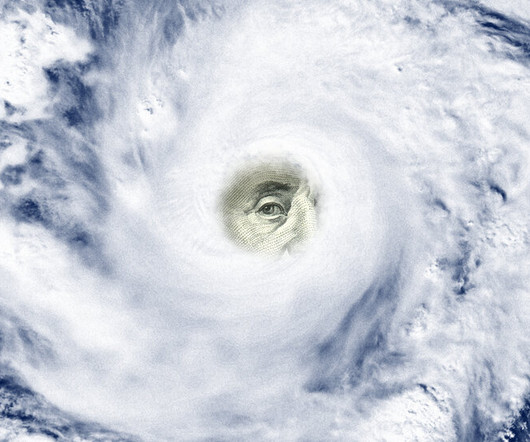

Russia’s Wartime Spending Raises Fears of an Economic Bubble

The New York Times: Banking

JULY 31, 2023

The economic strength has helped to maintain popular support for Vladimir Putin’s war, but some have warned the state-led spending is threatening the country’s financial stability.

Let's personalize your content