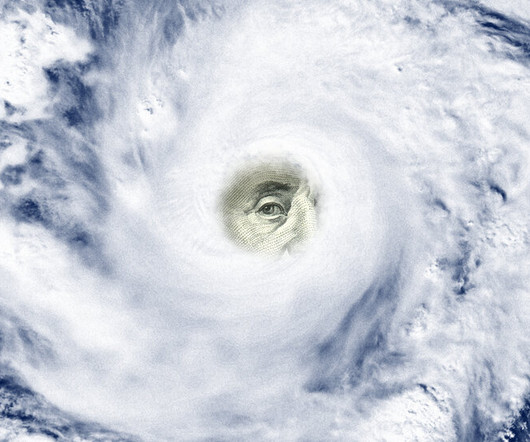

Dilemma on Wall Street: Short-Term Gain or Climate Benefit?

The New York Times: Banking

JUNE 20, 2024

Portfolio managers have conflicting incentives as the economic and financial risks from climate change become more apparent but remain imprecise.

The New York Times: Banking

JUNE 20, 2024

Portfolio managers have conflicting incentives as the economic and financial risks from climate change become more apparent but remain imprecise.

CNBC: Investing

DECEMBER 26, 2023

These stocks are less economically sensitive and have attractive defensive qualities, according to portfolio manager Patrick Kaser.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CNBC: Investing

JUNE 19, 2023

Economic freedom has been more elusive for Black people. Veteran portfolio manager Jim Casselberry is trying to do something about that.

The TRADE

JULY 10, 2024

The platform is managed by Jonathan Webb, who previously served as head of FX strategy at Jefferies. He has also worked as a FX portfolio manager/proprietary trader at banks and hedge funds, including HSBC, Credit Suisse and Bank of America. “At

Wall Street Mojo

FEBRUARY 9, 2024

For example, a portfolio has cash flows that match put options in the market. Replicating Portfolio Approach Explained Replicating portfolio involves the pooling of assets in a manner that allows portfolio managers to easily hedge the risks of these assets and balance the risk-return of the target asset.

The TRADE

MAY 28, 2024

The levels of trading volumes in European equities are influenced by a complex interplay of various factors like market fragmentation, economic conditions, monetary policy, investor behaviour and market volatility among other things. Where should regulators be focusing their attention to boost volumes in Europe?

OfficeHours

JULY 14, 2023

Other good questions include asking about sourcing methodology, investment committee structure, level of post-execution portfolio management, or further detail around investment strategy. As a pre-law student in undergrad, I double majored in Economics and Politics. as many times as you possibly can. Is Business School For You?

Let's personalize your content