When Private Equity Came for the Music Industry

The New York Times: Mergers, Acquisitions and Dive

MARCH 18, 2024

Private equity is cannibalizing the music industry by buying up old hits and pushing them back into our cultural consciousness.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The New York Times: Mergers, Acquisitions and Dive

MARCH 18, 2024

Private equity is cannibalizing the music industry by buying up old hits and pushing them back into our cultural consciousness.

OfficeHours

JUNE 5, 2023

Private equity firms play a vital role in the broader investment landscape, and their success relies heavily on their ability to execute deals effectively. Simply put, any private equity associate course must focus on developing and refining these skills. We understand that, as a junior in the finance industry, time is of the essence.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

OfficeHours

MAY 21, 2023

Private equity associates are the workhorses of any investment team. They are typically closest to the financial modeling, analytical work, and diligence that private equity firms perform. Embark on an exciting journey in the world of private equity—a fast-paced and fulfilling career path.

Align Business Advisory Services

AUGUST 21, 2023

While ESOPs have certain benefits, they are not the most ideal structure for the exit of a business or to receive market value for their equity. Read, download, and share our latest report about the power of M&A over ESOPs.

OfficeHours

MAY 29, 2023

GENERALLY FOR INCOMING PE ASSOCIATES LOOKING TO LEVEL UP TO VP… Perfect for anyone starting their Private Equity Associate Job this summer… Discounts available for former OfficeHours Mentees, email nadia@getofficehours.com for more details Dive deeper into the details! You’ve got your dream private equity!

Focus Investment Banking

JANUARY 8, 2025

John-Michaels career spans an impressive range of finance disciplines, including derivatives, private equity, and investment banking. His tenure in private equity saw him identifying lucrative investment opportunities and driving successful transactions.

OfficeHours

JUNE 26, 2023

Download the Free Resume Template used by thousands of Investment Banking Analysts today! Download our Free Resume Template 1. We’ll guide you on what to include and what to exclude, ensuring that you focus on relevant information that aligns with your lateral switch or private equity aspirations.

Focus Investment Banking

JUNE 12, 2023

Thriving US Middle Market Fundraising and Resilient Private Equity Regarding Global M&A Private Equity Trends, looking at the positive news, the US middle-market fundraising landscape remained stable throughout 2022, with 156 funds closing at an aggregate value of $133.5 Reference: [link] [link] DOWNLOAD ARTICLE HERE.

OfficeHours

OCTOBER 20, 2023

For private equity investors who have been monitoring the situation around inflation for the last few months to a year, many have been disappointed to see the slow trajectory with which inflation has been coming down from highs. Explore the role of private equity now. Currently, inflation in the U.S.

OfficeHours

FEBRUARY 9, 2024

Having spent time in technology growth equity and VC in college, I realized quickly that my passions and career goals didn’t align with RX or the exit opps from MM banking to MM private equity. You’ve got your dream private equity! But that is just the first step of the private equity journey. Knowledge is Power.

Focus Investment Banking

JANUARY 8, 2025

With decades of experience in law firm M&A, legal staffing and recruiting and private equity, Lipton brings unparalleled knowledge and a track record of success to the firm Bob Lipton has extensive experience advising businesses on mergers and acquisitions, growth strategies, and operational efficiencies within the HCM space.

Francine Way

JULY 13, 2017

Calculating cost of debt, cost of equity, and weighted average cost of capital (WACC). Determining the year-by-year future non-equity claims from the latest 10-K, especially those that will occur during the forecast horizon, and their combined present value. Tangible Book Value = Book Value of Equity - Goodwill.

OfficeHours

OCTOBER 23, 2023

However, for private equity investors, this uncertainty represents a unique opportunity to take advantage of investment opportunities in public markets. A “take-private” transaction in the context of private equity is a process by which a PE firm acquires a publicly listed company and converts it into a privately held entity.

Focus Investment Banking

NOVEMBER 20, 2024

Funding is available through private equity investment and programs provided by the Small Business Administration (SBA). There’s a lot of private equity interest out here,” Strandberg continued. Full disclosure: they’re typically looking for some pretty substantially-sized organizations.”

Focus Investment Banking

JANUARY 21, 2025

With closer operational integration and a shared vision for growth, the new structure is the natural next step in growing the Companys international offerings in M&A, debt advisory, and equity raising. Its an exciting time for our firm and our clients as we continue to expand our reach and deliver exceptional results.

TechCrunch: M&A

MAY 8, 2023

And it will also involve Blinkist’s biggest investor, Insight Partners , taking an additional $30 million in equity in Go1 at an “upround,” but again with the exact numbers not being discussed. ” Blinkist has had 25 million downloads of its app and has just under 1 million paying users, including some 1,500 companies.

Francine Way

JULY 12, 2017

Calculate cost of debt, cost of equity, and weighted average cost of capital (WACC). Determine the year-by-year future non-equity claims from the latest 10-K, especially those that will occur during the forecast horizon, and their combined present value. The cost of equity calculation is more complex.

Focus Investment Banking

MAY 25, 2023

private equity firms. Download Case Study The post Creative MultiCare, LLC Case Study appeared first on FOCUS Investment Banking LLC. Creative MultiCare, LLC (“Creative”) received a growth investment from Coral Gables-based Trivest Partners LP (“Trivest”), one of the leading U.S.

OfficeHours

JANUARY 15, 2024

OfficeHours Headhunter 101 Doc 10-15 Headhunters control the process…download our 101 Doc to learn more about them! However, for private equity investors, this uncertainty represents The Path to Success: Building a Thriving Career in Private Equity Congratulations! You’ve got your dream private equity!

Focus Investment Banking

JUNE 5, 2023

Celito , a communications and managed service provider serving businesses in the Raleigh, North Carolina region, has received a significant equity investment from M/C Partners , a leading private equity firm focused on the digital infrastructure and technology services sectors. FOCUS advised Celito in this transaction.

Focus Investment Banking

MARCH 24, 2024

In the dynamic realm of direct-to-consumer (DTC) businesses, a clear hierarchy emerges in private equity valuations, largely based on the perceived stability, scalability, control over supply chains and customer experiences. Download the article here. Physical stores increase brand visibility and credibility.

Francine Way

JULY 18, 2017

Because dividends is a piece of equity, we can use the Capital Asset Pricing Model (CAPM) to calculate the proper Rate of Return (r). To perform this forecast, we need the target’s dividend history again, the book value of equity and year-end shares outstanding, and the stock prices at year-end.

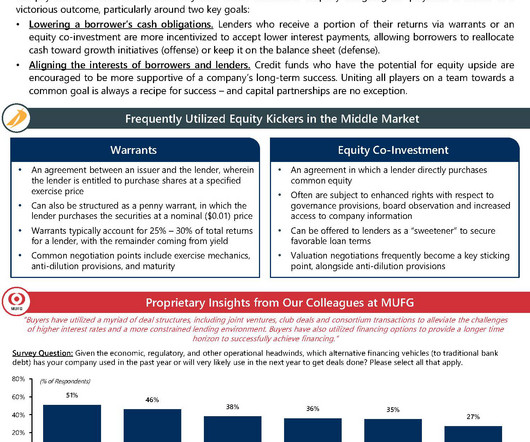

Intrepid Banker Insights

AUGUST 16, 2024

Intrepid Investment Bankers Market Moments That Matter | It’s Time for Kickers to Shine this Football Season Intrepid Capital Advisory MARKET MOMENTS THAT MATTER With football season right around the corner, we are seeing a renewed focus on (equity) kickers as a differentiator on both sides of the ball.

Focus Investment Banking

NOVEMBER 14, 2024

About FOCUS Investment Banking’s MSP Team FOCUS’ Managed Service Provider (MSP) Team, one of North America’s most dynamic and accomplished, has successfully orchestrated transactions with 76 parties in the past five years alone, propelling 12 MSPs into new platforms for private equity sponsors. million to $30 million.

Focus Investment Banking

AUGUST 2, 2023

It is important to note the increase in Private Equity participation in this market. DOWNLOAD THIS REPORT The post Supply Chain Technology and Logistics Report First Half 2023 appeared first on FOCUS Investment Banking LLC.

Francine Way

JULY 11, 2017

Inexpensive Excel-plugin simulator such as @RISK are available for download online. For a public company, a reliable source of this information can be the SEC EDGAR database or sources like Mergent Online that provide easily downloadable data. A 5- or 10- year historical data is preferable.

Intrepid Banker Insights

JULY 15, 2024

Key highlights include: Summary of year-to-date 2024 transaction activity and our predictions for the rest of the year, including the impact of the presidential election cycle Commentary on twelve of the most impactful transactions in the past six months Analysis on key trends driving interest with strategic acquirors and private equity investors Download (..)

Solganick & Co.

JANUARY 28, 2025

You can download the full report here: IT Solutions Providers Q4 2024 and 2025 Mergers Outlook The following summarizes the report: The IT Solutions Provider landscape continues its dynamic evolution, marked by a steady stream of mergers and acquisitions (M&A) in Q4 2024 and the start of 2025.

OfficeHours

OCTOBER 17, 2023

So you want to pursue a role in Private Equity and Growth Equity? OfficeHours Headhunter 101 Doc 10-15 Headhunters control the process…download our 101 Doc to learn more about them! Therefore, it’s hard to predict what exactly this expense will be in the future but it’s good to be prepared with a more conservative number.

Beyond M&A

MARCH 3, 2023

Sage advice, as I have come to learn how Private Equity investors operate. Download 8 Future Categories for Tech Due Diligence However, five years in, I am starting to consider what the future of Tech Due Diligence will be like. There is a natural affinity between us and commercial due diligence, for example.

Focus Investment Banking

NOVEMBER 19, 2023

As M&A advisors, we see literally billions of dollars of hard-earned owner equity at significant risk of vaporizing if owners don’t consider all of their options and devise a plan when they are faced with a consolidating industry scenario. DOWNLOAD THE FULL ARTICLE.

Solganick & Co.

SEPTEMBER 30, 2022

You can download the full report here: Solganick HCIT Q2 2022 M&A transactions have remained active in the healthcare IT sector in Q2 2022. is active in Healthcare IT M&A and has completed multiple transactions with private equity firms as well as strategic buyers and sellers. Consumer Health 3.7x Revenue Cycle Management 3.4x

Francine Way

JULY 19, 2017

To download @RISK for a free trial version, click here. I recommending downloading and opening @RISK prior to building and working with a Monte Carlo-embedded Excel file. For the purpose of our post, the output variables should be the per-share equity value returned from our DCF, Comparable Company, etc. valuation exercises.

Focus Investment Banking

JANUARY 8, 2025

John-Michaels career spans an impressive range of finance disciplines, including derivatives, private equity, and investment banking. His tenure in private equity saw him identifying lucrative investment opportunities and driving successful transactions.

Sica Fletcher

MAY 13, 2024

Private Equity-backed buyers retain their stronghold on M&A activity with 87% of Q1 2024 Index transactions, even as the interest rate environment and strategic acquisitions continue to slow down a handful of platforms. “The The shift in buyer rotation year-over-year continues to shape the dynamic insurance M&A landscape.

OfficeHours

MAY 31, 2023

You can even download pre-set financial statements that will help you see how knowledge is getting pulled and manipulated from company public filings, but similar to the Corporate Finance Institute guide, you will need to hold yourself accountable and make sure that you’re not just memorizing how to build a financial model for the example company.

Sica Fletcher

AUGUST 5, 2024

Private Equity-backed buyers maintain a dominant position in M&A activity, accounting for 87% of YTD June 2024 Index transactions. Several SF Index Members experienced consistent growth in their deals compared to the same period last year, while others have temporarily paused their activities.

Sica Fletcher

AUGUST 5, 2024

Private Equity-backed buyers maintain a dominant position in M&A activity, accounting for 87% of YTD June 2024 Index transactions. Several SF Index Members experienced consistent growth in their deals compared to the same period last year, while others have temporarily paused their activities.

Software Equity Group

MARCH 13, 2023

For a more in-depth look at our research, download SEG’s Annual 2023 SaaS Report. While some public strategics backed off, they were more than made up for by private equity companies with plenty of dry powder and a healthy competitive environment. Private equity direct and private equity-backed strategic buyers together made up 59.5%

Sica Fletcher

AUGUST 30, 2023

The quarterly report emphasizes the ever-growing presence of private equity-backed firms in insurance brokerage M&A. About 91% of SF Index transactions were executed by private equity-backed firms through YTD June 2023, continuing the trend observed year over year.

Focus Investment Banking

JUNE 1, 2023

Danny is a telecommunications industry veteran who has led several private equity backed companies. Download this press release as a PDF The post FOCUS Investment Banking Represents Celito in its Growth Investment from M/C Partners appeared first on FOCUS Investment Banking LLC. FOCUS advised Celito in this transaction.

Trout CPA: M&A

JANUARY 7, 2022

Download the PDF Version By W. There was plenty of M&A activity, lots of “dry powder” with private equity firms, low interest rates, and a great time to sell or buy a business.

How2Exit

OCTOBER 22, 2023

rn Ride along here- [link] rn Download her free due diligence tool here- [link] rn Connect on LinkedIn: [link] rn About The Guest(s): Alexis Grant is the founder of They Got Acquired, a media brand that focuses on covering acquisitions in the six, seven, and low eight-figure range.

Focus Investment Banking

OCTOBER 2, 2023

FOCUS was named to Axial’s ranking of the Top 50 lower middle market private equity investors and M&A advisors in consumer, mainly due to its work on sell-side transactions. Axial is a platform for deal sourcing, deal marketing, and relationship-driven business development. For more information, visit www.focusbankers.com.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content