CEO Ousters Hit Record Numbers

JD Supra: Mergers

SEPTEMBER 23, 2024

According to research firm Exechange, 74 chief executive officers have been fired or forced out this year, which is the highest number since 2017.

JD Supra: Mergers

SEPTEMBER 23, 2024

According to research firm Exechange, 74 chief executive officers have been fired or forced out this year, which is the highest number since 2017.

Deal Lawyers

SEPTEMBER 23, 2024

Many companies resolve potential activist proxy contests by entering into cooperation agreements under which the company agrees to add one or more activist nominees to its board of directors. A recent post on the CLS Blue Sky Blog says that following the Delaware Supreme Court’s decision in Coster v. UIP, (Del.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

JD Supra: Mergers

SEPTEMBER 23, 2024

In this episode, AGG Corporate partner and member of the firm’s Women in Tech Law, Paula Nagarajan, is joined by Jenea Bradley, an audit partner at Deloitte, to discuss the critical aspects of preparing for a transaction, particularly for emerging growth companies. They provide a comprehensive guide on navigating private fundraises and M&A deals, covering essential phases such as due diligence, negotiating terms, and closing the deal.

Global Newswire by Notified: M&A

SEPTEMBER 23, 2024

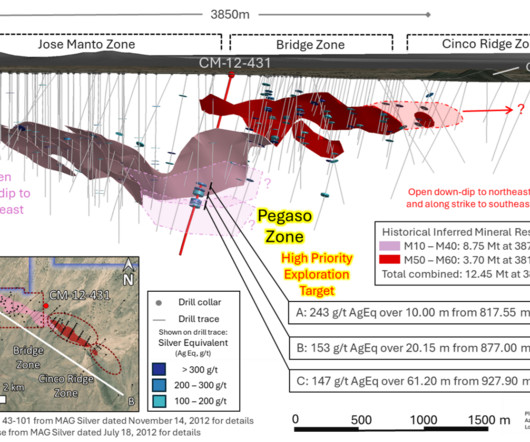

VANCOUVER, British Columbia, Sept. 23, 2024 (GLOBE NEWSWIRE) -- Apollo Silver Corp. (“ Apollo Silver ” or the “ Company ”) (TSX.V:APGO, OTCQB:APGOF, Frankfurt:6ZF0) has entered into an exploration, earn-in and option agreement (the “ Option Agreement ”), dated effective September 20, 2024, with MAG Silver Corp. (“ MAG ”) (TSX:MAG) and its subsidiary, Minera Pozo Seco, S.A. de C.V. (“ MPS ”), pursuant to which Apollo Silver has the option (the “ Transaction ”) to acquire the Cinco de Mayo Project

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

JD Supra: Mergers

SEPTEMBER 23, 2024

In the world of corporate compliance, some very basic compliance lessons seem destined to be repeated. This was certainly clear from the recently announced Securities and Exchange Commission (SEC) Foreign Corruption Practices Act enforcement action involving Deere (John Deere herein).

Investment Banking Today brings together the best content for investment banking professionals from the widest variety of industry thought leaders.

JD Supra: Mergers

SEPTEMBER 23, 2024

Put down the lemonade and break out the pumpkin spice: summer is coming to an end. And while you were in the pool – or maybe just answering emails poolside – the antitrust agencies showed no signs of a summer slowdown. Before we bid farewell to the warmest months of the year, join us for a look back at some of the antitrust news stories that made headlines this summer.

The New York Times: Banking

SEPTEMBER 23, 2024

The country’s central bank also freed commercial banks to lend more money in a package of moves aimed at rekindling growth in a stagnant economy.

JD Supra: Mergers

SEPTEMBER 23, 2024

In Maso Cap. Invs. Ltd. v. E-House (China) Holdings Ltd., No. 22-355 (2d Cir. June 10, 2024), the United States Court of Appeals for the Second Circuit affirmed the district court’s dismissal of a putative securities-fraud class action brought against a company and several of its directors based on, among other things, the alleged failure to disclose newer projections before a go-private merger in violation of Section 10(b) of the Securities Exchange Act of 1934 and its implementing rule, Rule.

CNBC: Investing

SEPTEMBER 23, 2024

Bill Nygren, portfolio manager at Oakmark Funds for 40 years, said he is picking cheap stocks outside the dominant tech sector.

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant (or getting "ghosted") if they fail to meet the evolving needs of Gen Z consumers. Credit cards with flexible payment options, especially for young adults with little-to-no credit history, are a particularly important and valuable solution for this generation.

JD Supra: Mergers

SEPTEMBER 23, 2024

On August 31, the last day of its 2024 Legislative Session, the California Legislature approved Assembly Bill 3129 (Wood), which provides for notification to and review by the Attorney General of health care transactions involving private equity groups and hedge funds. This bill has been subject to intense lobbying, and its scope changed significantly in the month leading up to its passage.

The TRADE

SEPTEMBER 23, 2024

Last week, the US Securities and Exchange Commission (SEC) adopted amendments to certain rules under Regulation NMS to amend minimum pricing increments and access fee caps, as well as rules to enhance the transparency of better priced orders. The additional minimum pricing increment or ‘tick size’ will apply to the quoting of certain NMS stocks, while the reduction in access fee caps will be linked to protected quotations of trading centres.

JD Supra: Mergers

SEPTEMBER 23, 2024

The Office of the Comptroller of the Currency (OCC) released guidance regarding its planned changes to the Bank Merger Act (BMA). The New Rule: Explicitly adds financial stability as a key factor for assessing mergers, reflecting the growing concerns about potential risks from mergers involving large or systemically important banks.

CNBC: Investing

SEPTEMBER 23, 2024

The Baltimore-based nuclear operator's move to restart Three Mile Island could lead to more such deals, benefiting renewable and natural gas stocks as well.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

JD Supra: Mergers

SEPTEMBER 23, 2024

On September 17, 2024, the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC) issued formal statements of policy on reviewing transactions under the Bank Merger Act (BMA). The FDIC policy statement (relevant to mergers where the surviving bank is a state-chartered nonmember bank) and the OCC policy statement (relevant to mergers where the surviving bank is a national bank) were released on the same day the Department of Justice (DOJ) announced.

The New York Times: Banking

SEPTEMBER 23, 2024

The agency plans to argue that the company illegally penalizes customers that try to use rival payment processors.

JD Supra: Mergers

SEPTEMBER 23, 2024

On September 17, the DOJ announced its withdrawal from the 1995 Bank Merger Guidelines, stating the 2023 Merger Guidelines will be the only authoritative statement across all industries. This decision followed collaboration with the Fed, FDIC and OCC and was informed by public feedback, departmental experience and market developments. The 2023 Merger Guidelines include predefined market definitions and thresholds for Herfindahl-Hirschman Index (HHI) calculations to identify mergers with.

CNBC: Investing

SEPTEMBER 23, 2024

Numerous retailers and home improvement stocks could outperform over the next year as the Federal Reserve begins its interest rate-cutting cycle.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

JD Supra: Mergers

SEPTEMBER 23, 2024

On September 17, the OCC approved a final rule amending its procedures for reviewing applications under the Bank Merger Act. The rule will aim to provide clearer guidelines for institutions regarding the OCC’s review process for bank mergers and ensure institutions remain relevant in the current financial landscape. Some commenters argued this change could increase the cost of applications — particularly for smaller banks.

The TRADE

SEPTEMBER 23, 2024

Redburn Atlantic made two new hires within its sales trading teams in Boston and Frankfurt. Alexander Laux was appointed as a new equity sales trader, based in Frankfurt, covering German clients primarily. Laux joined Redburn Atlantic from Barclays, where he spent the last 14 years. According to the firm, his experience in high touch, low touch and PT trading will help broaden the client base in Germany.

Razorpay

SEPTEMBER 23, 2024

Accessorize London, a global fashion brand with 17 years in India, was already a retail staple when the brand seamlessly transitioned to online shopping as the market evolved. They are a strong player in the eCommerce and D2C space, with 50% of its business now happening online. With the rise of the online business came the need for seamless payment solutions, and that’s where Razorpay entered the picture.

Sun Acquisitions

SEPTEMBER 23, 2024

Chicago, IL, September 18, 2024 – Sun Acquisitions, a leading mergers and acquisitions firm, is proud to announce the successful sale of American Heritage Fireplace (AHF) to a private investor. Founded in 1992 by John Dunlevy and Jim Sako, AHF quickly became a premier supplier, installer, and servicer of hearth products and outdoor living solutions.

Advertisement

In the fast-moving manufacturing sector, delivering mission-critical data insights to empower your end users or customers can be a challenge. Traditional BI tools can be cumbersome and difficult to integrate - but it doesn't have to be this way. Logi Symphony offers a powerful and user-friendly solution, allowing you to seamlessly embed self-service analytics, generative AI, data visualization, and pixel-perfect reporting directly into your applications.

Global Banking & Finance

SEPTEMBER 23, 2024

Author: Shilpa Doreswamy, Sector Director of Retail Banking, GFT The financial services industry is increasingly grappling with the critical issue of downtime. In today’s digital age, even a brief outage can have severe repercussions, costing banks almost $5 million an hour, discounting any penalties and fees.

Sun Acquisitions

SEPTEMBER 23, 2024

Chicago, IL – September 18, 2024 – Sun Acquisitions, a leading mergers and acquisitions firm, is pleased to announce the successful sale of Spill-Stop Mfg. LLC, a renowned manufacturer and distributor of bar supplies, to North Park Group, a private family office investment group. Spill-Stop, founded by Fritz Katsky in 1935, boasts a rich history. Daniel Silverstein joined the company in 1945 and eventually took ownership in 1951.

CNBC: Investing

SEPTEMBER 23, 2024

D.A. Davidson believes that "Microsoft has been escalating an arms race it may not be able to win.

Lake Country Advisors

SEPTEMBER 23, 2024

Timing plays an essential role in the success of a business sale, much like it influences key business decisions throughout a company’s lifecycle. Deciding when to sell your business is not just about achieving financial gains but also about capitalizing on strategic opportunities that arise at the optimal moment. Aligning Business Sales with Market and Personal Conditions The decision to sell a business is profoundly influenced by a blend of personal, financial, and market conditions.

Advertisement

In the rapidly evolving healthcare industry, delivering data insights to end users or customers can be a significant challenge for product managers, product owners, and application team developers. The complexity of healthcare data, the need for real-time analytics, and the demand for user-friendly interfaces can often seem overwhelming. But with Logi Symphony, these challenges become opportunities.

Razorpay

SEPTEMBER 23, 2024

InsuranceDekho has been making waves in the insurtech world, simplifying the way people discover and purchase insurance. InsuranceDekho offers a diverse range of insurance products, including motor, health, life, and SME coverage. Initially focused on B2B, the platform expanded into the B2C market, catering to individuals as well, becoming a one-stop shop for a comprehensive insurance discovery and fulfillment platform.

Global Banking & Finance

SEPTEMBER 23, 2024

(Reuters) – Sterling dipped against the dollar on Monday but touched a new two-year high versus the euro as business activity readings pointed to diverging economic cycles in the British and euro zone economies. The pound slipped 0.2% to $1.3298, hovering below a more than two-year high it touched against the dollar on Friday.

Global Newswire by Notified: M&A

SEPTEMBER 23, 2024

International Petroleum Corporation (IPC or the Corporation) (TSX, Nasdaq Stockholm: IPCO) is pleased to announce that IPC repurchased a total of 190,600 IPC common shares (ISIN: CA46016U1084) during the period of September 16 to 20, 2024 under IPC’s normal course issuer bid / share repurchase program (NCIB).

Let's personalize your content