Debt or Equity? Making the right choice at the right time

Wizenius

APRIL 1, 2023

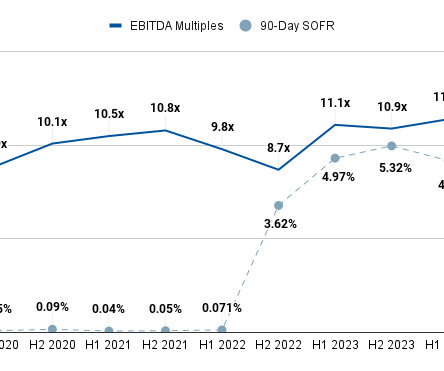

When companies need to raise capital, they have two primary options: Debt involves borrowing money, while equity involves issuing shares of ownership in the company. Let's take a look at examples of companies that raised capital through debt, and analyze the factors that influenced their decision.

Let's personalize your content