What is Value at Risk (VaR)? Definition and Basics

Peak Frameworks

SEPTEMBER 12, 2023

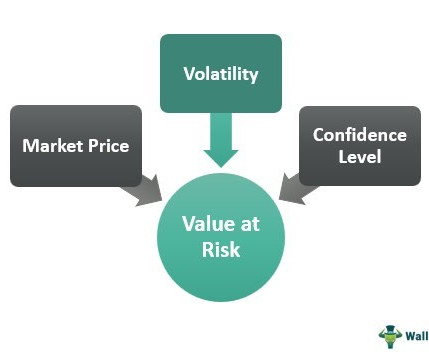

Value at Risk , commonly referred to as VaR, seeks to quantify the maximum potential loss an investment portfolio could face over a specified period for a given confidence interval. Understanding the Basics Definition VaR determines the potential loss an investment might encounter over a specific timeframe at a given confidence level.

Let's personalize your content