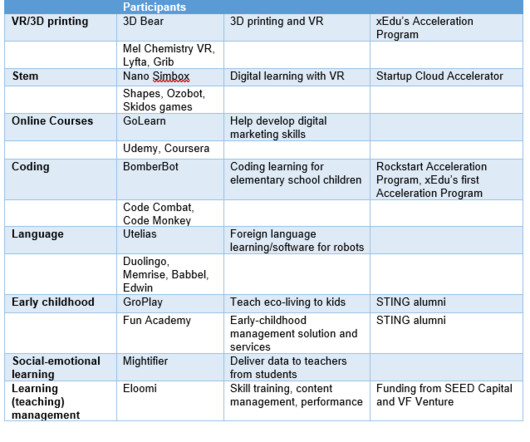

AUGUST 14, 2019

The benefits of VR are not limited to language immersion, architecture, interior design, space expedition, biology, chemistry or pharmaceutical practices. Other corporations such as Chipotle and Walmart who support front-line employees to get college degrees are also supported by Guild Education, which raised $40 million in 2018.

Growth Business

MAY 31, 2023

VCs tend to use the money raised from various corporate investors into a strategically managed fund. How is it different to venture capital funding? Angel investors use their own money and many have been entrepreneurs themselves, like you see on Dragons’ Den. VCs tend to come in further down the line.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content