Food for thought: Dealmakers drawn to Europe’s sustainable farming sector

JD Supra: Mergers

JUNE 20, 2024

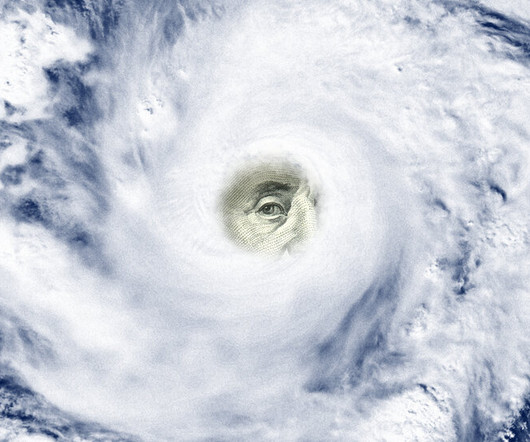

M&A in the agricultural sector received a boost in the first quarter of 2024. Deal value rose by more than 600 percent year on year from US$820 million in the first quarter of 2023 to US$5.87 billion in the first three months of this year.

Let's personalize your content