Oura has acquired metabolic health startup Veri

TechCrunch: M&A

SEPTEMBER 11, 2024

Blood sugar levels are foundational to the Veri platform. © 2024 TechCrunch. All rights reserved. For personal use only.

TechCrunch: M&A

SEPTEMBER 11, 2024

Blood sugar levels are foundational to the Veri platform. © 2024 TechCrunch. All rights reserved. For personal use only.

JD Supra: Mergers

SEPTEMBER 10, 2024

The Small Business Administration (SBA) recently issued a proposed rule (Rule) that would significantly change a government contractor’s obligations to recertify its size and socioeconomic status under set-aside contracts and the effect of such recertifications. The Rule impacts eligibility for set-aside contracts, significantly alters the landscape for mergers and acquisitions (M&A) in the government contracts industry, and could have other unintended downstream consequences.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

H. Friedman Search

SEPTEMBER 12, 2024

Bankers and bond counsels want back in! Why? When I start writing most blogs I can understand a trend that I am seeing. I feel a great responsibility to my readers to report these trends as they unfold. The returning of bankers and bond counsels and their desire to pick up opportunities that they left behind (sometimes as long as five years ago) is most interesting, to say the least.

CNBC: Investing

SEPTEMBER 11, 2024

Despite the increasingly partisan sentiment in the crypto industry, bitcoin will thrive regardless of who wins the U.S. presidential election in November.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

TechCrunch: M&A

SEPTEMBER 13, 2024

The U.K.’s antitrust regulator has delivered its provisional ruling in a longstanding battle to combine two of the country’s major telecommunication operators. The Competition and Markets Authority (CMA) says that Three and Vodafone’s planned $19 billion merger — announced 15 months ago — could lead to higher prices for consumers, diminished service such as smaller […] © 2024 TechCrunch.

JD Supra: Mergers

SEPTEMBER 9, 2024

On September 3, 2024, the European Union’s Court of Justice (ECJ) issued its highly anticipated judgment in the Illumina/Grail case (C-611/22 P and C-625/22 P) concerning the European Commission’s (EC’s) power to review transactions based on a referral by national competition authorities in the EU pursuant to Article 22 of the EU Merger Regulation (EUMR).

Investment Banking Today brings together the best content for investment banking professionals from the widest variety of industry thought leaders.

CNBC: Investing

SEPTEMBER 10, 2024

Oracle co-founder Larry Ellison did not disclose the location of the data center or the future reactors.

TechCrunch: M&A

SEPTEMBER 9, 2024

Automation and IT monitoring company Progress on Monday announced that it intends to acquire file management platform ShareFile for $875 million in cash and credit. Progress CEO Yogesh Gupta said that the deal, which is expected to close by November 30, will bolster Progress’ portfolio with tools to help businesses more efficiently share — and […] © 2024 TechCrunch.

JD Supra: Mergers

SEPTEMBER 10, 2024

What if the key to unlocking true autonomy and advancing artificial intelligence lies in the development of more efficient and intelligent visual sensors? On today's episode of Founder Shares, Charbel Rizk, the visionary founder and CEO of Oculi, discusses the need for a shift towards advanced visual sensors over traditional motion sensors, and shares their potential to revolutionize automation and AI capabilities.

Global Banking & Finance

SEPTEMBER 11, 2024

LONDON (Reuters) – German bank shares were among the worst performing European equities on Tuesday, as a selloff in U.S. lenders following downbeat comments from the boss of Goldman Sachs rippled through European markets. Deutsche Bank shares closed down 4.9%.

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant (or getting "ghosted") if they fail to meet the evolving needs of Gen Z consumers. Credit cards with flexible payment options, especially for young adults with little-to-no credit history, are a particularly important and valuable solution for this generation.

CNBC: Investing

SEPTEMBER 11, 2024

Since mid-July, Berkshire Hathaway has sold more than 174.7 million shares of the Charlotte-based bank for $7.2 billion.

The New York Times: Mergers, Acquisitions and Dive

SEPTEMBER 9, 2024

In a second antitrust trial that starts on Monday, the Justice Department has called for a breakup of the tech giant, which it says controls the vast majority of online advertising.

JD Supra: Mergers

SEPTEMBER 10, 2024

To date, 2024 has not yet seen the type of mega-merger (Pfizer/Seagen) or level of agency enforcement (Sanofi/Maze or Amgen/Horizon) as 2023. But two notable investigations — one still active — show the Federal Trade Commission (FTC) is continuing to closely examine life sciences transactions for both horizontal and vertical concerns.

Global Banking & Finance

SEPTEMBER 9, 2024

The world is an increasingly interconnected place. Between the growth and stabilization of e-commerce and Internet-based online retail, the business world has needed to grow and change dramatically. Successful enterprises are more and more incentivized to be multicultural, cross-border ventures between entities in multiple nations in order to meet business needs and secure new investments.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

CNBC: Investing

SEPTEMBER 7, 2024

Analyst Alexander Perry said the upscale lifestyle and fitness company has increased its number of pickleball courts by 43% since the first quarter of 2023.

The New York Times: Mergers, Acquisitions and Dive

SEPTEMBER 10, 2024

Federal regulators are trying to block Kroger’s merger with Albertsons. In a Portland suburb, residents already know what deteriorating access to fresh food looks like.

JD Supra: Mergers

SEPTEMBER 13, 2024

The mergers and acquisitions (M&A) landscape remains a key area of focus for business and legal professionals, reflecting the broader economic climate and regulatory trends. For eDiscovery specialists, understanding the ebb and flow of M&A activity is critical in navigating the complexities of compliance, investigations, and litigation. The most recent statistics from the Premerger Notification Office offer valuable insight into current M&A activity, providing a useful benchmark for

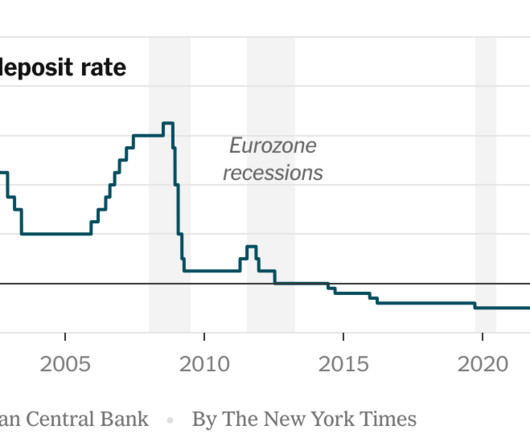

The New York Times: Banking

SEPTEMBER 12, 2024

The reduction, to 3.5 percent from 3.75 percent, comes as inflation has slowed and the bank faces pressure to bolster the region’s flagging economy.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

CNBC: Investing

SEPTEMBER 13, 2024

The hedge fund veteran discussed his outlook for the Federal Reserve and his bullish view on gold.

The New York Times: Mergers, Acquisitions and Dive

SEPTEMBER 12, 2024

While the cable TV business is declining quickly, satellite TV is decaying even faster.

JD Supra: Mergers

SEPTEMBER 12, 2024

The Situation: To address a perceived enforcement gap, the European Commission ("EC") has issued guidelines expanding the types of non-reportable transactions subject to its "upward referral mechanism," which permits EU National Competition Authorities to refer transactions to the EC for merger review. Illumina and GRAIL, the parties to the first transaction prohibited on this basis, challenged the EC's new interpretation before the Court of Justice of the European Union ("ECJ").

How2Exit

SEPTEMBER 9, 2024

E242: The Art of the Deal: Steve Rooms' Masterful M&A Strategies, Unraveling the Secrets to Success - Watch Here About the Guest(s): Steve Rooms is a seasoned financial expert and serial entrepreneur with extensive experience as a Chief Financial Officer (CFO). He has a strong background in mergers and acquisitions (M&A) from his corporate life, including travel and transactions across Europe.

Advertisement

In the fast-moving manufacturing sector, delivering mission-critical data insights to empower your end users or customers can be a challenge. Traditional BI tools can be cumbersome and difficult to integrate - but it doesn't have to be this way. Logi Symphony offers a powerful and user-friendly solution, allowing you to seamlessly embed self-service analytics, generative AI, data visualization, and pixel-perfect reporting directly into your applications.

CNBC: Investing

SEPTEMBER 7, 2024

Wells Fargo said this week that the firm likes stocks such as Microsoft in September.

Deal Lawyers

SEPTEMBER 11, 2024

Section 220 of the DGCL gives stockholders the right to inspect “the corporations’ stock ledger, a list of its stockholders, and its other books and records” upon showing a proper purpose.

JD Supra: Mergers

SEPTEMBER 10, 2024

In all types of business transactions, the parties rely heavily on their own counsel to negotiate business and legal points, and to draft the transaction documentation to reflect the agreed-upon terms. In addition to relying on due diligence on the representations and warranties contained in the transaction document, one party to a business transaction may require a written legal opinion from counsel to another party as a condition to the closing of the transaction.

The New York Times: Mergers, Acquisitions and Dive

SEPTEMBER 13, 2024

Owner Stephen Ross is talking to private equity firms after the N.F.L. changed the rules on what types of investors can buy into the league.

Advertisement

In the rapidly evolving healthcare industry, delivering data insights to end users or customers can be a significant challenge for product managers, product owners, and application team developers. The complexity of healthcare data, the need for real-time analytics, and the demand for user-friendly interfaces can often seem overwhelming. But with Logi Symphony, these challenges become opportunities.

CNBC: Investing

SEPTEMBER 7, 2024

Never mind the VanEck Semiconductor ETF (SMH) falling more than 11% last week. Wall Street analysts aren't running away from chip stocks.

Deal Lawyers

SEPTEMBER 13, 2024

A recent Grant Thornton survey asked dealmakers about how the US presidential election was affecting their M&A activity.

JD Supra: Mergers

SEPTEMBER 10, 2024

In merger and acquisition (M&A) transactions, the definitive purchase agreement typically contains representations and warranties made by the seller with respect to the target company. The scope and detail of these representations and warranties are often heavily negotiated and tailored to reflect both the nature of the target and its business, financial condition and operations, but also the relative negotiating strength of the buyer and seller.

The New York Times: Mergers, Acquisitions and Dive

SEPTEMBER 10, 2024

More than a year has passed since the tour agreed to a deal with LIV Golf, but there is some hope an in-person gathering in New York could create momentum.

Advertisement

Generative AI is upending the way product developers & end-users alike are interacting with data. Despite the potential of AI, many are left with questions about the future of product development: How will AI impact my business and contribute to its success? What can product managers and developers expect in the future with the widespread adoption of AI?

Let's personalize your content