Can Ghana’s Debt Trap of Crisis and Bailouts Be Stopped?

The New York Times: Banking

SEPTEMBER 18, 2023

The government of Ghana is essentially bankrupt, and has turned to the International Monetary Fund for its 17th financial rescue since 1957.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The New York Times: Banking

SEPTEMBER 18, 2023

The government of Ghana is essentially bankrupt, and has turned to the International Monetary Fund for its 17th financial rescue since 1957.

The New York Times: Banking

AUGUST 27, 2024

Crushing obligations to foreign creditors that have few precedents have sapped numerous African nations of growth and stoked social instability.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Global Banking & Finance

DECEMBER 10, 2024

By Naomi Rovnick LONDON (Reuters) – The threat of soaring government debt supply destabilising financial markets has intensified, the world’s top central banking advisory body said on Tuesday, as it urged policymakers to act swiftly to prevent economic damage.

The New York Times: Banking

AUGUST 22, 2023

Beijing has often addressed economic troubles by boosting spending on infrastructure and real estate, but now heavy debt loads make that a hard playbook to follow.

Peak Frameworks

JUNE 27, 2023

Public finance deals with the revenue and expenditure of government entities. Public finance relates to how a government generates revenue and how it disburses these funds to fulfill societal needs. Public finance relates to how a government generates revenue and how it disburses these funds to fulfill societal needs.

Wall Street Mojo

JANUARY 15, 2024

What is a Collateralized Debt Obligation? Table of contents What is a Collateralized Debt Obligation? How does Collateralized Debt Obligation (CDO) Work? CDOs provide investors with a diversified portfolio of debt instruments across different risk levels. read more , etc.

OfficeHours

AUGUST 25, 2023

Following the GFC, the government enacted new regulations that limited banks’ abilities to underwrite highly leveraged financing. This means that banks commit to providing debt financing for a transaction, and then they syndicate this debt out to a variety of investors and pocket a fee for this service (say, 2-3% on average).

The Harvard Law School Forum

OCTOBER 24, 2022

Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism (discussed on the Forum here ) by Lucian A. A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System (discussed on the Forum here ) by Leo E. Strine, Jr.

How2Exit

MARCH 5, 2023

Ali Taraftar left Canada in 2007 to go to the United States and met a couple of investment bankers who put together a firm to do debt restructuring and mortgage modifications. Concept 3: Debt Restructuring Can Save Businesses The current economic climate has put many businesses in a precarious situation.

Mergers and Inquisitions

DECEMBER 4, 2024

No matter the economic climate, you can always bet on sports fans to show up for their favorite teams. Therefore, expect more debt deals for stadiums and arenas and more M&A deals , spin-offs, divestitures , minority stake purchases , and JV deals for teams and leagues. Can teams carry debt?

Global Banking & Finance

OCTOBER 8, 2024

By Lefteris Papadimas ATHENS (Reuters) – The Greek government is forecasting economic growth of 2.3% Greece, which is still recovering from a debt crisis that nearly saw the country drop out […]

The New York Times: Mergers, Acquisitions and Dive

MAY 1, 2023

The resolution of First Republic Bank came after a frantic night of deal making by government officials and executives at the country’s biggest bank.

Peak Frameworks

SEPTEMBER 19, 2023

government. For seasoned investors , novice financial enthusiasts, and even the government, these instruments hold unique significance. government. government , meaning they are virtually risk-free. A classic example of T-Bills in action occurred during the European Sovereign Debt Crisis. creditworthiness.

Wall Street Mojo

JANUARY 17, 2024

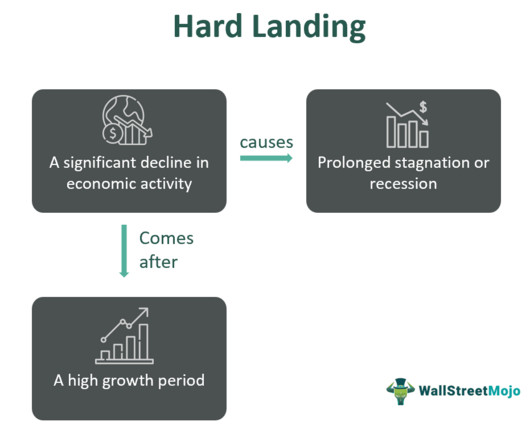

Hard Landing Meaning Hard landing refers to a significant economic downturn or slowdown following a period of fast or rapid growth. Nations must prevent it to avoid a significant drop in economic growth. Moreover, it may lead to prolonged economic stagnation and even recession.

Wall Street Mojo

JANUARY 14, 2024

The European Stability Mechanism Board (ESM) operates as a financial backstop intergovernmental institution established in 2012 to combat the European sovereign debt crisis of 2009-2011 in euro member states. It has two types: PCCL for economically strong nations and Enhanced Conditions Credit Line (ECCL) for those not meeting PCCL criteria.

Peak Frameworks

SEPTEMBER 12, 2023

The Solow Growth Model is an economic framework that attempts to explain long-term economic growth. The model, named after Nobel laureate Robert Solow, is indispensable for understanding investment decisions and the dynamics of economic growth. Take, for instance, the aftermath of the 2008 financial crisis.

Wall Street Mojo

JANUARY 4, 2024

read more is that amount of interest, which is due for a debt or bond but not paid to the lender of the bond. Investors invest in this government scheme to save taxes under 80 c. But the interest paid by the government on the invested amount is yearly. But the interest paid by the government on the invested amount is monthly.

Francine Way

JULY 11, 2017

Target’s primary country (where the company is likely to borrow) risk-free rate: Can be obtained from government sources such as Treasury.gov’s 10-years Treasury Bond Yield. Assumptions about the debt portion of the proposed transaction: Remember that LBOs are heavily financed with short-term loans (revolver, etc.),

Wizenius

JUNE 21, 2023

Assess the technical, economic, and legal aspects of the project. Political instability, changes in government policies, fluctuating feed-in tariffs, and legal uncertainties are common challenges. In this step-by-step guide, we will explore the key considerations and strategies to navigate this complex landscape successfully.

OfficeHours

JULY 18, 2023

How I bought an apartment, funded business school, and still had fun in the midst of difficult economic times When it comes to timing the market and getting that anticipated bonus you’ve worked hard all year for, I couldn’t have gotten unluckier. I started my career in 2014 as an investment banking analyst in an oil & gas coverage group.

InvestmentBank.com

MAY 26, 2021

As the world headed into the uncharted territory of a worldwide pandemic, investors in both debt and equity markets reacted to shifts and changing conditions in several interesting ways, and the lessons they learned and the actions they take this year will set the stage for everyone’s access to capital in the years to come.

Sica Fletcher

APRIL 16, 2020

Some of the economic predictions regarding the economic impact of the coronavirus on the economy and GDP are quite dire. While Bullard, Goldman Sachs, and Morgan Stanley all expect the economy to bounce back toward the end of the year, substantial economic damage will be done. Louis, predicts the U.S. So how do we stop the U.S.

Peak Frameworks

JUNE 27, 2023

Definition of the Money Market The money market is a subsection of the financial market where participants engage in the buying and selling of short-term debt securities. Importance of the Money Market Money markets provide a stable environment for economic entities to manage their short-term funding requirements. government.

Wall Street Mojo

JANUARY 15, 2024

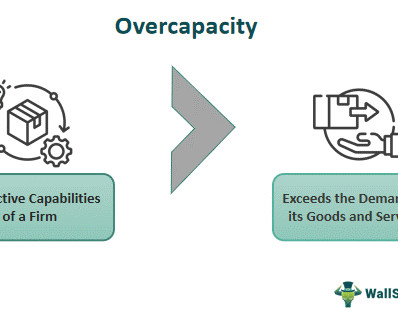

It can result from factors such as rapid technological advancements, economic downturns, strategic misjudgments, globalization, and government incentives that encourage excessive production. Firstly, economic downturns can trigger overcapacity as reduced consumer spending leads to weakened demand for goods and services.

The New York Times: Banking

MAY 23, 2024

A new approach by China’s top leaders is bold but pales against the problem: a vast number of empty apartments no one wants to buy.

The New York Times: Banking

APRIL 16, 2024

China’s big bet on manufacturing helped to counteract its housing slowdown in the first three months of the year, but other countries are worried about a flood of Chinese goods.

Mergers and Inquisitions

JULY 31, 2024

The commonalities are that industrial companies serve enterprise customers and governments rather than consumers (with some exceptions, such as airlines) and are very sensitive to broad macro factors and economic conditions. billion with Debt of $2.1 No Debt has been repaid, so the Exit Equity Proceeds are $3.6

How2Exit

MAY 15, 2023

His advisory practice helps them through catalytic, transformational, and strategic events, such as mergers and acquisitions, governance issues, capital raising, and disputes. Concept 3: Lawyers Provide Beneficial Skills Ronald talks about his economics professor who had a law degree and was a successful real estate investor.

The TRADE

DECEMBER 18, 2023

Convertible bonds will also provide cheaper financing options to those companies with other types of debt coming due which will lead to greater primary issuance. It will be more important than ever to support government bond liquidity in the current high interest rate environment and ongoing volatile markets.

Peak Frameworks

MAY 2, 2024

Accounting Insights for Credit Sales The accounting treatment of credit sales is vital for reflecting a company's financial health accurately: Revenue Recognition: The accrual basis of accounting typically governs credit sales, recognizing revenue at the time of sale rather than upon cash receipt.

Wall Street Mojo

JANUARY 18, 2024

read more regularly invest in such bonds issued by a sovereign government, and it forms a major part of their investment portfolio. It refers to the possibility that the lender may not receive the debt's principal and an interest component, resulting in interrupted cash flow and increased cost of collection.

Sun Acquisitions

MAY 15, 2023

Consider Various Factors During Valuation: Various factors should be considered, such as cash flow, debt levels, earnings history, and growth prospects. Market-based valuations compare the target company to similar businesses and use market trends to estimate value.

Focus Investment Banking

OCTOBER 30, 2023

You probably couldn't do an ESOP with a small proprietorship because you may not be able to raise the debt involved and there are ongoing expenses to managing an ESOP a business must be able to afford. And if the bad times come every five to seven years, which is a typical economic cycle, you can work through that. continues Beard. “I

The M&A Lawyer

SEPTEMBER 23, 2015

Hexion focused its arguments on Huntsman’s repeated failure to achieve its forecasts as well as an increase in Huntsman’s net debt as compared to its projected decrease and the underperformance of two of Huntsman’s operating divisions. failure by the target to meet revenue or earnings projections.

How2Exit

JULY 3, 2023

The transcript highlights the need for the financials to tell the true story of the transferable economics of the business. Concept 8: Financials And Governance Matter In Sales The podcast transcript sheds light on the significance of financials and governance in sales transactions.

Wall Street Mojo

JANUARY 17, 2024

It also enables stakeholders Stakeholders A stakeholder in business refers to anyone, including a person, group, organization, government, or any other entity with a direct or indirect interest in its operations, actions, and outcomes. It aids investors in analyzing the company's performance. read more arising from each activity.

The New York Times: Banking

NOVEMBER 9, 2023

Powell, the Federal Reserve chair, said officials would proceed carefully. But if more policy action is needed, he pledged to take it.

Wall Street Mojo

FEBRUARY 9, 2024

The primary sources of LMM companies are primarily different forms of debt and credit line lending systems. Such firms enjoy high growth rates and play a vital economic role. A combination of equity and debt financing allows the firm to convert equity interest if they default on the loan.

Growth Business

NOVEMBER 23, 2023

In March this year, the UK government launched the Centre for Finance, Innovation and Technology – a quango which aims to solidify the UK’s stance as a global centre in the sector. Can provide a mixture of equity and mezzanine debt to businesses mostly at the Series A stage. There are other reasons for fintechs to be hopeful, too.

Sica Fletcher

JUNE 20, 2024

This is even more interesting when we view the rate of return for these insurance agencies, which has actually dropped below the cost of acquiring debt for a transaction, creating a negative spread for the first time in M&A history. It used to be the case that equity structures consisted of senior debt (i.e., in 2020 to 9.5%

The New York Times: Banking

SEPTEMBER 17, 2024

For corporate America, this week’s expected interest rate cut carries risks along with rewards.

The TRADE

MAY 24, 2024

Longer term, the new Government will face a number of aggressive assumptions regarding UK growth and tax revenue, with implication for absolute debt service levels. We have some changes in government potentially beginning in July. Macro-economic headwinds are building but the housing market is showing no real signs of stress.

Lake Country Advisors

JULY 25, 2024

Business valuation is a critical process that determines a company’s economic worth. Poor Financial Performance The first factor that could affect your business value is declining financial performance, which is determined by two main factors: low profitability and debt or poor cash flow management.

How2Exit

MAY 23, 2023

Castle Placement specializes in raising private equity and debt capital for clients. This is why it is essential that governments and companies take steps to ensure that private information is secure.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content