These S&P 500 stocks are cheap and expected to do well from here

CNBC: Investing

NOVEMBER 6, 2024

A select few stocks are still trading cheap despite the broader equity market trading near its all-time highs.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

CNBC: Investing

JANUARY 22, 2024

The technology sector has boosted equities to new heights this year, but there could still be some winning tech stocks with room to rally.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The TRADE

JULY 17, 2024

Kepler Cheuvreux has entered a strategic partnership with independent research provider Argus Research to distribute US equity research across continental Europe from 1 August. The partnership will enable Kepler Cheuvreux to offer broader coverage of the S&P 500, which aims to meet increasing client demand.

CNBC: Investing

OCTOBER 17, 2023

The JPMorgan Equity Premium Income ETF (JEPI) has held up better than the S&P 500 over the past three months.

Global Banking & Finance

AUGUST 26, 2024

By Chibuike Oguh and Dhara Ranasinghe NEW YORK/LONDON (Reuters) -World equity markets edged lower on Monday as markets digested the likelihood of U.S. The benchmark S&P 500 index and the Nasdaq gave up early gains and traded lower, […]

Global Banking & Finance

FEBRUARY 7, 2024

Global stocks hit two-year highs, as dollar eases By Chris Prentice and Amanda Cooper NEW YORK/LONDON (Reuters) -Global equities rose to a more than two-year high and the S&P 500 touched a record peak on Wednesday, as strong earnings offset jitters related to U.S. regional banks and China markets.

Sica Fletcher

APRIL 18, 2024

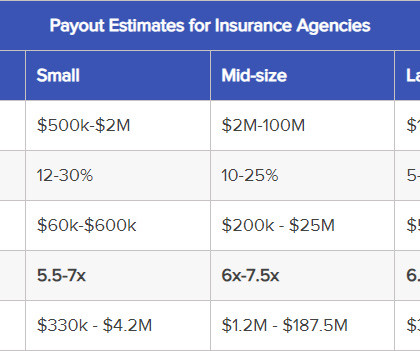

Price, however, is not the only consideration - contemporary deals also include additional considerations, like equity and overall deal structure, to determine what a business owner will actually get from a completed M&A transaction. It’s common to see deals completed in which earnouts make up the lion's share of payments to sellers.

Wizenius

APRIL 1, 2023

When companies need to raise capital, they have two primary options: Debt involves borrowing money, while equity involves issuing shares of ownership in the company. Apple had a strong credit rating and could borrow at a lower interest rate than the expected return on equity. The 10-year US Treasury yield in April 2013 was around 1.7%.

The TRADE

AUGUST 14, 2023

European agency broker and equities research specialist Redburn and US equity brokerage Atlantic Equities have completed the merger of their operations under Redburn’s parent company Rothschild & Co, initially announced on 26 April. Atlantic clients will also be able to delve into the existing European product.

Mergers and Inquisitions

FEBRUARY 28, 2024

While everyone seems to know about equity research and trading stocks, fixed income research gets far less attention. Equity Research vs. Fixed Income Research Common Myths What Do You Do as a Fixed Income Research Analyst or Associate? Each role has common analytical elements, but the specifics and deliverables differ (e.g.,

Mergers and Inquisitions

JANUARY 3, 2024

My portfolio did “OK” (up 10% for the year), but it greatly underperformed the S&P 500 , which was up 24%. On the other hand, I was only down 9% in 2022 vs. a 19% drop for the S&P, so both the index and my portfolio are now back to “early 2022” numbers. and far too little in equities. I sold most of my U.S.

OfficeHours

OCTOBER 23, 2023

However, for private equity investors, this uncertainty represents a unique opportunity to take advantage of investment opportunities in public markets. A “take-private” transaction in the context of private equity is a process by which a PE firm acquires a publicly listed company and converts it into a privately held entity.

OfficeHours

OCTOBER 16, 2023

However, for private equity investors, this uncertainty represents a unique opportunity to take advantage of investment opportunities in public markets. A “take-private” transaction in the context of private equity is a process by which a PE firm acquires a publicly listed company and converts it into a privately held entity.

FineMark

JANUARY 17, 2024

This Christmas, Santa’s Route Included a Stop on Wall Street At year end, the stock market rallied sharply and bond market performance was nothing short of breathtaking. The equity market also noted the Fed’s comments as investors piled back into equities and the S&P 500 finished the year up more than 26%.

The Deal

JUNE 22, 2023

billion in cash and stock announced June 12. Reed and Michael P. Chief legal officer Joshua S. Geller is on the deal at Adenza, while managing partner Holden Spaht and partner Brian Jaffee lead the investment at Thoma Bravo, a private equity sponsor. (NDAQ) turned to regular outside counsel David K. Lam and Mark F.

The TRADE

SEPTEMBER 26, 2024

Algorithmic Trading Awards shortlists: Best Trading Performance Berenberg BNP Paribas Jefferies Redburn Atlantic Best Access to Market Berenberg BNP Paribas Redburn Atlantic Virtu Financial Best Price Improvement Capabilities Berenberg BNP Paribas Citi Redburn Atlantic Best Client Service Berenberg Jefferies Redburn Atlantic Stifel Europe Best Dark (..)

Lake Country Advisors

AUGUST 8, 2024

It’s integral to ensuring that the sale benefits all stakeholders and should be one of your priorities before advertising it to potential buyers. It’s a delicate balancing act, as inaccurate valuations have polarizing consequences. However, company valuation isn’t as simple as slapping a price on your business.

The Harvard Law School Forum

MAY 2, 2023

stock market in 2022 experienced increased volatility relative to 2021. Persistently high inflation, coupled with the fastest Fed tightening cycle seen since 1988, contributed to making 2022 the worst performing year for the S&P 500 Index since 2008, thrashing growth and technology stocks in particular. [1]

Focus Investment Banking

JANUARY 18, 2024

stock markets are at or near their all-time highs. The S&P 500 has recently traded near 4800, close to its record at the end of 2021. And, at least in recent years, there has been enough capital at private equity firms to handle any liquidity needs. As 2024 starts, the U.S. It seems that the trend is to stay private.

Sica Fletcher

JULY 11, 2024

However, the brokerage's tech stack now handles many of these job functions, which significantly improves the bottom line and increases profitability. Pay attention to how the equity a buyer offers is actually valued. In this way, private companies, in particular, may benefit from not having an observable stock price.

The TRADE

JUNE 23, 2023

What movement have you seen in the global equities market in the last week? For the first time ever, yield on cash, bonds and equities is the same in the US. That is the same level as the expected 12-month forward earnings yield across the S&P 500, which has risen by >15% since January.

The TRADE

NOVEMBER 8, 2024

In the trading venues arena, Liquidnet, ICE BondPoint and Bloomberg FXGO each took home Outstanding Trading Venue awards, while London Stock Exchange Group was crowned overall Outstanding Exchange Group. Elsewhere, FlexTrade collected the Outstanding Trading Technology Provider award.

Sica Fletcher

JUNE 11, 2024

The use of stock nearly doubled since last year’s data. Whereas 2022 saw equity making up nearly 17.5% Last year's data saw PE firms acting as buyers in ~90% of all transactions. Sica | Fletcher’s team is the industry leader in insurance M&A, sitting at the top of the S&P Global charts for a decade.

Software Equity Group

MARCH 13, 2023

On the surface, things looked rough: the Dow Jones, S&P 500, and the NASDAQ all finished the year with significant losses, with tech stocks hit particularly hard. Median EV/TTM Revenue Multiple Down from 2021’s high of 7.3x, 2022’s median EV/Revenue multiple of 5.6x was only a slight decline from 2020’s 5.7x

Peak Frameworks

AUGUST 15, 2023

These assets can be in the form of equities (stocks), fixed income (bonds), mutual funds, exchange-traded funds (ETFs), real estate, commodities , and more. A tech entrepreneur may be comfortable with high-risk growth stocks like Tesla, while a pension fund might prefer the steady income of blue-chip dividends.

Focus Investment Banking

APRIL 11, 2024

gain in the S&P 500 and the 9.1% However, this return lagged the year-over-year performance of both the S&P 500 (up 27.9%) and the NASDAQ (up 34.0%). Over this time frame, every single stock in the sub sector had a double-digit return, with the strongest gains coming from ePlus and PC Connection.

Mergers and Inquisitions

JANUARY 31, 2024

They might have separate teams for specific strategies or markets, but everything is run under a single Profit & Loss statement (P&L). There are very few real “requirements” besides the single PM / single P&L one above and the standard Limited Partner / General Partner structure that all hedge funds use.

Sica Fletcher

MAY 29, 2024

Stock Will Take Up a Larger Percentage of Payout Structures While 20 years ago, transaction payouts were typically 100% cash, more often than not, modern payouts now almost universally contain some amount of equity in the buyer company as a central part of the deal.

Mergers and Inquisitions

MAY 3, 2023

The main argument in favor of the DDM is that it best represents what happens in real life when you buy a stock. In other words, you profit based on the company’s dividend s and the potential increases in its stock price over time. Otherwise, the written version follows: Why Use a Dividend Discount Model?

The TRADE

JANUARY 18, 2024

In the past there were 5,000 people who worked on the floor of the New York Stock Exchange and now there’s probably 300. He explains: “If somebody’s entering a huge notional-sized order into the marketplace, they might not want to put that on-screen. There’s often much, much more liquidity behind those on-screen prices.

Peak Frameworks

AUGUST 15, 2023

The Fear and Greed Index is a valuable gauge that attempts to quantify what many think cannot be measured – the emotional state of investors in the stock market. The Seven Indicators Stock Price Momentum : The S&P 500 versus its 125-day moving average. For instance, the 2018 U.S.

Francine Way

JULY 11, 2017

Access to credible sources of information such as SEC EDGAR database , Treasury.gov , OECD GDP Forecast , Mergent Online, S&P Capital IQ, Hoovers, ValueLine, Yahoo Finance , MarketWatch , and Damodaran Online. Target’s current stock price: Can be obtained from sources such as Yahoo Finance.

The TRADE

DECEMBER 21, 2023

YTD the S+P is up 17%! After a wild run by the Magnificent 7, equity performance drivers will broaden. Such Whether seeking specific large blocks or small-mid cap stocks, complex, hard to source and sometimes niche liquidity requires knowledge, connectivity and market access to execute efficiently and effectively.

Sica Fletcher

MARCH 28, 2024

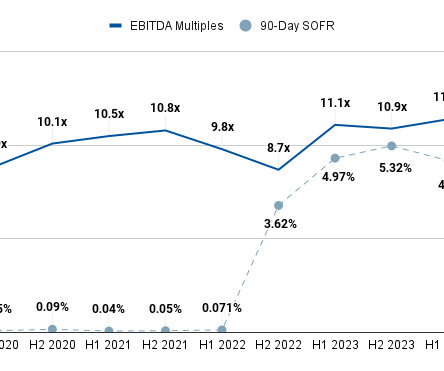

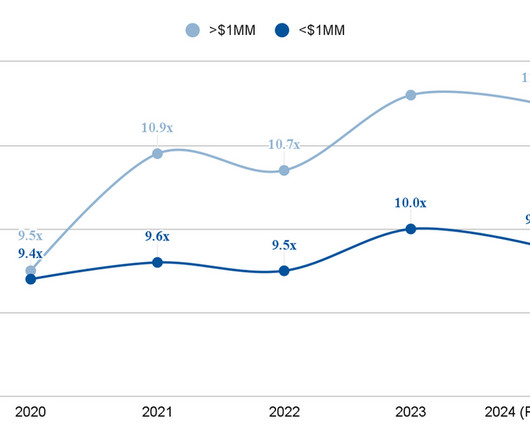

H2 2024 Will See Increased Deal Volume & Value If Interest Rates Lower Insurance M&A Buyers Are Looking For New Things In 2024 Equity will play a larger role in deals H2 2024 Will See Increased Deal Volume & Value If Interest Rates Lower 2023 is widely regarded as one of the worst years for M&A in recent memory.

The TRADE

OCTOBER 18, 2023

Among the key players in this competitive landscape, The TRADE has selected Cboe Global Markets, London Stock Exchange Group (LSEG), Nasdaq and SIX Swiss Exchange for our 2023 shortlist, following various individual achievements by these exchanges over the past year.

Peak Frameworks

JUNE 21, 2023

These could be as diverse as the average income of a demographic, the variability in bond yields over a decade, or the correlation between stock prices and GDP growth. For example, to calculate the average return of an S&P 500 portfolio over the past ten years, we would sum up the returns for each year and then divide by ten. ,

The TRADE

OCTOBER 24, 2024

While adoption is widespread in equities other asset classes such as fixed income have been slower to adopt these systems given the nuances of the workflows and liquidity landscapes in these markets. They’re typically used in equities given that this asset class trades on exchange unlike fixed income and some foreign exchange assets.

Software Equity Group

JANUARY 8, 2024

Now, we are excited to make the SEG SaaS Index available as an interactive tool that will enable software executives, private equity companies, venture capitalists, and others to view and sort key metrics for all companies in the Index and study historical trends.

Software Equity Group

JANUARY 8, 2024

Now, we are excited to make the SEG SaaS Index available as an interactive tool that will enable software executives, private equity companies, venture capitalists, and others to view and sort key metrics for all companies in the Index and study historical trends.

Sica Fletcher

JUNE 20, 2024

The History of Private Equity in Insurance One of the primary forces differentiating the insurance M&A market in 2024 from those of decades past is the presence and dominance of private equity (PE) firms in the buyer space. We’ve seen this number jump even in the last two years, with the percentage of equity almost doubling.

Mergers and Inquisitions

DECEMBER 6, 2023

They do this by setting up entire teams (“pods”) for specific sectors, having each team learn their stocks or other securities in-depth, and then trading frequently based on catalysts and changes in investor sentiment. Beta-Neutral Portfolios: For example, if the S&P 500 goes up or down by 5%, your team’s portfolio should move by ~0%.

Software Equity Group

MAY 8, 2024

Learn more about the external influences shaping your SaaS company’s valuation multiple below. #1. Also of note, ERP / Business Management saw stable M&A volume in 2023, which mirrors its consistent growth and steady valuations in the public markets and further demonstrates the category’s mission-critical nature. #2.

Software Equity Group

MAY 7, 2024

Learn more about the external influences shaping your SaaS company’s valuation multiple below. #1. Also of note, ERP / Business Management saw stable M&A volume in 2023, which mirrors its consistent growth and steady valuations in the public markets and further demonstrates the category’s mission-critical nature. #2.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content