Gov. Jim Justice Faces Heavy Business Debts as He Seeks Senate Seat

The New York Times: Banking

MAY 12, 2024

The Justice companies have long had a reputation for not paying their debts. But that may be catching up to them.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The New York Times: Banking

MAY 12, 2024

The Justice companies have long had a reputation for not paying their debts. But that may be catching up to them.

Global Newswire by Notified: M&A

OCTOBER 28, 2024

Array acquired Payitoff, a pioneer in private-label, embedded debt guidance solutions for financial institutions, fintechs and brands.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PE Hub

NOVEMBER 3, 2023

BID III's limited partners include public and private pension plans, sovereign wealth funds, financial institutions, endowments, foundations and family offices. The post Brookfield Asset Management wraps up third infrastructure debt fund appeared first on PE Hub.

The New York Times: Banking

AUGUST 27, 2024

Crushing obligations to foreign creditors that have few precedents have sapped numerous African nations of growth and stoked social instability.

The New York Times: Banking

AUGUST 18, 2023

Debt rose to more than $1 trillion in the second quarter, a report found — a sign of financial strain for some, even before student loan payments resume.

The New York Times: Banking

JUNE 7, 2023

The government has avoided default, but the effects of the debt-ceiling brinkmanship may still ripple across the economy.

The New York Times: Banking

DECEMBER 20, 2023

Buying mattresses, clothes and other goods on installment plans has propped up spending, but economists worry that such loans could put some people at risk.

The New York Times: Banking

OCTOBER 8, 2023

Instead of receiving funds to address the climate crisis, Africa is borrowing money at a cost up to eight times higher than the rich world to rebuild.

The New York Times: Banking

SEPTEMBER 18, 2023

The government of Ghana is essentially bankrupt, and has turned to the International Monetary Fund for its 17th financial rescue since 1957.

The New York Times: Banking

DECEMBER 16, 2023

Economists offer alternatives to financial safeguards created when the U.S. was the pre-eminent superpower and climate change wasn’t on the agenda.

The New York Times: Banking

AUGUST 23, 2024

More borrowers have been falling behind on their credit card bills and are paying more for basic banking services, like A.T.M.

The New York Times: Banking

JULY 26, 2024

Financial regulators and consumer advocates frown upon using credit cards to pay off installment loans because of the risk that consumers will dig themselves further into debt.

The New York Times: Banking

MAY 26, 2023

Here’s a look at what markets are expecting and planning for, and how a default might happen.

The TRADE

APRIL 25, 2025

Citi has named Christopher Chang as its new head of markets solutions for financial institutions for Asia South and Asia North. He also brings more than 28 years of experience covering markets and debt capital markets (DCM) to his new role.

The New York Times: Banking

JANUARY 16, 2024

percent, as China worked to export more to make up for weak demand, high debt and a steep property contraction at home. Gross domestic product expanded 5.2

Wall Street Mojo

JANUARY 15, 2024

What is a Collateralized Debt Obligation? It happens when capital borrowers like banks, big companies, and other financial institutions lose capital provider's trust like depositors, investors, and capital markets. Table of contents What is a Collateralized Debt Obligation? read more it may cause.

The New York Times: Banking

SEPTEMBER 21, 2023

A financially troubled firm has stopped paying investors, risking panic and testing the Chinese government’s resolve to take on debts from its property crisis.

Midaxo

OCTOBER 12, 2023

Operational debt is as serious as tech debt. Additional Q&A with Mart Lumeste: Q: How Do You Uncover and Evaluate the Extent of Technical Debt? Organizations usually incur technical debt when the cost of adding additional features increases (e.g., Reducing the debt requires a plan and management buy-in.

The New York Times: Banking

DECEMBER 13, 2023

The Fed’s rate increases since March 2022 have sent shock waves through financial markets, raising borrowing costs on things like mortgages and government debt and weighing on the stock market.

The New York Times: Banking

SEPTEMBER 29, 2023

Banks hold enormous amounts of real estate debt, and regulators are nervous. But a fast-moving crisis is unlikely because the government has extensive control of the system.

The New York Times: Banking

FEBRUARY 2, 2024

Legislation that went into effect this year makes it easier for student loan borrowers to save for retirement while paying down their debt.

How2Exit

NOVEMBER 25, 2024

Financial institutions, through methods like industrial revenue bonds and mezzanine loans, present existing CEOs and potential entrepreneurs with creative funding structures to support roll-ups. Many acquisitions are funded through a blend of debt financing, seller financing, and equity rollovers.

The New York Times: Banking

AUGUST 23, 2024

More borrowers have been falling behind on their credit card bills and are paying more for basic banking services, like A.T.M.

The New York Times: Banking

MARCH 20, 2024

Higher rates benefit those who can save, but for borrowers, falling rates would reduce bills on credit cards, student loans and other forms of debt.

The New York Times: Banking

AUGUST 22, 2023

Beijing has often addressed economic troubles by boosting spending on infrastructure and real estate, but now heavy debt loads make that a hard playbook to follow.

The New York Times: Banking

AUGUST 20, 2023

Beijing wanted to cool its housing market, but created a bigger problem, as the fallout from debt-laden developers and sinking sales spreads to the broader economy.

The New York Times: Banking

JULY 31, 2024

Higher rates benefit those who can save, but for borrowers, falling rates would reduce bills on credit cards, home equity loans and other forms of debt.

Wizenius

MARCH 30, 2023

An Asset Reconstruction Company (ARC) is a specialized financial institution that acquires non-performing assets (NPAs) or distressed assets from banks or financial institutions at a discounted price. The assets can include non-performing loans, bad debts, and other distressed assets.

The New York Times: Banking

JUNE 2, 2023

debt default, yet they remain more attractive than just about everything else, our columnist says. Treasuries have been threatened by a possible U.S.

The New York Times: Banking

MAY 1, 2024

Higher rates benefit those who can save, but for borrowers falling rates would reduce bills on credit cards, home equity loans and other forms of debt.

The New York Times: Banking

JANUARY 31, 2024

Higher rates benefit those who can save, but for borrowers, falling rates would reduce bills on credit cards, student loans and other forms of debt.

Global Newswire by Notified: M&A

NOVEMBER 20, 2024

TORONTO, Nov. 20, 2024 (GLOBE NEWSWIRE) -- Apolo IV Acquisition Corp.

The Harvard Law School Forum

JUNE 27, 2023

bank failure since the 2008 financial crisis; JPMorgan Chase later agreed to buy the majority of its assets. [2] government’s battle over the debt ceiling, though resolved in early June, destabilized markets in May when it appeared lawmakers might not come to a resolution. [5] 3] [4] The U.S.

Software Equity Group

MARCH 21, 2023

There are several resources for growth capital: debt from a lender or financial institution, minority equity financing, or majority equity financing through a control transaction. Growth debt, also called venture debt, most often comes as a principal loan accompanied by an interest payment.

MergersCorp M&A International

JANUARY 23, 2024

Another strength of MergersCorp M&A International’s project finance consulting service is its ability to bridge the gap between financial institutions and businesses. Securing project financing can be a complex and time-consuming process that requires extensive knowledge of the financial industry.

Wall Street Mojo

JANUARY 4, 2024

read more is that amount of interest, which is due for a debt or bond but not paid to the lender of the bond. The rate of interest charged by the financial institution for the loan is monthly. Similarly, a company that has debts in its books will have to report the amount of interest accrued for the bonds it has lent.

Intrepid Banker Insights

MAY 29, 2024

“I could not be more excited to lead this platform at Intrepid at a time when middle market brands and their franchisees need expert advice as they face generational and institutional transfers, financing needs, and acquisition opportunities,” J.B. The combination of J.B.’s

Wall Street Mojo

JANUARY 17, 2024

Financial institutions with good credit ratings offer swap facilities to clients and charge fees from brokers. Usually, financial institutions with very high credit worthiness are the ones that offer the swap market to clients who may be investors or other financial institutions. read more of the risk.

Peak Frameworks

SEPTEMBER 19, 2023

5 Cs in Detail , Character Character pertains to an individual's or a company's historical record when it comes to managing debt and fulfilling obligations. Capacity Capacity evaluates the borrower's ability to repay a loan by assessing their current financial obligations relative to their income.

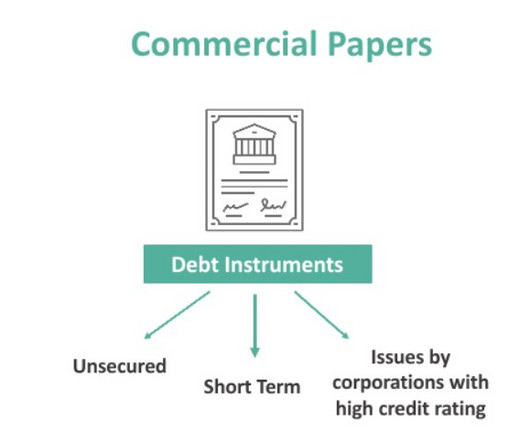

Peak Frameworks

OCTOBER 17, 2023

Commercial paper is a form of unsecured short-term debt. Commercial paper is a financial instrument that helps corporations with short-term funding and liquidity needs, such as payroll or accounts payable. Absence of Covenants Unlike some longer-term debt instruments, commercial papers usually don’t come with restrictive covenants.

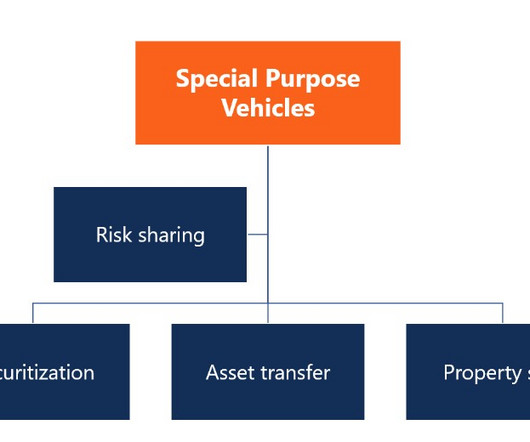

Peak Frameworks

SEPTEMBER 11, 2023

Off-balance-sheet Arrangements Companies can use SPVs to move assets or liabilities off their balance sheets, which can improve financial ratios and make the company more attractive to investors. For instance, a company laden with debt could transfer some of it to an SPV, thereby reducing its debt-to-equity ratio.

The Harvard Law School Forum

JUNE 27, 2023

bank failure since the 2008 financial crisis; JPMorgan Chase later agreed to buy the majority of its assets. [2] government’s battle over the debt ceiling, though resolved in early June, destabilized markets in May when it appeared lawmakers might not come to a resolution. [5] 3] [4] The U.S.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content