How Scammers Launder Money and Get Away With It

The New York Times: Banking

MARCH 22, 2025

Documents and insiders reveal how one of the worlds major money laundering networks operates.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The New York Times: Banking

MARCH 22, 2025

Documents and insiders reveal how one of the worlds major money laundering networks operates.

The M&A Lawyer

OCTOBER 19, 2016

Each document in our M&A forms database is available for purchase in Microsoft Word format and reflects what is, in my opinion, a reasonable starting point for drafting and negotiation. That is not to say that each document is ideally suited to every circumstance or to your specific transaction. Ancillary Documents.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Beyond M&A

SEPTEMBER 3, 2023

These software solutions offer many features, including document management, risk assessment, compliance monitoring, and reporting capabilities. Common challenges in the due diligence process The due diligence process can be a complex and time-consuming endeavour, often involving multiple stakeholders and extensive documentation.

Global Banking & Finance

JUNE 7, 2024

5 Reasons Your Finance Business Needs an E-Signature Experience Now E-signature programs offer unique advantages to financial institutions, making signing documents faster, easier, and more convenient. They streamline operations, reduce the risk of incorrectly […]

Razorpay

JANUARY 19, 2024

Prepare the necessary KYC documents such as identification proof and address proof. Upload scanned or photographed copies of your KYC documents. Provide any additional information or documents as requested by the bank. Identification Proof: Valid identification document (e.g.,

Razorpay

MARCH 27, 2024

Due to the highly liquid nature of checking accounts, banks and financial institutions typically do not offer interest on them. Various financial institutions offer the quick opening of this type of account with limited documentation and processing time. A founder can open a checking account offline and online.

How2Exit

FEBRUARY 23, 2023

There are a number of organizations and programs that exist to support SMBs, including business associations, government agencies, and financial institutions. Financial due diligence involves reviewing and evaluating a company's financial information and records in order to assess its financial health and performance.

Razorpay

OCTOBER 13, 2023

This is done by providing specific documents, which upon verification by the banks, releases payment from the buyer’s bank to the exporter’s bank. However, it is an extremely labour intensive method as it requires providing detailed documents that are prone to errors and discrepancies.

Razorpay

MARCH 19, 2024

Conduct foreign transactions Instead of having a separate account for foreign exchange, several financial institutions provide facilities with their current accounts, which are customised for startups. Conduct bulk payment transactions with collection services With a current account , you can make bulk payments for your startup.

Razorpay

OCTOBER 8, 2024

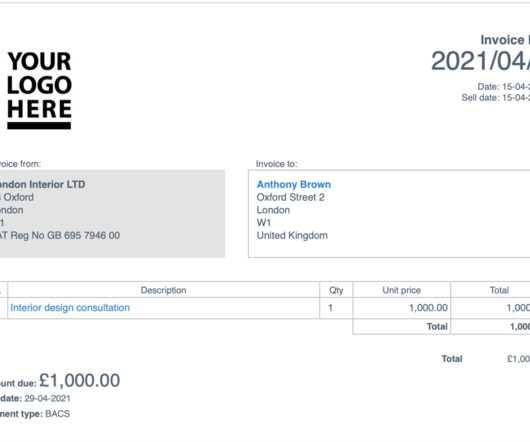

A proforma invoice is a preliminary or initial document issued by a seller to a prospective buyer before a sale is completed. This document allows both parties to negotiate terms and clarify expectations before committing to the sale. What is a Proforma Invoice? This promotes healthy connections and seamless interactions.

Razorpay

JUNE 12, 2024

Business Credibility Regular and accurate Softex Filings enhance a company’s credibility with financial institutions, investors, and other stakeholders. Submission to STPI/SEZ: The prepared Softex Forms, along with supporting documents like invoices and agreements, must be submitted to the relevant STPI or SEZ authority.

Razorpay

DECEMBER 1, 2023

Eligibility criteria vary, and financial institutions assess factors like credit history, processing volume, industry type, and risk assessment. Documents you are likely to provide: Contact information Authorized signer information Bank account number Tax ID 6. What documents are required for a merchant account?

Razorpay

MARCH 18, 2024

In addition, it comes loaded with features that help ventures focus on their growth instead of wasting precious time on financial management. It must be noted that the eligibility criteria and documents required to open a corporate account vary from one business structure to another. How to open a Corporate Account?

Razorpay

JANUARY 15, 2025

Debit Card EMI is a financial service offered by banks and financial institutions that allows debit cardholders to split high-value purchases into manageable monthly instalments. What is Debit Card EMI? Unlike traditional credit-based financing options, Debit Card EMI requires no credit card.

Razorpay

DECEMBER 15, 2024

A letter of credit is a financial document issued by a bank or financial institution that guarantees payment to a seller on behalf of the buyer, as long as specific conditions outlined in the document are met. Negotiation Fee: Charged when the sellers bank verifies the documents and forwards them for payment.

Wall Street Mojo

JANUARY 4, 2024

An Audit Engagement Letter is a formal document that confirms the acceptance of the audit process and is dispatched by the auditor. Clients often annually revise and sign this foundational document, ensuring alignment with changing circumstances. It is typically more subtle, and brief compared to formal contract documents.

Mergers and Inquisitions

DECEMBER 4, 2024

Recruiting and Daily Life as an Analyst or Associate in Sports Investment Banking Sports investment banking is not particularly specialized, so you don’t get extra points for having “industry experience” in the same way you might in an oil & gas , mining , or financial institutions group.

Razorpay

AUGUST 6, 2024

An invoice is a detailed document issued by a seller to a buyer, listing the products or services provided and the amount due. Knowing the difference between an invoice and a bill helps business owners and financial professionals streamline their accounting processes and avoid confusion. What are the Uses of a Bill?

Bronte Capital

MAY 21, 2021

The words of the release outlined what the key issue was - trust in a financial institution. On 17 May the company put out a press release stating that they have received an unqualified audit report. The stock rose sharply. You can find an archived copy of the press release here. Here is a direct quote: "We have delivered.

Lake Country Advisors

AUGUST 28, 2024

Preparing Your Financial Documents Organizing your financial documents is crucial in presenting your business as a transparent and trustworthy investment. Where local market conditions can vary widely, well-prepared financial documents give your business a competitive edge.

Razorpay

AUGUST 13, 2024

It is crucial to have well-documented and regularly updated access roles in place to restrict data access and prevent unauthorized use or disclosure. Access Logs and Documentation Comprehensive access logs are crucial for cardholder data security and PCI DSS compliance. Proper documentation is key to meeting PCI DSS requirements.

Accenture Capital Markets

SEPTEMBER 5, 2023

What you should end up with is a counterparty pairing list that will drive subsequent documentation discussions and custodian setups. Accenture has extensive experience helping various global financial institutions comply with the uncleared margin rules. This step will be easier for some than others.

Razorpay

OCTOBER 31, 2023

Large payments may be subject to additional scrutiny by banks and other financial institutions, which can increase the risk of failure. With currency coverage, a range of currencies are offered and supported by a payment service provider or financial institution.

Razorpay

JULY 24, 2024

Issuing Banks These financial institutions issue payment cards to consumers. What Documentation is Required for Merchant Onboarding? Registration Documents: These include incorporation papers or registration certificates. Periodic reviews verify and validate provided documents.

Razorpay

NOVEMBER 14, 2024

Bring necessary documentation including mandate details and ID proof. The institution will process and dispatch the termination documents to their affiliated bank that same day. Documentation Keep records of your cancellation request and any confirmations received from your bank or service provider.

Razorpay

AUGUST 15, 2023

A financial document issued by a bank on behalf of a buyer to a seller, guaranteeing payment to the seller upon meeting conditions specified in the document. Discounting: The process of selling the bill of exchange to a bank or financial institution at a discounted price.

Razorpay

MARCH 21, 2024

You compared other banks, gathered documents, submitted them, and waited for verification. The documents required to set up an e-mandate are: Submit a duly filled e-mandate form, which you can get from the service provider or merchant you want to pay through e-Mandate. In 2001, you needed money and had to take a bank loan.

Razorpay

MAY 27, 2024

While customers or business bodies reap the benefits of carrying out transactions freely, financial institutions via core banking solutions benefit from lesser time and can save upon resources that are used for repetitive business activities. Core banking solutions help in efficient documents and record management.

Wall Street Mojo

JANUARY 15, 2024

Article Link to be Hyperlinked For eg: Source: Collateralized Debt Obligation (CDO) (wallstreetmojo.com) The rise and demise Collateralized Debt Obligation assets turned out to be a cyclical process, initially reaching the top because of its inherent benefits, but ultimately collapsing and leading to one of the largest financial crises.

Wall Street Mojo

JANUARY 4, 2024

The rate of interest charged by the financial institution for the loan is monthly. Companies do not wait to receive receipt of cash Receipt Of Cash A cash receipt is a small document that works as evidence that the amount of cash received during a transaction involves transferring cash or cash equivalent.

Razorpay

AUGUST 12, 2024

This process can be initiated by the customer, the merchant, or the financial institution involved in the transaction. Common Causes of Payment Reversals Payment reversals can occur for various reasons, often leading to financial losses and operational challenges for businesses. Frequently Asked Questions (FAQs) 1.

Razorpay

SEPTEMBER 12, 2024

This helps financial institutions decide whether they should approve funding to a particular applicant or not. Automated KYC Processes AI-assisted systems handle Know Your Customer (KYC) documentation by cross-referencing information with databases and detecting discrepancies.

Razorpay

NOVEMBER 19, 2024

Following the submission, the financial institution performs a thorough verification process of all details provided in the mandate. Secure processing methods and complete electronic records ensure that all financial transactions remain safe and well-documented. Benefits of NACH Mandates 1.

Razorpay

AUGUST 9, 2024

Processing Transactions The terminal communicates with financial institutions or payment gateways to authorize and complete payments, transferring funds securely from the customer’s account to the merchant’s account.

Razorpay

OCTOBER 26, 2023

Also, banks and traditional lenders offer solutions that are document-incentive with stringent requirements and limited innovation. Banks vs. NBFCs vs. Fintechs Banks are like the foundation upon which other financial institutions build. SMEs face several hurdles when it comes to taking loans from banks.

Growth Business

JULY 11, 2023

– What documents do you need when fundraising and which are the most important? There are newer ways of getting investment too, such as crowdfunding. Some of the core principles of success will be the same, no matter which method you choose.

Wall Street Mojo

JANUARY 17, 2024

Statement of Cash Flows Definition A Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. Thus, it accounts for a company’s financial standing and reveals the corporate efficiency in managing its cash and liquidity position.

Devensoft

JUNE 13, 2023

They can help assess the financial and legal risks of the transaction, identify potential deal-breakers, and provide guidance on structuring the deal. Financial Institutions : Banks, investors, and other financial institutions that have a stake in the organization’s financial performance and stability are important stakeholders.

The TRADE

APRIL 30, 2024

Over the past two decades, several critical financial market regulations have been implemented globally, particularly in response to the 2008 Global Financial Crisis (GFC). The years following 2008’s GFC experienced continued financial regulatory reform.

The New York Times: Banking

JUNE 19, 2023

A court document shows that James E. Staley of JPMorgan Chase consulted with Mr. Epstein, a registered sex offender, on a wide variety of matters.

Razorpay

MARCH 24, 2025

Parties Involved It involves Drawer, Drawee and Bank/Financial Institution It involves Seller, Buyer and Factoring Company (Factor) Process The business sells its bills or invoices to a lender at a discount for upfront cash. Ownership of receivables is transferred to the factoring company. What is Bill Discounting?

Razorpay

DECEMBER 23, 2024

An account aggregator is an RBI-regulated entity that helps individuals securely and digitally access and share information from one financial institution they have an account with to any other regulated financial institution in the AA network. The data sharing is based on an individual’s explicit consent.

The TRADE

DECEMBER 30, 2024

Financial institutions are drowning in data but struggling to extract its true value. Market analysts and compliance officers, for instance, can spend countless hours sifting through information scattered across various documents and systems. However, the path to widespread adoption of AI is not without challenges.

Razorpay

DECEMBER 27, 2024

You will need to submit documentation such as financial records, compliance certifications, and technical specifications. Seamless Transactions PSPs act as a bridge between users, merchants, and financial institutions, ensuring quick and hassle-free payment processing. Ensure all documentation is accurate to avoid delays.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content