Why nature risk is the next frontier in financial risk management

Global Banking & Finance

DECEMBER 2, 2024

The regulatory […]

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Global Banking & Finance

DECEMBER 2, 2024

The regulatory […]

JD Supra: Mergers

DECEMBER 21, 2023

With mounting geopolitical tensions, multinationals face a very real and immediate risk of being deprived of profits, control or even ownership of some wholly or partially owned local businesses. By: Skadden, Arps, Slate, Meagher & Flom LLP

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

OfficeHours

JUNE 6, 2023

Below, we will explore the role of private equity firms in New York City’s economic landscape, examining their impact on job creation, economic growth, capital allocation, and industry transformation. These investments spur economic activity, generate tax revenues, and contribute to overall economic growth in the city.

Devensoft

JUNE 1, 2023

During economic uncertainty, it is important to conduct thorough due diligence to identify potential risks and make informed investment decisions. Cash flow: examine the company’s cash flow statements to determine whether it has sufficient liquidity to weather economic downturns.

Global Banking & Finance

APRIL 11, 2024

Navigating the New Era of Risk Management: Complex Models in Modern Banking Written by Sanjay Moolchandani April 2024 The banking and finance sector is navigating significant change driven by rapid technological advancements, evolving regulations, a changing economic landscape, and the sophisticated nature of today’s financial markets.

Peak Frameworks

SEPTEMBER 12, 2023

Economics is a vast discipline, but at its core, economics examines how entities manage their scarce resources. Economics not only shapes how we view the world, but also guides how businesses, governments, and individuals allocate resources. Adam Smith's Perspective on Economics Who was Adam Smith?

The TRADE

JUNE 17, 2024

“With this trading system and technology infrastructure upgrade, we envisage becoming more competitive and staying attractive for both domestic and international investors,” said Sunandar, director of information technology and risk management at IDX. “We

The TRADE

JANUARY 3, 2024

If the current low-volume environment in Europe continues, tied to GDP and economic growth, we will see renewed effort from policy makers to address some of the structural problems in Europe. They will need to take the Capital Markets Union more seriously and remove the frictional cost of trading between countries.

Sun Acquisitions

AUGUST 19, 2024

Economic volatility adds an extra layer of complexity to the ever-evolving landscape of mergers and acquisitions (M&A). Uncertain economic times, marked by market fluctuations and unpredictable consumer behavior shifts, pose significant challenges for financing M&A deals.

Peak Frameworks

JUNE 5, 2023

It forms the core of economic forecasting and is central to all aspects of financial decision-making. This is a period of economic growth, characterized by increased production, rising employment, and heightened consumer confidence. This is the point where economic activity has reached its maximum output.

The TRADE

MAY 20, 2024

Read more: Swap Connect launches as first derivatives trading link between Mainland China and Hong Kong The new acceptance of mainstream IMM dates-based IRS contracts will enable the scheme to further meet investors’ risk management needs, according to Bloomberg.

M&A Leadership Council

MARCH 25, 2024

He led teams at the Corporate Executive Board (now Gartner), an advisory company; Algorithmics (now SS&C), a financial risk-management solution provider; and Honeywell Aerospace, a Tier-1 supplier of aviation systems. Accounting and Economics) and M.Com. Economics) degrees from the University of South Africa.

The TRADE

SEPTEMBER 20, 2024

Central clearing is likely to help ease counterparty credit limits due to better risk management and transparency provided by the CCPs and migrate previously uncollateralised bilateral contracts to the CCPs. In particular, counterparty default and fire sales risk should be much lower.

Peak Frameworks

OCTOBER 17, 2023

Headwinds in finance are conditions or events that can impede economic growth or reduce the profitability of an investment. For instance, an economic downturn can lead to job losses, which in turn can result in decreased consumer spending, which then affects retail, real estate, and other sectors. How do Headwinds Work?

The TRADE

APRIL 26, 2024

Always stay connected and able to understand the markets and the economic, geopolitical, and technical factors to anticipate. Our role today is to implement these processes to automate as much as possible, while respecting constraints related to compliance, risk management, etc.

Peak Frameworks

JULY 20, 2023

A stock market crash is typically triggered by a combination of economic factors and investor psychology. Economic Factors Influencing Market Downturns Macroeconomic indicators, such as GDP, inflation, and interest rates , play a significant role in shaping market conditions.

Peak Frameworks

MAY 23, 2023

It helps guide capital allocation, risk management , and growth initiatives, thereby driving financial performance. Economic, political, and social factors can have significant impacts on the process. For instance, Apple Inc., The Role of Strategic Planning in Finance In finance, strategic planning holds significant importance.

Sun Acquisitions

FEBRUARY 23, 2024

Accountants, lawyers, and brokers are pivotal in helping buyers and sellers make informed decisions that safeguard their economic interests. Budgeting and Forecasting: They assist in creating post-acquisition budgets and forecasts , which are crucial for financial planning and risk management.

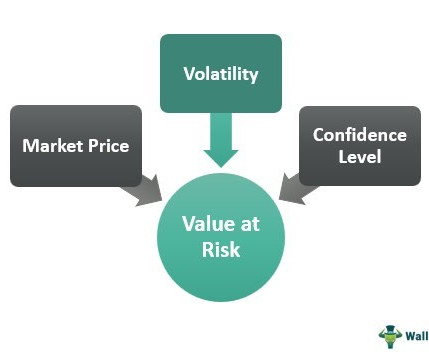

Peak Frameworks

SEPTEMBER 12, 2023

The choice depends on the nature of the portfolio and the objectives of the risk management exercise. Monte Carlo Simulation: Generates a vast number of potential economic scenarios using random value generation. It’s computationally intensive but offers a more holistic view of potential risks.

Peak Frameworks

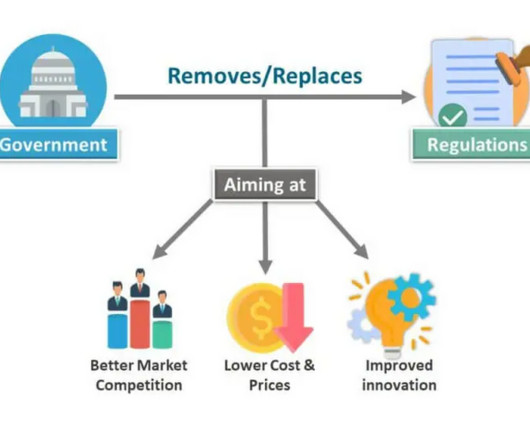

MAY 2, 2024

Benefits of Deregulation for the Financial Industry Deregulation has unleashed a wave of benefits within the financial sector, including: Market efficiency and responsiveness: Markets are better able to adjust to changes in consumer demand and global economic conditions.

The TRADE

DECEMBER 5, 2024

Clearing obligations will become stricter, with enhanced oversight of margin requirements and risk management processes. Despite these new potentially arduous compliance pressures, trading desks are also likely to benefit from reduced counterparty risk and improved market confidence thanks to the changes.

Wall Street Mojo

FEBRUARY 9, 2024

Leveraging derivatives to capture the best results at a given point in time may help portfolio managers achieve closely matching outcomes, in addition to performance monitoring, effective risk management , risk diversification , etc. Insurance companies use this tool for risk management and planning.

The TRADE

JANUARY 12, 2024

Firms continually assess their risk management strategy and the tools that they have which can include recalibrating risk models, adjusting position sizes and diversifying portfolios to better withstand the volatile environment as regulators seek to manage risks and economic enhanced stability.

Peak Frameworks

JULY 19, 2023

Implementing appropriate , risk management techniques, such as setting stop-loss orders and managing position size, is essential. Market Volatility and Sudden Reversals Rapid price movements can lead to unexpected reversals, causing potential losses if not managed effectively. Real-time Market Data and News Sources.

The TRADE

AUGUST 4, 2023

Overall, CME, ICE and Eurex posted solid quarterly results, driven in large part by the demonstrably positive correlation between an uncertain macroeconomic backdrop and risk management opportunities. Speaking to this, Jeffrey C.

The TRADE

MAY 29, 2024

Building on the partnership formed last year to tackle the future of digital assets together, the Depositary Trust and Clearing Corporation (DTCC), Clearstream and Euroclear have published a whitepaper to establish a set of risk management controls and guidelines for the future development of the technology. The principles, named the Digital Asset (..)

Growth Business

MAY 23, 2023

per cent of total economic output, and, according to Deloitte , the UK’s particular strengths include wealthtech (including PFM and cryptocurrencies) and payment technology, which account for more than 50 per cent of all firms. These include accounting, finance, tax, forecasting, cash management, risk management and strategic planning.

Cleary M&A and Corporate Governance Watch

FEBRUARY 7, 2024

The published changes to the Code are targeted and minimal, aimed at striking a balance between enhancing transparency and investor confidence whilst supporting UK economic growth and competitiveness.

The TRADE

SEPTEMBER 15, 2023

For most of my career in credit trading, the majority of traders have been accounting and finance or economics majors. More and more, price formation is happening via smart algos, so our traders are morphing into a combination of programmers and risk managers. The skillset of traders has evolved over recent years.

Peak Frameworks

MAY 2, 2024

Risk Management: Offering sales on credit introduces the risk of default, requiring businesses to implement robust risk management strategies. This approach requires careful consideration to ensure that reported revenues accurately represent economic reality.

The TRADE

FEBRUARY 2, 2024

This prominence is fuelled by the substantial economic activity, considerable gains from globalisation, and a strengthened regulatory and risk management framework post the 1997 Asian financial crisis. The early adoption of electronic trading platforms for Asian NDFs is another distinguishing factor.

M&A Leadership Council

JUNE 18, 2024

Use tools such as SWOT analysis, PEST analysis, and risk matrices: Conduct SWOT analysis to identify strengths, weaknesses, opportunities, and threats. Utilize PEST analysis to assess political, economic, social, and technological factors. Develop risk matrices to evaluate and prioritize risks based on likelihood and impact.

Peak Frameworks

MAY 22, 2023

Real estate plays a crucial role in the global economy, offering opportunities for investment, wealth creation, and economic growth. In this article, we will delve into the four main types of real estate – land, residential, commercial, and industrial – and explore the investment strategies, risks, and key considerations for each. ,1.

Solganick & Co.

JANUARY 21, 2024

Cybersecurity services are expected to represent 42% of total security and risk management end-user spending in 2024 and to remain the largest area of security and risk management spending in 2024. 2024 Outlook: A Year of Focused Growth for Technology Services and IT Consulting M&A?

Peak Frameworks

SEPTEMBER 12, 2023

The World Trade Organization (WTO ) plays a pivotal role in shaping the global economic landscape. Trade Rules' Significance in Financing Decisions and Risk Management Understanding Tariffs Investment decisions, especially in sectors like manufacturing and agriculture, are often influenced by tariffs.

M&A Leadership Council

JUNE 18, 2024

Use tools such as SWOT analysis, PEST analysis, and risk matrices: Conduct SWOT analysis to identify strengths, weaknesses, opportunities, and threats. Utilize PEST analysis to assess political, economic, social, and technological factors. Develop risk matrices to evaluate and prioritize risks based on likelihood and impact.

Software Equity Group

MARCH 26, 2024

And it typically boils down to a few common elements that successful SaaS companies do particularly well: High-quality SaaS companies feature predictable, recurring revenues, solid unit economics , and high gross margin and gross profit rates. The firm has made 878 total investments since inception. READ MORE : Selling Your SaaS Company?

Mergers and Inquisitions

MARCH 8, 2023

I noted the following points: A few people (~5-10%) had a political, legal, or compliance background , probably for the same reason that people use experience at central banks or in economics/strategy roles to get into global macro. Trafigura White Papers – Free reports on all commodities from one of the top firms.

The TRADE

OCTOBER 16, 2024

Speaking to the increasing importance of emerging market bonds for desks going forward, Paparella highlights that the rapid economic growth of developing countries can re-value bond prices over time, enabling investment and infrastructure opportunities which further increase demand for bonds.

Peak Frameworks

OCTOBER 30, 2023

Risk Management and Loan Loss Reserves Lending money is a risky business. Capital Buffer: Regulatory bodies require banks to maintain a certain level of capital to ensure they can weather economic downturns. Not all borrowers will pay back, and banks have to be prepared for these eventualities.

Software Equity Group

AUGUST 20, 2024

The software offers features for operations management, work planning and control, dashboards, business intelligence, reporting, environmental health and safety, workforce management, and risk management.

Wall Street Mojo

JANUARY 14, 2024

Importance The allowance method holds substantial importance in financial accounting as it provides a structured approach to anticipate and manage potential losses from uncollectible accounts.

Devensoft

AUGUST 22, 2023

Additionally, the globalized nature of markets demands strategies capable of responding to diverse cultural, regulatory, and economic nuances. Furthermore, real-time decision-making can introduce uncertainty, requiring a shift in risk management strategies. Identify potential scenarios and devise contingency plans.

Solganick & Co.

NOVEMBER 15, 2023

By incorporating Adjusted EBITDA into financial analysis, analysts can provide more insightful and reliable assessments, enabling stakeholders to make informed decisions about investments, strategic initiatives, and risk management.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content