Oura has acquired metabolic health startup Veri

TechCrunch: M&A

SEPTEMBER 11, 2024

Blood sugar levels are foundational to the Veri platform. © 2024 TechCrunch. All rights reserved. For personal use only.

TechCrunch: M&A

SEPTEMBER 11, 2024

Blood sugar levels are foundational to the Veri platform. © 2024 TechCrunch. All rights reserved. For personal use only.

JD Supra: Mergers

SEPTEMBER 11, 2024

The Securities and Exchange Commission’s (SEC) new accelerated Schedule 13G filing deadlines will become effective on September 30, 2024. On October 10, 2023, as part of an initiative to modernize beneficial ownership reporting requirements, the SEC adopted amended rules that, among other things, shortened the filing deadlines for initial and amended Schedule 13G beneficial ownership reports and added a materiality qualifier to the amendment requirement.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CNBC: Investing

SEPTEMBER 11, 2024

Despite the increasingly partisan sentiment in the crypto industry, bitcoin will thrive regardless of who wins the U.S. presidential election in November.

JD Supra: Mergers

SEPTEMBER 11, 2024

Leading up to the U.S. presidential election this November, our Antitrust & Competition team continues to offer insights into what antitrust enforcement may look like under the next presidential administration. As we look forward to the next four years, we should also look back on antitrust enforcement under previous recent administrations. Much has been made of the more aggressive and public stance on antitrust enforcement under the Biden administration.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

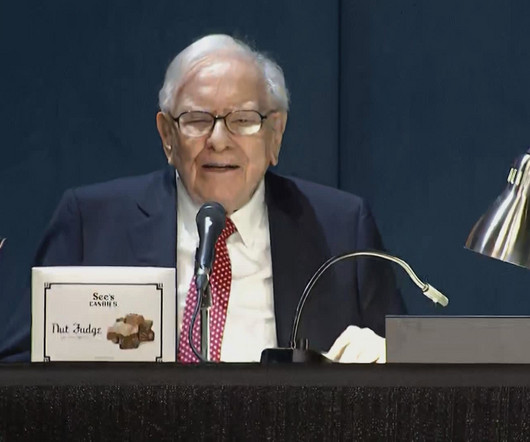

CNBC: Investing

SEPTEMBER 11, 2024

Since mid-July, Berkshire Hathaway has sold more than 174.7 million shares of the Charlotte-based bank for $7.2 billion.

JD Supra: Mergers

SEPTEMBER 11, 2024

According to the American Bar Association's Private Target Mergers and Acquisitions Deal Points Studies, financial statement representations are universally required from sellers in private company M&A deals, included in almost every transaction—99% covered by the most recent study in 2021. Prior ABA studies showed these representations included within comparable levels of reported transactions.

Investment Banking Today brings together the best content for investment banking professionals from the widest variety of industry thought leaders.

JD Supra: Mergers

SEPTEMBER 11, 2024

In M&A transactions, the definitive purchase agreement, whether asset purchase agreement, stock purchase agreement, or merger agreement, typically contains representations and warranties and related indemnification covenants. Buyers and sellers often negotiate the scope and types of damages subject to indemnification under the purchase agreement, including whether consequential damages that the buyer may suffer as a result of the seller's breach should be included in, or excluded from, the.

Deal Lawyers

SEPTEMBER 11, 2024

Section 220 of the DGCL gives stockholders the right to inspect “the corporations’ stock ledger, a list of its stockholders, and its other books and records” upon showing a proper purpose.

JD Supra: Mergers

SEPTEMBER 11, 2024

In merger and acquisition (“M&A”) transactions, the definitive purchase agreement, whether asset purchase agreement, stock purchase agreement, or merger agreement, typically contains representations, warranties, and covenants, along with related indemnification obligations. One issue often negotiated is whether the amounts recoverable as indemnified damages should be calculated on an after-tax basis.

CNBC: Investing

SEPTEMBER 11, 2024

Here are Wednesdays' biggest calls on Wall Street.

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant (or getting "ghosted") if they fail to meet the evolving needs of Gen Z consumers. Credit cards with flexible payment options, especially for young adults with little-to-no credit history, are a particularly important and valuable solution for this generation.

JD Supra: Mergers

SEPTEMBER 11, 2024

Suppose you are an avid fan of the English Premier League (the “EPL”) like I am. In that case, you have likely heard or read about the ensuing arbitration between Manchester City Football Club and the EPL over the EPL’s Associated Party Transaction (“APT”) rules. By: Adler Pollock & Sheehan P.C.

Financial Times - Banking

SEPTEMBER 11, 2024

What is the truth behind the inequality campaigner’s Citigroup memoir?

JD Supra: Mergers

SEPTEMBER 11, 2024

Fast-growing private companies are exciting to observe as outsiders, but on the inside the company founder has the challenge of securing enough capital to fuel the rapid growth of the business. The company’s continuous need for capital places the founder in the position of having to manage the company’s operations while at the same time engaging in perpetual fundraising efforts.

Financial Times - Banking

SEPTEMBER 11, 2024

Jumbo fee comes as Wall Street hopes that long-awaited deal boom is back

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

JD Supra: Mergers

SEPTEMBER 11, 2024

The majority of all 2023 EMEA restructurings involving an equitisation and/or a maturity extension required the provision of new money. While equitisation can solve for an over-leveraged capital structure, and maturity extensions can provide runway for business recovery and turnaround, those steps alone are often insufficient without there also being a contemporaneous solution for liquidity.

Cisco: M&A

SEPTEMBER 11, 2024

Experience the learning, inspiration, and fun with Learning & Certifications at Cisco Connect LatAm in Cancùn, Mexico, September 10-12, 2024.

CNBC: Investing

SEPTEMBER 11, 2024

The three major averages made a stunning comeback from their lows to close with gains on Wednesday. Here's what CNBC TV is watching going into Thursday.

Cisco: M&A

SEPTEMBER 11, 2024

Integrating ThousandEyes with Meraki MX revolutionizes managed services by enhancing network visibility, proactive monitoring, and seamless management, ensuring superior digital experiences and reduced downtime for clients.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

Global Newswire by Notified: M&A

SEPTEMBER 11, 2024

MIDLAND, Texas, Sept. 11, 2024 (GLOBE NEWSWIRE) -- Viper Energy, Inc. (NASDAQ:VNOM) (“Viper” or the “Company”), a subsidiary of Diamondback Energy, Inc. (NASDAQ:FANG) (“Diamondback”), today announced it and its operating subsidiary Viper Energy Partners LLC (“OpCo”) have entered into a definitive purchase and sale agreement to acquire certain mineral and royalty interest- owning subsidiaries of Tumbleweed Royalty IV, LLC in exchange for $461.0 million of cash and approximately 10.1 million OpCo

CNBC: Investing

SEPTEMBER 11, 2024

These financial stocks can run even further from here after the sector's breakout year.

The TRADE

SEPTEMBER 11, 2024

Financial services firm Velocity Clearing has opened a new office in Chicago as part of the expansion of its execution, clearing and custody operations including the options markets. Brian Schaeffer, president at Velocity Clearing To commemorate the milestone, Velocity Clearing representatives will ring the closing bell at the Cboe Global Markets trading floor in Chicago on Monday, 23 September at 15:15 CT.

CNBC: Investing

SEPTEMBER 11, 2024

Tony Zhang breaks down a 'broken wing butterfly' options trade.

Advertisement

In the fast-moving manufacturing sector, delivering mission-critical data insights to empower your end users or customers can be a challenge. Traditional BI tools can be cumbersome and difficult to integrate - but it doesn't have to be this way. Logi Symphony offers a powerful and user-friendly solution, allowing you to seamlessly embed self-service analytics, generative AI, data visualization, and pixel-perfect reporting directly into your applications.

Mergers and Inquisitions

SEPTEMBER 11, 2024

If there is one sector that has attracted even more hype than technology and TMT , it might just be renewable energy investment banking. The good news is that if you can get in, the group has many positives: Diverse deal activity, a generalist technical skill set, and many exit opportunities. The bad news is that despite these positives, it’s still highly dependent on the government and overall macro conditions – despite claims to the contrary.

CNBC: Investing

SEPTEMBER 11, 2024

This GLP-1 drug could emerge as the next big treatment and rival key competitors.

Global Banking & Finance

SEPTEMBER 11, 2024

In the rapidly evolving landscape of financial services, the adoption of immersive experiences is emerging as a transformative force that could redefine how banks and capital markets engage with clients and employees.

CNBC: Investing

SEPTEMBER 11, 2024

A major U.S. bank and a home goods company were among the companies being talked about by analyst on Wednesday.

Advertisement

In the rapidly evolving healthcare industry, delivering data insights to end users or customers can be a significant challenge for product managers, product owners, and application team developers. The complexity of healthcare data, the need for real-time analytics, and the demand for user-friendly interfaces can often seem overwhelming. But with Logi Symphony, these challenges become opportunities.

The TRADE

SEPTEMBER 11, 2024

Ashley Watson has joined Panmure Liberum as an electronic equity trader following five years at Mirabaud Group. They announced their new role in a social media post. Most recently, Watson served as an equity trader at Mirabaud, responsible for executing equities and ETFs across both high and low touch. Read more: James Perry to continue leading trading for Panmure Liberum following merger Prior to this, London-based Watson spent almost 13 years at Sanford C.

CNBC: Investing

SEPTEMBER 11, 2024

This back-to-school season, Nuveen sees opportunity in a corner of the education muni bond market.

Global Newswire by Notified: M&A

SEPTEMBER 11, 2024

ANI and Alimera Scheduled the Closing for September 16, 2024 ANI and Alimera Scheduled the Closing for September 16, 2024

CNBC: Investing

SEPTEMBER 11, 2024

UBS has unveiled its top picks in the technology, media and telecommunications space heading into year's end.

Advertisement

Generative AI is upending the way product developers & end-users alike are interacting with data. Despite the potential of AI, many are left with questions about the future of product development: How will AI impact my business and contribute to its success? What can product managers and developers expect in the future with the widespread adoption of AI?

Let's personalize your content