Tech Due Diligence: Your Financial Model Sucks.

Beyond M&A

SEPTEMBER 24, 2024

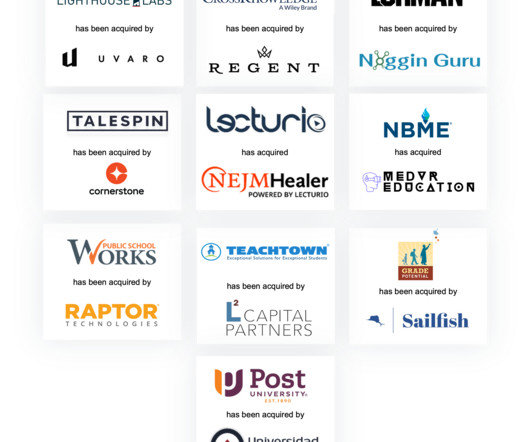

The Financial Model Challenge in Tech Due Diligence It’s no secret that the current economic climate is challenging. The M&A world is feeling the squeeze, and nowhere is this more apparent than in the financial models being presented during Tech Due Diligence (DD). Fundraising is tough across the board.

Let's personalize your content