Can Ghana’s Debt Trap of Crisis and Bailouts Be Stopped?

The New York Times: Banking

SEPTEMBER 18, 2023

The government of Ghana is essentially bankrupt, and has turned to the International Monetary Fund for its 17th financial rescue since 1957.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The New York Times: Banking

SEPTEMBER 18, 2023

The government of Ghana is essentially bankrupt, and has turned to the International Monetary Fund for its 17th financial rescue since 1957.

The New York Times: Banking

AUGUST 27, 2024

Crushing obligations to foreign creditors that have few precedents have sapped numerous African nations of growth and stoked social instability.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The New York Times: Banking

DECEMBER 16, 2023

Economists offer alternatives to financial safeguards created when the U.S. was the pre-eminent superpower and climate change wasn’t on the agenda.

Sun Acquisitions

SEPTEMBER 20, 2024

Economic uncertainty can cast a shadow of doubt over potential deals in the realm of mergers and acquisitions (M&A). In this article, we’ll explore some creative financing strategies that can help facilitate M&A transactions even in uncertain economic times.

OfficeHours

AUGUST 25, 2023

In particular, new guidelines from the FDIC and Federal Reserve (among other governmental agencies) made it more difficult for banks to underwrite financings that resulted in debt-to-EBITDA ratios in excess of 6.0x. This capital is released once investors buy the debt off the banks’ balance sheets.

Wall Street Mojo

JANUARY 15, 2024

What is a Collateralized Debt Obligation? Table of contents What is a Collateralized Debt Obligation? How does Collateralized Debt Obligation (CDO) Work? CDOs provide investors with a diversified portfolio of debt instruments across different risk levels. read more , etc.

The Harvard Law School Forum

OCTOBER 24, 2022

Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism (discussed on the Forum here ) by Lucian A. A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System (discussed on the Forum here ) by Leo E.

OfficeHours

OCTOBER 20, 2023

sits around 3.7%; while that is certainly better than the 8% and 9% seen earlier this year, it still remains a key point of concern for anyone monitoring the economic situation. Inflation is one of the several economic factors that impact private equity returns, as it can have a material impact on returns as it rises and falls.

PCE

MAY 17, 2023

Wednesday, May 17, 2023 Given today’s economic uncertainty—and all the focus on rising interest rates, bank failures, and market conditions—business owners and financial executives may find that debt markets are top of mind.

Growth Business

NOVEMBER 23, 2023

Ascension Ventures Early-stage VC built by exited entrepreneurs ready to back the next generation of tech and impact founders Augmentum Fintech Augmentum Europe’s leading publicly listed fintech fund, investing in fast growing businesses that are disrupting the financial services sector. mortgages, insurance) software (e.g.

Cooley M&A

SEPTEMBER 25, 2020

The decisions from the court on those preliminary matters, as well as the arguments raised by legal counsel, offer some valuable lessons for sellers considering sale transactions that require debt financing, and may motivate sellers to re-evaluate certain provisions and remedies that have become customary in those transactions.

Mergers and Inquisitions

JULY 19, 2023

When you hear the term “long-only hedge funds,” your first thought might be: “How can a hedge fund hold only long positions? Doesn’t that contradict the term ‘hedge fund’? Why would investors pay high fees for what is effectively a mutual fund?” These are all good questions.

The New York Times: Mergers, Acquisitions and Dive

JUNE 2, 2023

With the fight over the debt ceiling resolved, investors are turning to other concerns, including inflation and interest rates.

Focus Investment Banking

SEPTEMBER 19, 2024

This more aggressive monetary policy shift reflects the central bank’s heightened concerns about economic stability and its commitment to stimulating growth. In turn, this typically stimulates investment and spending, helping to buoy economic growth during periods of uncertainty or slower expansion.

OfficeHours

OCTOBER 16, 2023

Existing Debt : The US is a country riddled with debt. Others may have car payments, mortgages, credit card debt, or other debt that could be hanging over your head as a large liability. Other investments may be more protected from economic impacts and can help with diversification.

Sun Acquisitions

FEBRUARY 14, 2024

Consider options such as raising capital through equity financing or securing a bank loan to fund your expansion plans. In such cases, evaluating the financial health of target companies and understanding their debt structures is crucial. Debt Financing: Debt financing involves borrowing money to fund your acquisition.

Mergers and Inquisitions

MAY 29, 2024

Project Finance Definition: “Project Finance” refers to acquisitions, debt/equity financings, and new developments of capital-intensive infrastructure assets that provide essential utilities and services. However, many people also use the term more broadly to refer to equity, debt, and advisory for infrastructure assets.

OfficeHours

OCTOBER 23, 2023

Once the terms are agreed upon, the acquisition is financed through a combination of debt and equity from the PE firm , as with a typical transaction. This results in the target company receiving a potentially very different capital structure than they previously had, typically with higher debt levels.

OfficeHours

JULY 18, 2023

How I bought an apartment, funded business school, and still had fun in the midst of difficult economic times When it comes to timing the market and getting that anticipated bonus you’ve worked hard all year for, I couldn’t have gotten unluckier. By December of that year, prices had fallen to $59 per barrel.

Wall Street Mojo

JANUARY 4, 2024

read more is that amount of interest, which is due for a debt or bond but not paid to the lender of the bond. This accrued interest reflects the time value of money, recognizing that the lender is entitled to compensation for the delay in receiving funds. Still, the same is not received or paid in the same accounting period.

Wall Street Mojo

JANUARY 15, 2024

Liabilities come next, divided into current liabilities (like debts and payables) and long-term liabilities (e.g., Cash and paper money, US Treasury bills, undeposited receipts, and Money Market funds are its examples. It is a way of raising funds by the company to meet its various business goals. read more other companies.

Intrepid Banker Insights

NOVEMBER 16, 2022

Amidst public market volatility and economic uncertainty, private capital investment funds remain open for business, albeit with increased scrutiny and rigorous diligence on every deal. The Fed Funds Rate sits at 4%, and SOFR is expected to peak at 4.8% in Q2 2023.

The Deal

JULY 18, 2023

But the asset class has also carried over its caution from the second half of last year amid economic uncertainty and a tighter fundraising environment. Borrowers typically don’t have to pay interest on unfunded debt until they tap those credit lines. “They know they have the advantage.”

Wall Street Mojo

JANUARY 14, 2024

Its goal is to protect every nation in the eurozone from financial crises and retain long-term financial strength using ESM funds. The European Stability Mechanism Board (ESM) operates as a financial backstop intergovernmental institution established in 2012 to combat the European sovereign debt crisis of 2009-2011 in euro member states.

OfficeHours

OCTOBER 17, 2023

Existing Debt The US is a country riddled with debt. Others may have car payments, mortgages, credit card debt, or other debt that could hang over their head as a large liability. Other investments may be more protected from economic impacts and can help with diversification. Yes, I’m interested!

OfficeHours

OCTOBER 16, 2023

Once the terms are agreed upon, the acquisition is financed through a combination of debt and equity from the PE firm, as with a typical transaction. This results in the target company receiving a potentially very different capital structure than they previously had, typically with higher debt levels.

Peak Frameworks

JUNE 27, 2023

Public finance relates to how a government generates revenue and how it disburses these funds to fulfill societal needs. The key components of public finance include tax policy, expenditure policy, debt policy, and fiscal policy, which includes adjusting the other components to affect macroeconomic variables.

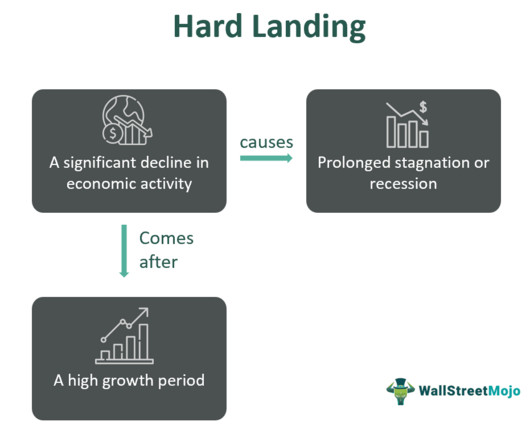

Wall Street Mojo

JANUARY 17, 2024

Hard Landing Meaning Hard landing refers to a significant economic downturn or slowdown following a period of fast or rapid growth. Nations must prevent it to avoid a significant drop in economic growth. Moreover, it may lead to prolonged economic stagnation and even recession.

Mergers and Inquisitions

JULY 31, 2024

Andrew Carnegie’s partner, Henry Phipps, used his deal proceeds to launch the Bessemer Trust , one of the first modern family offices and a “proto” private equity fund. Note that not all “large” funds do industrial deals. Morgan’s acquisition of Carnegie Steel in 1901 – was an industrials private equity deal.

Wall Street Mojo

JANUARY 14, 2024

The Allowance Method in accounting sets aside funds to cover anticipated bad debts from credit sales. Direct Write-Off Frequently Asked Questions (FAQs) Recommended Articles Key Takeaways The allowance method in accounting involves setting aside funds as a reserve to cover expected losses from uncollectible accounts.

Peak Frameworks

SEPTEMBER 19, 2023

5 Cs in Detail , Character Character pertains to an individual's or a company's historical record when it comes to managing debt and fulfilling obligations. Debt-to-income ratio: One common metric used to determine capacity. It is the proportion of a borrower's monthly debt payments to their monthly gross income.

Peak Frameworks

JUNE 27, 2023

Definition of the Money Market The money market is a subsection of the financial market where participants engage in the buying and selling of short-term debt securities. Importance of the Money Market Money markets provide a stable environment for economic entities to manage their short-term funding requirements. government.

Cooley M&A

JULY 28, 2022

In the US, it is common to adjust the purchase price for cash, any excess or deficit of net working capital relative to a required level of net working capital, unpaid debt, and unpaid transaction expenses of the target business as of the closing, with an adjustment done at closing based on estimates and followed by a post-closing true-up.

Growth Business

DECEMBER 12, 2023

Despite the retraction, the UK remains the centre of European fintech investment with British fintechs attracting more funding than fintech start-ups in the rest of Europe and the Middle East combined, second only to the US, and ahead of India, Germany, France, Sweden and Italy. What does this mean for UK fintech start-ups going forward?

How2Exit

AUGUST 8, 2023

The funds generated from the sale can be used to finance the M&A transaction, invest in growth opportunities, or pay down debt. By selling their real estate assets, businesses can quickly generate cash flow, which can be used to fund the acquisition or expansion of the company.

The TRADE

JULY 28, 2023

Despite the ups and downs in the global economy, emerging markets debt has been performing quite well this year. But the most interesting part – local debt in these emerging markets has been shining particularly bright. Meanwhile, emerging markets local debt continued to outperform core fixed income markets, mainly driven by yields.

Growth Business

OCTOBER 2, 2023

By Tim Bird on Growth Business - Your gateway to entrepreneurial success It was a buoyant 2018 for venture capital investment into UK and European companies – a trend which defied broader concerns about international trade tensions, economic growth prospects and, of course, Brexit.

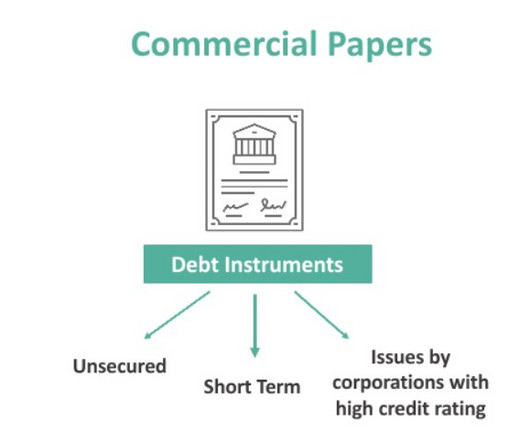

Peak Frameworks

OCTOBER 17, 2023

Commercial paper is a form of unsecured short-term debt. Commercial paper is a financial instrument that helps corporations with short-term funding and liquidity needs, such as payroll or accounts payable. Absence of Covenants Unlike some longer-term debt instruments, commercial papers usually don’t come with restrictive covenants.

Peak Frameworks

SEPTEMBER 19, 2023

A classic example of T-Bills in action occurred during the European Sovereign Debt Crisis. Investors, wary of the uncertainties in European debt markets, turned to U.S. Debt Ceiling Crisis , T-Bills experienced an unusual yield spike as investors momentarily questioned U.S. Represented by the full faith and credit of the U.S.

Sica Fletcher

JULY 1, 2020

No one really knows how the pandemic will play out from a medical, economic, political, and societal perspective. The answer relates to private equity and the availability of capital to fund acquisitions and the need to deploy this capital. We face a future of uncertainty. Multiples have also increased dramatically.

Tyton Partners

JANUARY 18, 2024

While some regions, such as Asia, achieved moderate growth, others struggled with weak demand , supply bottlenecks , and rising debt. Within our sample, respondents came from several organizations, with 54% from foundations, 26% from non-profit operators, and 21% from impact investing funds, family offices, and for-profit operators.

Peak Frameworks

MAY 22, 2023

Components of the Accounting Equation Assets are resources owned by a company that has economic value and can be converted into cash or provide future benefits. Liabilities represent the obligations a company has to outside parties, such as debts, loans, and accounts payable. For example, Apple Inc. reported total assets of $338.16

Peak Frameworks

SEPTEMBER 18, 2023

During this time, world leaders recognized the need for a new monetary order to ensure stability and prevent future economic crises. International Monetary Fund (IMF) and the World Bank Created to oversee the new system and provide financial assistance to countries in need. The End of Bretton Woods Every system has its breaking point.

Wall Street Mojo

JANUARY 17, 2024

It helps identify the availability of liquid funds with the organization in a particular accounting period. In other words, it mirrors the availability and usage of business funds to reveal its current state of liquidity Liquidity Liquidity is the ease of converting assets or securities into cash.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content