2024 Financial Services M&A Highlights

JD Supra: Mergers

JANUARY 10, 2025

Despite a cautious deal market and continuing economic and political uncertainty as 2024 began, Dechert remained active in the financial services M&A sector. By: Dechert LLP

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

JANUARY 10, 2025

Despite a cautious deal market and continuing economic and political uncertainty as 2024 began, Dechert remained active in the financial services M&A sector. By: Dechert LLP

Global Banking & Finance

NOVEMBER 16, 2023

Three ways to build a predictable revenue machine in an era of economic uncertainty How to use sales enablement programs and the latest AI to accelerate your pipeline. From financial services, fintech, SaaS and beyond, businesses are hunting for bigger deals that close faster and customers that […]

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Global Banking & Finance

AUGUST 6, 2024

By Charlotte Webb, Operations and Marketing Director of Hyve Managed Hosting Financial services (FinServ) firms no longer need to be convinced of the value of the cloud for businesses.

Cisco: M&A

OCTOBER 1, 2024

IT payment solutions offer an alternative source of capital that will not impact a customer’s existing credit lines.

Global Banking & Finance

SEPTEMBER 3, 2024

Craig Wilson, Head of Private Sector at Sopra Steria UK Amidst the current climate, marked by financial challenge and uncertainty, the definition of vulnerability has evolved. Recent global events and shifts in the socio-economic dynamics mean high inflation and more people feeling concerned about their financial wellbeing.

The New York Times: Banking

FEBRUARY 5, 2024

The Treasury secretary will offer an upbeat assessment of the economy on Tuesday, a year after the nation’s banking system faced turmoil.

The TRADE

JUNE 17, 2024

Nasdaq already has a range of technology partnerships across the Indonesian financial system, including providing surveillance technology to Indonesia’s Financial Services Authority, OJK; the technology platform that underpins Indonesia’s central securities depository, KSEI; and its Calypso treasury solution to Bank Indonesia.

The TRADE

JANUARY 3, 2024

If the current low-volume environment in Europe continues, tied to GDP and economic growth, we will see renewed effort from policy makers to address some of the structural problems in Europe. Regulation must establish a framework that encourages innovation while protecting consumers and maintaining financial stability.

OfficeHours

FEBRUARY 26, 2024

If you are anything like me, I entered the financial services industry a few years ago with a naive sense of job security. Economic Downturns While this reason may seem obvious at first, economic downturns are actually extremely nuanced.

OfficeHours

MARCH 6, 2024

Written by a Top OfficeHours Female Coach If you are anything like me, I entered the financial services industry a few years ago with a naive sense of job security. Economic Downturns While this reason may seem obvious at first, economic downturns are actually extremely nuanced.

The TRADE

SEPTEMBER 21, 2023

He told The TRADE that Aquis Equinox – the worlds first 24/7 matching engine – launched in Q1 had put the business on the map: “The great thing about 24/7 is the economic benefit […] without any loss of performance and that is the thing that is most appealing. We feel very much the leaders in cloud 24/7 exchange technology.”

M&A Leadership Council

SEPTEMBER 16, 2024

He has both operated and consulted in roles across the leadership spectrum in a variety of industries including business services, healthcare, retail, financial services, and others. After growing up in Portland, Oregon, Adam attended Indiana University and graduated with BA in Political Science, Economics, and Russian Studies.

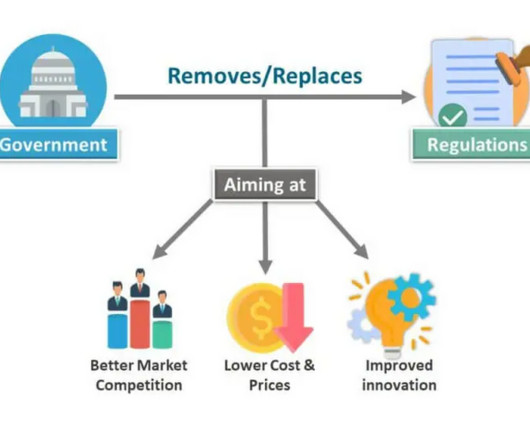

Peak Frameworks

MAY 2, 2024

Financial deregulation, for example, saw a pivotal moment with the partial repeal of the Glass-Steagall Act in 1999 , a move that obliterated the firewalls between commercial and investment banking and profoundly influenced the landscape of financial services.

Growth Business

NOVEMBER 23, 2023

Ascension Ventures Early-stage VC built by exited entrepreneurs ready to back the next generation of tech and impact founders Augmentum Fintech Augmentum Europe’s leading publicly listed fintech fund, investing in fast growing businesses that are disrupting the financial services sector. mortgages, insurance) software (e.g.

Viking Mergers & Acquisitions

MAY 9, 2023

He has navigated various challenges and changes in his career and emerged as a successful leader in the financial services and M&A industry. His friend’s father was a successful financial advisor and a great encouragement to Reed. This connection inspired him to pursue a career in financial services.

Software Equity Group

MAY 7, 2024

2023 saw a myriad of factors impact SaaS M&A multiples, including economic developments, technological advancements, and a public market rebound. In any given year, however, some sectors of the SaaS universe are more prosperous than others, depending on industry trends, global economics, and other influences.

Software Equity Group

MAY 8, 2024

2023 saw a myriad of factors impact SaaS M&A multiples, including economic developments, technological advancements, and a public market rebound. In any given year, however, some sectors of the SaaS universe are more prosperous than others, depending on industry trends, global economics, and other influences.

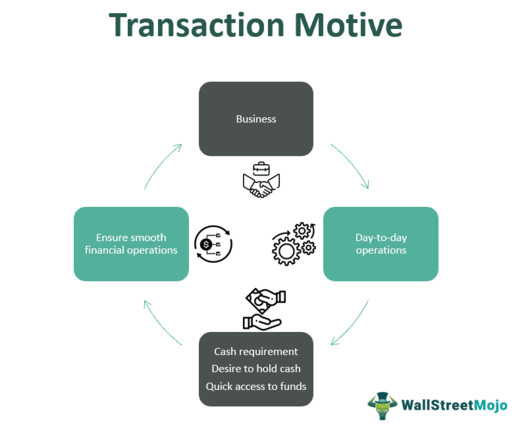

Wall Street Mojo

JANUARY 15, 2024

Transaction motive plays a significant role in uninterrupted economic operation by ensuring funds are available for all economic activities. It helps businesses and individuals buy goods and services to improve their output and quality of life. Promotes liquidity, leading to smoother economic activities.

MergersCorp M&A International

NOVEMBER 1, 2024

Asset management companies are integral players in the financial services sector, managing investments on behalf of clients, which can include individuals, institutions, and corporations. Their value is determined not only by their financial metrics but also by qualitative factors, market position, and growth potential.

Sun Acquisitions

FEBRUARY 26, 2024

It is no surprise the IT industry leads generative AI usage across multiple industries, including Financial Services, Media & Telecom, Energy, Transportation and Healthcare/Life Sciences. Technology leads the rest of the pact by over 20% adoption rate as a fundamental part of their product/service offerings.

The TRADE

DECEMBER 22, 2023

James Maxfield, chief product officer, Duco In 2024, regulatory challenges will loom large for c ompliance departments within the financial services sector. Against the additional challenge of the current economic environment, there will be a noticeable strain on budgets and resources.

The Deal

DECEMBER 5, 2023

“These businesses, regardless of economic cycle, are able to deliver meaningful return on investments to the end user,” Osman said. The firm also joined with Thoma Bravo LP to purchase customer and employee experience platform Medallia Inc. billion in 2021.

Growth Business

MAY 23, 2023

The UK’s fintech industry continues to grow thanks to a combination of many factors, including London’s existing standing as a centre of financial excellence, globally respected regulatory frameworks, as well as good education and infrastructure. Financial services contributed £132bn to the economy in 2019, which equated to 6.9

Wall Street Mojo

FEBRUARY 9, 2024

In the financial services industry, insurance companies use these portfolios to manage their assets and liabilities positions. These portfolios can help calculate the market values of various portfolio assets, enabling entities to derive an overall idea of their financial health. The transaction costs are considerable.

Solganick & Co.

DECEMBER 27, 2023

AI in Financial Services : AI’s application in financial services, such as for fraud detection, algorithmic trading, and personalized financial planning, is growing. Companies with technologies critical to national security or economic competitiveness could be targeted or restricted in M&A deals.

The New York Times: Banking

MARCH 6, 2024

Powell, chair of the Federal Reserve, said policymakers still expect to lower rates in 2024 — but the timing hinges on data.

Software Equity Group

MARCH 26, 2024

And it typically boils down to a few common elements that successful SaaS companies do particularly well: High-quality SaaS companies feature predictable, recurring revenues, solid unit economics , and high gross margin and gross profit rates. The firm employs 246 professionals.

The New York Times: Mergers, Acquisitions and Dive

MAY 1, 2023

The resolution of First Republic Bank came after a frantic night of deal making by government officials and executives at the country’s biggest bank.

Cooley M&A

MAY 23, 2024

As a result of the competition among insurers, we have seen increasingly favorable rates and policy terms for policy purchasers in 2023 and continuing into 2024, as well as carrier expansion into alternative transaction structures and historically harder to underwrite areas, such as healthcare and financial services.

RKJ Partners

AUGUST 6, 2017

Valuation can be simply defined as the process of assigning an estimated dollar amount or range to the worth of an item, good, or service. To be more specific, business valuation is a process involving a set of procedures and approaches used to gauge the economic value of an ownership interest in a business as a going concern.

M&A Leadership Council

FEBRUARY 8, 2023

You've probably felt the crunch caused by the current economic climate, which has led to corporate development and integration leaders being challenged like never before: Boards and executive committees are more cautious Cost of capital is dramatically higher Regulators are applying greater scrutiny to large deals Revenue and cost synergy plans have (..)

The TRADE

JULY 11, 2023

To help boost the attractiveness of the UK’s financial services sector, the UK government revealed last night that it had accepted all recommendations from Rachel Kent’s UK Investment Research Review, published yesterday.

Growth Business

OCTOBER 2, 2023

By Tim Bird on Growth Business - Your gateway to entrepreneurial success It was a buoyant 2018 for venture capital investment into UK and European companies – a trend which defied broader concerns about international trade tensions, economic growth prospects and, of course, Brexit.

M&A Leadership Council

FEBRUARY 13, 2024

Let’s illustrate this process at work with a recent acquisition by a global financial services organization. The target company was a strategic acquisition in a new product/service area outside the buyer’s core expertise. That’s not to say you can just put functional integration on the shelf – you can’t.

M&A Leadership Council

JUNE 8, 2023

Let’s illustrate this process at work with a recent acquisition by a global financial services organization. The target company was a strategic acquisition in a new product/service area outside the buyer’s core expertise. That’s not to say you can just put functional integration on the shelf – you can’t.

Growth Business

MARCH 1, 2024

A private equity investor’s track record in structuring their investments conservatively, supporting sustainable growth at their portfolio companies, and adhering to a set of established investment principles throughout the economic cycle has great importance.

Razorpay

OCTOBER 26, 2023

Additionally, the industry is highly susceptible to external factors like economic downturns, natural disasters, and global events, which can disrupt travel plans and further impact cash flow. This way, we simplify the flow of funds and contribute to making financial services more efficient.

M&A Leadership Council

JANUARY 3, 2022

Let’s illustrate this process at work with a recent acquisition by a global financial services organization. The target company was a strategic acquisition in a new product/service area outside the buyer’s core expertise. That’s not to say you can just put functional integration on the shelf – you can’t.

Razorpay

FEBRUARY 22, 2024

With the awesomeness of UPI and cards With pre-sanctioned Credit Line at Banks through UPI , fostering economic growth and financial inclusion with low-ticket, high-volume retail loans. Here’s how we help businesses: Razorpay’s UPI Switch gives you an end to end UPI stack.

Software Equity Group

AUGUST 20, 2024

The software provides features for financial management, budgeting, resource management, risk management, stream management, program management, forecasting, IT planning, reporting, and analytics. The public company was founded in 1985 and is domiciled in Sweden.

The TRADE

DECEMBER 21, 2023

One of the greatest revelations across the financial services sector (and beyond) was that mantra of ‘we don’t have to do things the way we used to’ as office hours turned to hybrid work-from-home setups and video conferencing and instant messaging became the norm.

Cooley M&A

DECEMBER 15, 2020

Under an agreement entered into in September 2019, a subsidiary of Anbang agreed to sell its membership interests in Strategic to Mirae Asset Financial Group, a Korean-based financial services conglomerate, for $5.8 billion, a portion of which was to be funded with third-party debt.

The New York Times: Banking

FEBRUARY 11, 2025

Powell is set to testify as inflation risks are resurfacing, regulatory changes are in flux and the Federal Reserves policy independence is in the spotlight.

The TRADE

APRIL 30, 2024

By mandating banks to hold more capital in reserve, Basel III’s goal is to improve the stability and solvency of financial institutions, alongside reducing the possibility of bank failures during periods of economic turmoil. A key determinant of the regulation is ESMA’s rules on AI is the promotion of responsible AI use.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content