These ‘Magnificent’ Seven Tech Stocks Are Driving the Market

The New York Times: Banking

JANUARY 22, 2024

See how a handful of stocks have had an outsize impact on the performance of the S&P 500

The New York Times: Banking

JANUARY 22, 2024

See how a handful of stocks have had an outsize impact on the performance of the S&P 500

The New York Times: Banking

JANUARY 19, 2024

The S&P 500 crossed above its January 2022 peak after weeks of wavering. Investors have been buying stocks after homing in on signals that the Fed’s campaign of raising interest rates is over.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The New York Times: Banking

DECEMBER 20, 2024

The S&P 500 jumped after a November inflation reading helped ease worries. A partial government shutdown, analysts said, wouldnt have a lasting economic impact.

Razorpay

APRIL 10, 2024

Let’s delve into the world of purpose codes and understand their significance. A purpose code is a unique identifier issued by a country’s central bank that is necessary for the successful execution of international payments. This classification is pivotal for monitoring service flow and analyzing economic trends.

Peak Frameworks

OCTOBER 17, 2023

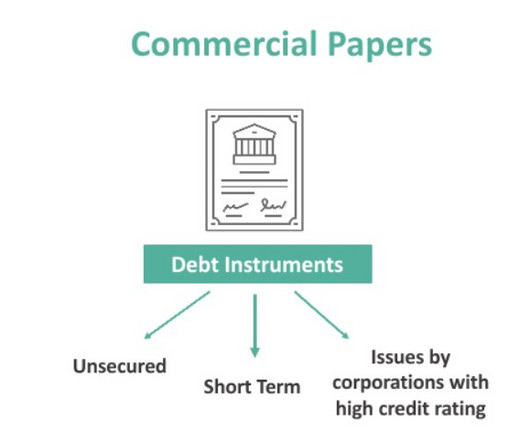

Denominations Commercial paper is typically issued in substantial denominations , making it more accessible to institutional investors rather than individual ones. This large denomination nature narrows down the typical buyers to money market funds, mutual funds, and other large financial institutions.

Mergers and Inquisitions

DECEMBER 4, 2024

No matter the economic climate, you can always bet on sports fans to show up for their favorite teams. My high-level summary would be: 1) Focus on Revenue Multiples – Many teams are not run efficiently and have low/negative cash flows and earnings, so revenue multiples are more common than EBITDA , P/E, or other valuation multiples.

Cooley M&A

FEBRUARY 1, 2024

2023’s much-discussed downturn in mergers & acquisitions – with global M&A volume and value down 6% and 17%, respectively, from 2022 – was largely driven by the slowdown in the tech sector, with global tech M&A volumes down 51% year over year, while other sectors saw marked increases. [1] 1] Evercore 2023 Year in Review.

Let's personalize your content