What Is an Electronic Payment System & How Does It Work?

Razorpay

NOVEMBER 30, 2023

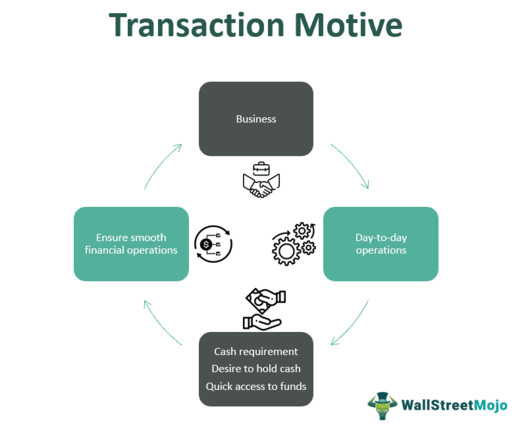

Instead, we have embraced the convenience and efficiency of electronic payment systems, or e-payment systems. In this comprehensive guide, we’ll delve into what an electronic payment system is, explore its various types, and uncover the inner workings that make it all possible. What is an Electronic Payment System?

Let's personalize your content