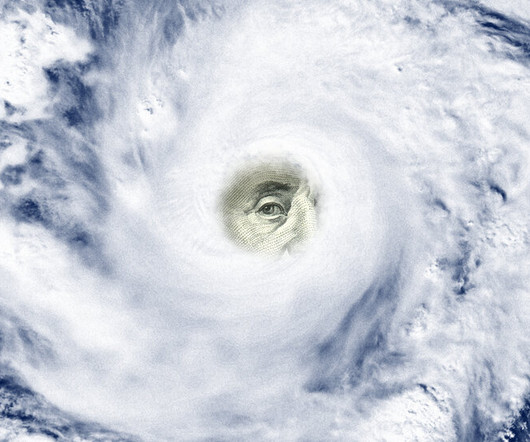

Dilemma on Wall Street: Short-Term Gain or Climate Benefit?

The New York Times: Banking

JUNE 20, 2024

Portfolio managers have conflicting incentives as the economic and financial risks from climate change become more apparent but remain imprecise.

The New York Times: Banking

JUNE 20, 2024

Portfolio managers have conflicting incentives as the economic and financial risks from climate change become more apparent but remain imprecise.

CNBC: Investing

DECEMBER 26, 2023

These stocks are less economically sensitive and have attractive defensive qualities, according to portfolio manager Patrick Kaser.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CNBC: Investing

JUNE 19, 2023

Economic freedom has been more elusive for Black people. Veteran portfolio manager Jim Casselberry is trying to do something about that.

Wall Street Mojo

FEBRUARY 9, 2024

What Is A Replicating Portfolio? A Replicating Portfolio refers to an investment portfolio built to copy the outcomes offered by a target asset. The purpose of building such a portfolio is to gain investment results similar to the results achieved by the target asset or the original instruments of the target portfolio.

The TRADE

JULY 10, 2024

The platform is managed by Jonathan Webb, who previously served as head of FX strategy at Jefferies. He has also worked as a FX portfolio manager/proprietary trader at banks and hedge funds, including HSBC, Credit Suisse and Bank of America. “At

The TRADE

MAY 28, 2024

The levels of trading volumes in European equities are influenced by a complex interplay of various factors like market fragmentation, economic conditions, monetary policy, investor behaviour and market volatility among other things. Where should regulators be focusing their attention to boost volumes in Europe?

The TRADE

OCTOBER 31, 2024

Chicago-based head of US trading at Legal and General Investment Management (LGIM) Ryan Raymond has seen enough economic turmoil during his career to know what to do when markets turn volatile. Chicago is a very small community and so I knew most of the portfolio managers and management at LGIM America before I came over.

Let's personalize your content