Gov. Jim Justice Faces Heavy Business Debts as He Seeks Senate Seat

The New York Times: Banking

MAY 12, 2024

The Justice companies have long had a reputation for not paying their debts. But that may be catching up to them.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The New York Times: Banking

MAY 12, 2024

The Justice companies have long had a reputation for not paying their debts. But that may be catching up to them.

The New York Times: Banking

SEPTEMBER 18, 2023

The government of Ghana is essentially bankrupt, and has turned to the International Monetary Fund for its 17th financial rescue since 1957.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The New York Times: Banking

JUNE 7, 2023

The government has avoided default, but the effects of the debt-ceiling brinkmanship may still ripple across the economy.

The New York Times: Banking

AUGUST 27, 2024

Crushing obligations to foreign creditors that have few precedents have sapped numerous African nations of growth and stoked social instability.

The New York Times: Banking

DECEMBER 13, 2023

The Fed’s rate increases since March 2022 have sent shock waves through financial markets, raising borrowing costs on things like mortgages and government debt and weighing on the stock market.

The New York Times: Banking

SEPTEMBER 29, 2023

Banks hold enormous amounts of real estate debt, and regulators are nervous. But a fast-moving crisis is unlikely because the government has extensive control of the system.

The New York Times: Banking

OCTOBER 8, 2023

Instead of receiving funds to address the climate crisis, Africa is borrowing money at a cost up to eight times higher than the rich world to rebuild.

The New York Times: Banking

MAY 26, 2023

Here’s a look at what markets are expecting and planning for, and how a default might happen.

Wall Street Mojo

JANUARY 15, 2024

What is a Collateralized Debt Obligation? It happens when capital borrowers like banks, big companies, and other financial institutions lose capital provider's trust like depositors, investors, and capital markets. Table of contents What is a Collateralized Debt Obligation? read more it may cause.

The New York Times: Banking

AUGUST 22, 2023

Beijing has often addressed economic troubles by boosting spending on infrastructure and real estate, but now heavy debt loads make that a hard playbook to follow.

The New York Times: Banking

JUNE 2, 2023

debt default, yet they remain more attractive than just about everything else, our columnist says. Treasuries have been threatened by a possible U.S.

The Harvard Law School Forum

JUNE 27, 2023

Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian A. A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Frankl and Kushner Leo E. Kushner are Senior Managing Directors at FTI Consulting. Strine, Jr.

The New York Times: Mergers, Acquisitions and Dive

MAY 1, 2023

The resolution of First Republic Bank came after a frantic night of deal making by government officials and executives at the country’s biggest bank.

The New York Times: Banking

MAY 1, 2024

Higher rates benefit those who can save, but for borrowers falling rates would reduce bills on credit cards, home equity loans and other forms of debt.

Wall Street Mojo

JANUARY 4, 2024

read more is that amount of interest, which is due for a debt or bond but not paid to the lender of the bond. The rate of interest charged by the financial institution for the loan is monthly. Investors invest in this government scheme to save taxes under 80 c. And the loan is payable every month.

Peak Frameworks

JUNE 27, 2023

Definition of the Money Market The money market is a subsection of the financial market where participants engage in the buying and selling of short-term debt securities. They also assist governments in managing the country’s financial affairs. government. government.

The Harvard Law School Forum

JUNE 27, 2023

Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian A. A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Frankl and Kushner Leo E. Kushner are Senior Managing Directors at FTI Consulting. Strine, Jr.

The New York Times: Banking

MAY 23, 2024

A new approach by China’s top leaders is bold but pales against the problem: a vast number of empty apartments no one wants to buy.

Wall Street Mojo

JANUARY 18, 2024

Banks and financial institutions Financial Institutions Financial institutions refer to those organizations which provide business services and products related to financial or monetary transactions to their clients. read more associated with any other issuer other than the government.

Wall Street Mojo

JANUARY 17, 2024

Financial institutions with good credit ratings offer swap facilities to clients and charge fees from brokers. Usually, financial institutions with very high credit worthiness are the ones that offer the swap market to clients who may be investors or other financial institutions. read more of the risk.

Growth Business

JULY 11, 2023

>See also: Here’s how you undertake an IPO in the UK in the best way It’s a stock market which provides primary and secondary markets for equity and debt products. Find out about crowdfunding by reading Crowdfunding UK small business: everything you need to know 11) Debt ‘I like debt,’ says Redtray’s Woodland.

The New York Times: Banking

DECEMBER 21, 2023

Despite legal reservations, policymakers are weighing the consequences of using $300 billion in Russian assets to help Kyiv’s war effort.

The New York Times: Banking

APRIL 16, 2024

China’s big bet on manufacturing helped to counteract its housing slowdown in the first three months of the year, but other countries are worried about a flood of Chinese goods.

The New York Times: Banking

OCTOBER 6, 2023

Employment data for September showed surprising strength in the economy, but that resiliency has become a cause for concern among investors.

Wall Street Mojo

JANUARY 17, 2024

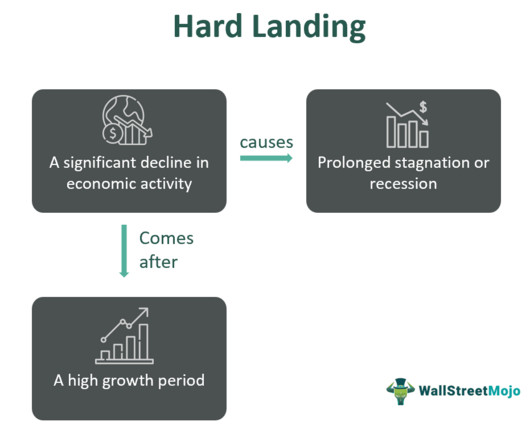

For example, when a nation’s government takes measures to curb inflation. Governments and central banks must take certain measures to avoid a scenario so that it does not lead to stagnation or recession. For example, a highly aggressive monetary policy, external shocks, and substantial debt. Can we avoid a hard landing?

Focus Investment Banking

OCTOBER 30, 2023

You probably couldn't do an ESOP with a small proprietorship because you may not be able to raise the debt involved and there are ongoing expenses to managing an ESOP a business must be able to afford. This tax-exempt status comes into play when structuring and analyzing the debt load the business can carry. continues Beard. “I

The New York Times: Banking

OCTOBER 3, 2023

The justices heard a challenge to the way Congress funded the Consumer Financial Protection Bureau but seemed persuaded that it was constitutional.

The New York Times: Banking

NOVEMBER 9, 2023

Powell, the Federal Reserve chair, said officials would proceed carefully. But if more policy action is needed, he pledged to take it.

The New York Times: Banking

SEPTEMBER 17, 2024

For corporate America, this week’s expected interest rate cut carries risks along with rewards.

Wall Street Mojo

JANUARY 17, 2024

It also enables stakeholders Stakeholders A stakeholder in business refers to anyone, including a person, group, organization, government, or any other entity with a direct or indirect interest in its operations, actions, and outcomes. The reports reflect a firm’s financial health and performance in a given period.

The New York Times: Banking

JULY 19, 2023

It’s “a surprisingly slippery concept,” he says.

The New York Times: Banking

SEPTEMBER 20, 2023

La carga de deuda de los países en desarrollo, que en este momento se calcula que supera los 200.000 millones de dólares, podría alterar economías y causar el desmoronamiento de los avances logrados en educación, salud y los ingresos.

Razorpay

DECEMBER 20, 2023

No interest: You don’t accumulate debt as with credit cards. However, they can lead to interest charges and potential debt accumulation if not managed efficiently. Interest: Accumulates debt if not paid in full, leading to high interest rates. Overspending: Easy to rack up debt beyond means.

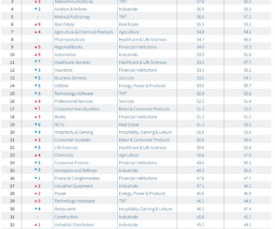

Mergers and Inquisitions

NOVEMBER 1, 2023

In most of the world, healthcare is either government-run or a mixed public/private sector. On #2, the government controls healthcare in many countries, but not everything in healthcare – there are still private healthcare firms even in Canada and the U.K. Why do PE firms operate there? Don’t they need companies with stable cash flows?

The New York Times: Banking

MAY 27, 2023

Investors, executives and economists are preparing contingency plans as they consider the turmoil that would result from a default in the $24 trillion U.S. Treasury market.

Lake Country Advisors

AUGUST 28, 2024

Equally critical is the evaluation of liabilities, including debts and loans, which profoundly affect your business’s market value. Coordinating with Stakeholders Coordinate with financial institutions, legal professionals, and other stakeholders to complete all necessary paperwork.

Bronte Capital

MAY 21, 2021

The words of the release outlined what the key issue was - trust in a financial institution. In response to the risk of material misstatement in financial reporting due to violations, we also reviewed the appropriateness of the debt collection process at the parent company level. The stock rose sharply.

Wall Street Mojo

JANUARY 15, 2024

By utilizing the calculator, individuals can assess the feasibility of different loan options, understand long-term financial commitments, and plan for effective loan repayment strategies. Begin by researching and selecting suitable educational loan programs offered by lenders, government agencies, or financial institutions.

Mergers and Inquisitions

DECEMBER 4, 2024

Sports Investment Banking Definition: In sports IB, bankers advise on equity and debt issuances, mergers, acquisitions, and restructuring deals for sports teams and leagues, sports-adjacent technology and services firms, and facilities such as arenas, stadiums, and racetracks. Can teams carry debt? What is Sports Investment Banking?

The TRADE

APRIL 30, 2024

Over the past two decades, several critical financial market regulations have been implemented globally, particularly in response to the 2008 Global Financial Crisis (GFC). The years following 2008’s GFC experienced continued financial regulatory reform.

Cooley M&A

FEBRUARY 1, 2024

Continuing the trend we noted for 2022 , sponsors increasingly used private credit sources in lieu of the syndicated debt markets to finance buyouts in 2023. For example, the energy and financial institutions group sectors saw deal values increase 74% and 83%, respectively, year over year. [2] in 2022 to 5.9x

The TRADE

FEBRUARY 28, 2025

With the levels of government debt exploding, the need for efficient financial markets and operational efficiency is clearly at the forefront of regulator minds, globally. The importance of data and analytics for large financial institutions cannot be overstated. Third is the need for scalability.

The New York Times: Banking

JUNE 18, 2024

Easy money destroyed the basis for productive, competitive markets.

The New York Times: Banking

OCTOBER 22, 2024

In an interview, the Treasury secretary also highlighted progress at the World Bank and the International Monetary Fund ahead of annual meetings this week.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content