Deal Lawyers Download Podcast: SRS Acquiom Annual M&A Deal Terms Study

Deal Lawyers

MAY 29, 2024

In our latest Deal Lawyers Download Podcast, SRS Acquiom’s Kip Wallen joined me to discuss his firm’s 2024 M&A Deal Terms Study.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Deal Lawyers

MAY 29, 2024

In our latest Deal Lawyers Download Podcast, SRS Acquiom’s Kip Wallen joined me to discuss his firm’s 2024 M&A Deal Terms Study.

Francine Way

JULY 11, 2017

Just as any home appraiser or credit officer does before going through the analytical exercise to produce a score for a home or a borrower, valuation professionals go through several steps of preparation before the actual exercise of producing a number that can be used as a value of a company.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Francine Way

JULY 13, 2017

As I mentioned in my valuation preparation post , Comparable Company is a valuation method that uses metrics of other similar businesses (same industry, size, geography, valuation multiples, etc.) Calculating the Equity Value and the per-share Equity Value - this number would serve as the base case share price valuation.

Francine Way

JULY 19, 2017

Thus far, we have discussed five valuation methods: DCF, Comparable Company, Precedent Transaction, LBO, and Dividend Discount Model (DDM). So, a good valuation model has to take into account the possibilities of a variable having multiple values along with each value’s probability of occurring. To-date, we have lumped them together.

Francine Way

JULY 18, 2017

For this valuation post, I wanted to talk about a valuation method that is making its way out of academia and into the real world, a method that is gaining popularity in the world of portfolio management. The major steps of DDM are: Deriving the proper discount rate (rate of return). Deciding on a forecast horizon (holding period).

Francine Way

JULY 12, 2017

As I mentioned in my last post, Discounted Cash Flow (DCF) is a valuation method that uses free cash flow projections, a discount rate, and a growth rate to find the present value estimate of a potential investment. Calculate the Equity Value and the per-share Equity Value - this number would serve as the base case share price valuation.

Midaxo

SEPTEMBER 28, 2023

M&A transactions can be incredibly rewarding, but they also come with significant risks. M&A due diligence is the process that allows you to dig deep into a target company’s details and evaluate whether the acquisition aligns with your strategic goals. This goes beyond just the surface-level aspects of the target company.

Solganick & Co.

JANUARY 28, 2025

. (“Solganick”) has issued its latest mergers and acquisitions (M&A) report on the IT Solutions and VARs sector. Private Equity Influence : Private equity firms continue to play a significant role in the M&A landscape, investing in promising IT solution providers and driving further consolidation.

Software Equity Group

DECEMBER 18, 2023

Given geopolitical instability, high interest rates, and the perception that B2B SaaS valuation multiples are declining, it is no great surprise that many founders interested in pursuing a transaction are considering delaying a liquidity event. Continue reading to learn more about what is driving today’s B2B SaaS valuation multiples.

TechCrunch: M&A

MAY 8, 2023

After raising $100 million at a valuation of over $2 billion last year, the Australian ed-tech startup Go1 is making an acquisition and getting some investment to expand its reach and technology to serve the market of corporate online learning. Blinkist’s last valuation was $160 million in 2018 , when it raised $18.8

Solganick & Co.

OCTOBER 7, 2022

has published its latest Healthcare IT M&A Update for Q3 2022. The report covers the latest mergers and acquisitions trends and valuations for the industry sector. To summarize, the Healthcare IT M&A market was still active even though the economic market and stock market were volatile.

Solganick & Co.

FEBRUARY 15, 2023

has published its latest M&A report on the Technology Services industry. Highlights of public valuation multiples include: The report covers public and private companies including public valuation tables for each subsector. February 16, 2023 – Solganick & Co.

Solganick & Co.

AUGUST 14, 2023

has published its latest M&A Market Update on the Technology Services industry sector. Here are the highlights of the report: Transaction volume and valuation multiples for technology services companies has remained solid during the first half of 2023, continuing to exceed pre-pandemic levels in aggregate. Solganick & Co.

Sica Fletcher

DECEMBER 13, 2023

Since the dramatic uptick in interest rates last year, a number of articles appeared in the press arguing that the insurance brokerage M&A market would slow due to higher interest rates. The full article can be downloaded here. This prediction that the market would slow was simply incorrect.

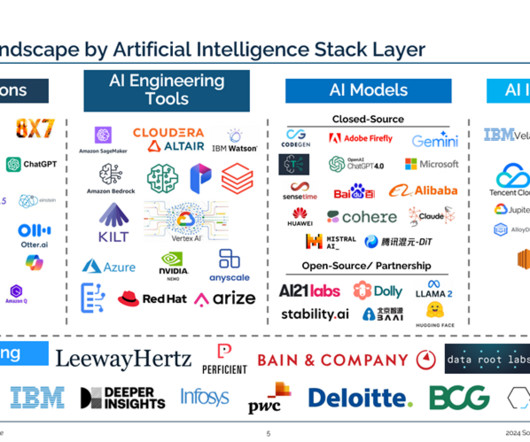

Solganick & Co.

JULY 12, 2024

Report: Artificial Intelligence in a Growing M&A Landscape, 1H 2024 July 12, 2024 – Solganick has published its latest M&A update on the artificial intelligence industry sector as of 1H 2024. It will be a buyer’s “techquisition” market as valuations face pressure.

Solganick & Co.

SEPTEMBER 30, 2022

has published its latest Healthcare IT M&A Update for Q2 2022. You can download the full report here: Solganick HCIT Q2 2022 M&A transactions have remained active in the healthcare IT sector in Q2 2022. September 30, 2022 – Manhattan Beach, CA and Dallas, TX – Solganick & Co. Consumer Health 3.7x

Solganick & Co.

AUGUST 21, 2024

August 20, 2024 – Solganick has published its latest mergers and acquisitions (M&A) update on AWS Services Consulting Partners. For more information or to inquire about an M&A transaction, please contact us. billion in revenue during Q2 2024, representing a 19% year-over-year increase.

Solganick & Co.

NOVEMBER 6, 2023

has published its latest mergers and acquisitions (M&A) update on the Cloud Computing sector. It covers relavant M&A transactions within the cloud partner ecosystem including AWS Cloud, Google Cloud, and Microsoft Intelligent Cloud/Azure (and others). November 6, 2023 – Solganick & Co.

Focus Investment Banking

MAY 10, 2024

In this article, which joins our ongoing coverage of the Food & Beverage industry, we introduce an overview of M&A activity in food distribution with a focus on fresh food. M&A activity flourishes in large industries undergoing growth and stress, making food distribution ripe for dealmaking. What’s Ahead?

Focus Investment Banking

JUNE 12, 2023

Thriving US Middle Market Fundraising and Resilient Private Equity Regarding Global M&A Private Equity Trends, looking at the positive news, the US middle-market fundraising landscape remained stable throughout 2022, with 156 funds closing at an aggregate value of $133.5 While average valuations in the U.S.

Trout CPA: M&A

JANUARY 7, 2022

Download the PDF Version By W. Michael Wolfe, CPA/ABV, CVA, Valuation Services Partner at Trout CPA Pandemic Impact on M&A We can now appreciate the normalcy that existed at the end of 2019. In the midst of this uncertainty, companies continued to want to engage in M&A.

Devensoft

JUNE 6, 2023

Pursuing an M&A deal is a major decision for any business, one that comes with a unique set of both risks and rewards. It’s crucial that you conduct a thorough due diligence process before entering an M&A deal. This due diligence questionnaire will explain how you can adequately vet potential M&A deals.

Software Equity Group

FEBRUARY 28, 2023

SEG’s 2023 Annual SaaS Report provides a comprehensive analysis of the public SaaS market’s performance and M&A activity in the software industry. Our report provides context for private companies to better understand factors influencing their valuations and evaluate how they can position themselves within a changing marketplace.

Software Equity Group

MARCH 13, 2023

While median EV/Revenue multiples declined from 4Q20–1Q22, they still outperformed the median public market multiple, and SaaS M&A deal volume jumped to a new record. Following are some highlights of SaaS M&A deal activity over 2022. For a more in-depth look at our research, download SEG’s Annual 2023 SaaS Report.

Solganick & Co.

JANUARY 15, 2025

January 15, 2025 – Solganick has issued its latest mergers and acquisitions (M&A) update for the Cybersecurity industry sector, covering Q4 2024 and a 2025 outlook. We expect strengthening M&A activity over the next 12 months, driven by ongoing strategic consolidation and escalating cyber risks from AI-powered attacks.

Software Equity Group

APRIL 24, 2024

SaaS, of course, plays a central role in these efforts, driving a heightened level of M&A activity in the software space. M&A Overview: The Quest for Industry 4.0 After a gradual decline since the mid-20th century, the U.S. manufacturing and industrial sector is making a comeback. Now, signs of recovery are emerging.

Solganick & Co.

JANUARY 22, 2025

Solganick Technology Services M&A Update- Q4 2024 and 2025 Outlook Final January 23, 2025 – Dallas, TX and Los Angeles, CA – Solganick has published its latest mergers and acquisitions (M&A) update on the Technology Services sector. AI will fuel an increase in IT services M&A for the next several years.

Focus Investment Banking

APRIL 14, 2024

These characteristics, coupled with bakery manufacturers’ ability to continually innovate and adapt to consumer trends, have attracted investors and boosted M&A activity in recent years. It’s no surprise that bakery is one of the food industry’s most dependable performers. The bakery category is also incredibly resilient.

Focus Investment Banking

JULY 24, 2024

In our First Half 2024 report, we summarize 125 M&A transactions across the Supply Chain Technology and Logistics segments including the reason why they are happening. We also provide commentary on current supply chain trends and document the ups and downs in public company valuations.

Focus Investment Banking

JULY 24, 2024

In our First Half 2024 report, we summarize 125 M&A transactions across the Supply Chain Technology and Logistics segments including the reason why they are happening. We also provide commentary on current supply chain trends and document the ups and downs in public company valuations.

Focus Investment Banking

FEBRUARY 21, 2024

In our Second Half 2023 report, we summarize 73 M&A transactions across the Supply Chain Technology and Logistics segments including the reason why they are happening. We also provide commentary on current supply chain trends and document the ups and downs in public company valuations. DOWNLOAD THIS REPORT

Solganick & Co.

DECEMBER 2, 2024

December 2, 2024 – Solganick has published an update M&A report on Amazon Web Services (AWS) consulting services partners. Solganick is a data-driven investment bank and M&A advisory firm focused exclusively on software and IT services companies. The business unit generated $27.5

Devensoft

JUNE 13, 2023

Preparing for Post-Merger Integration or Divestiture In this chapter, we will discuss the steps that need to be taken before embarking on an M&A integration or divestiture transaction. Download the full article as a PDF. Don’t have time to read the full article? Get a copy to-go.

Focus Investment Banking

AUGUST 20, 2024

2Q 2024 M&A Report : The second quarter brought a slight uptick in Food & Beverage deal volume, offering a positive signal as M&A markets recover from the declines observed in 2023. Deals valued at less than $100 million all saw increases in average valuation, as did deals valued between $250 million and $500 million.

Focus Investment Banking

AUGUST 2, 2023

In our First Half 2023 report, we summarize 140 M&A transactions across the Supply Chain Technology and Logistics segments including the reason why they are happening. We also provide commentary on current supply chain trends and document the ups and downs in public company valuations.

PCO M&A Specialists

MARCH 8, 2021

In this educational webcast Andrew de la Chapelle, Senior Strategic M&A Consultant and Dan Gordon, Founder of PCO M&A Specialists have a detailed and highly entertaining conversation to help demystify what is required for business owners to maximize their hard work.

Software Equity Group

SEPTEMBER 26, 2023

The software M&A market is like a living and breathing organism: constantly evolving, adapting, and reacting to the world around it. This is especially true in recent years, with COVID driving historic SaaS adoption and the monetary and fiscal policy that followed, creating a unique M&A dynamic. Why is this?

OfficeHours

FEBRUARY 9, 2024

Not only did the groups do completely different things (RX/bankruptcy vs. tech M&A), but even the deal processes ran differently. Given that we were mainly doing sell-sides at the EB, a lot of the analysis work was valuation as well as positioning the company and helping the management team with the presentations.

OfficeHours

OCTOBER 20, 2023

For private equity investors who have been monitoring the situation around inflation for the last few months to a year, many have been disappointed to see the slow trajectory with which inflation has been coming down from highs. Currently, inflation in the U.S. Currently, inflation in the U.S.

Focus Investment Banking

MAY 3, 2024

In the Food and Beverage sector, the M&A scene kicked off the year with promise, marked by a steady stream of transactions, including several significant ones. Notably, completed deals in the fourth quarter boasted valuations averaging 7.5x Notably, completed deals in the fourth quarter boasted valuations averaging 7.5x

Solganick & Co.

OCTOBER 15, 2024

October 16, 2024 – Solganick & Co. (“Solganick”) has published its latest M&A update on the Cybersecurity industry sector. It covers the latest mergers and acquisitions deal announcements, valuations, public company data, and other trends announced in Q3 2024.

Focus Investment Banking

JULY 16, 2024

This is well below levels that we saw in 2023, which itself had an unusually low amount of M&A activity. Number of Transactions $ Value of Transactions in Millions ANNOUNCED TRANSACTIONS (4/1/24 – 6/30/24) M&A TRANSACTIONS WITH ANNOUNCED MULTIPLES (7/1/23 – 6/30/24) DOWNLOAD THE FULL REPORT HERE.

Focus Investment Banking

NOVEMBER 19, 2023

In this final segment we examine the risks photonics companies run by not seriously considering exiting now when buyers are able and willing to pay premium prices and valuations. DOWNLOAD THE FULL ARTICLE. If not, then it is time for some deep and honest reflection.

Solganick & Co.

JULY 6, 2023

It covers the latest funding and M&A transactions as well as a macro analysis and viewpoint of the sector. Here is a brief summary of the report: The demand for artificial intelligence has boosted the technology sector over the last 12+ months and will continue to support strong growth in jobs, capital, and M&A activity.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content