How China Censors Critics of the Economy

The New York Times: Banking

JANUARY 30, 2024

As Beijing struggles with a slumping stock market and a collapsing real estate sector, commentary and even financial analysis it deems negative are blocked.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Financial Analysis Related Topics

Financial Analysis Related Topics

The New York Times: Banking

JANUARY 30, 2024

As Beijing struggles with a slumping stock market and a collapsing real estate sector, commentary and even financial analysis it deems negative are blocked.

How2Exit

SEPTEMBER 9, 2024

In this exciting episode, host Ronald Skelton engages with Steve Rooms—a highly experienced financial expert and M&A specialist. Financial Analysis: Deep diving into financial statements, understanding cash flow trends, and identifying red flags are essential steps.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

OfficeHours

MAY 19, 2023

A Few Reads to Digest Valuation Simplified: How Discounted Cash Flow Modeling Drives Financial Analysis Harness Discounted Cash Flow (DCF) modeling for financial analysis. Fill this out and we’ll be in touch to connect you with one of our Top Coaches! Master valuation, drive decisions, and understand market dynamics.

How2Exit

AUGUST 22, 2023

rn Concept 4: Financial Analysis Is Crucial rn One of the key takeaways from the podcast is the importance of financial analysis in the process of acquiring businesses. This highlights the need for financial analysis to separate fact from fiction and make informed decisions.

OfficeHours

JUNE 6, 2023

Seek staffing that is related to M&A deals that employ intense financial analysis and due diligence. While gaining the right practical experience through roles that involve M&A deals and intense financial analysis is crucial, it does not excuse you from adequate interview preparation.

MergersCorp M&A International

NOVEMBER 16, 2024

” The sale of a top-tier soccer club such as this is a multi-faceted process, involving thorough due diligence, financial analysis, and market positioning. MergersCorp will be working diligently to ensure that the club’s legacy, brand value, and growth potential are front and center throughout the negotiation process.

How2Exit

JANUARY 21, 2024

rn SCORE offers online resources, workshops, and customizable templates to help entrepreneurs with business planning, financial analysis, and other essential aspects of running a business. Small Business Administration (SBA) and works closely with other SBA resource partners to serve business owners nationwide.

How2Exit

DECEMBER 21, 2023

Paul emphasizes the importance of looking beyond the financial statements and considering operational metrics and industry benchmarks. rn The Power of Leading Indicators in Financial Analysis rn While financial statements provide valuable insights, they are lagging indicators.

Peak Frameworks

JUNE 7, 2023

However, a look at the CFO shows a different story, mainly due to changes in their working capital, signaling potential financial stress. Software and Tools - Powerful financial analysis tools like Bloomberg Terminal, Capital IQ, and even Excel are widely used for CFO analysis.

Peak Frameworks

MAY 2, 2024

The Role of Financial Analysis in Vertical Mergers Financial analysis underpins the decision-making process, involving: Financial Modeling: Creating models to forecast the financial performance of the merged entity.

Solganick & Co.

NOVEMBER 15, 2023

Delving deeper into the differences between EBITDA and Adjusted EBITDA can pave the way for clearer financial analysis, strategic planning, and efficient communication with stakeholders. By grasping the distinctions, businesses can optimize their performance measurement and make well-informed financial decisions.

Wizenius

AUGUST 7, 2023

This aspect involves understanding pricing strategies, which is covered in **investment banking courses** that focus on financial analysis and strategies. Analyzing market demand is a key aspect covered in courses related to **investment banking** and financial analysis.

Wizenius

OCTOBER 6, 2024

Some unique aspects include: Internal committee approvals: Prior to deal execution, senior banker approval is required, necessitating a comprehensive memo presentation detailing deal terms, rationale, and financial analysis.

Wizenius

JULY 14, 2023

Thanks, Pratik Unlock the Secrets of Investment Banking and Financial Modeling - Enroll in Wizenius Investment Banking Course Today! Master the art of investment banking and financial modeling with our comprehensive online course. Take your career to new heights in the dynamic world of finance.

OfficeHours

JUNE 5, 2023

Business Intuition: While financial analysis and data-driven methodologies are essential, private equity professionals rely on their business intuition to navigate uncertainties within both their investments and the overall economic landscape. Talk about a great head start!

OfficeHours

MAY 24, 2023

Building a Strong Understanding of Financial Concepts In order to pass the interview process, it is important to develop a solid understanding of financial concepts, including financial analysis, valuation techniques, financial modeling, and corporate finance.

OfficeHours

JUNE 6, 2023

Deal sourcing typically involves the “softer” skills, and this includes maintaining relationships with investment bankers, brokers, industry professionals, and other intermediaries who can provide leads on potential opportunities.

OfficeHours

JUNE 6, 2023

Through extensive due diligence and financial analysis, they identify investment opportunities with favorable risk-return profiles. These firms are not unsophisticated retail investors; they are among the brightest minds in one of the most competitive industries in the white-collar world.

Mergers and Inquisitions

OCTOBER 16, 2024

But most coverage suggests generic answers about wanting to learn a lot, liking financial analysis or valuation, or wanting to “understand different industries.” An older version of this article from ~15 years ago addressed this question, and you can find dozens of other articles that suggest answers.

MergersCorp M&A International

JANUARY 18, 2024

In addition to financial analysis and risk assessment, MergersCorp M&A International also provides expert advice on negotiating and structuring M&A deals.

MergersCorp M&A International

JANUARY 25, 2024

The firm conducts detailed financial analysis, assessing key financial metrics such as revenue, profitability, and cash flow. In addition to financial analysis, MergersCorp’s analysts also evaluate factors such as the target’s competitive positioning, market share, and growth potential.

Peak Frameworks

JUNE 21, 2023

With this foundational understanding, let's delve deeper into two of the most commonly used parameters in financial analysis: the mean and the median. The Role of Mean in Financial Analysis The mean is pivotal in data analysis.

Solganick & Co.

MARCH 11, 2024

David’s impressive background includes extensive experience as a Chief Financial Officer for Pandera Systems, a cloud and data analytics IT consulting firm (and former client of Solganick & Co.).

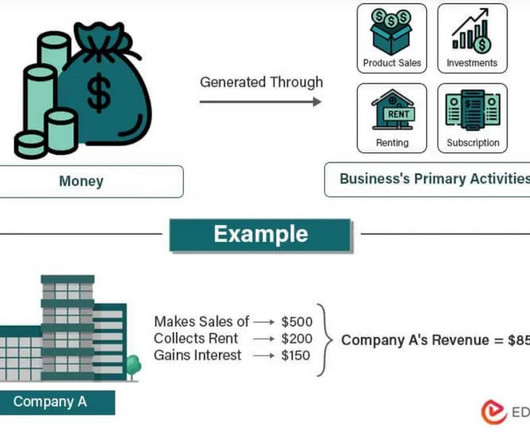

Razorpay

JULY 25, 2023

A corporate accountant helps in basic bookkeeping, extending insights regarding financial analysis, planning budgets, preparing financial reports, management of expenses and account receivables etc. On the other hand, a public accountant deals with multiple clients and is generally related to government jobs and agencies.

Wizenius

JULY 26, 2023

Pros and Cons for CAs in Investment Banking: - Pros: CAs bring a strong financial and accounting background to investment banking, enabling them to understand complex financial structures and regulations easily. Additionally, they are skilled in financial analysis, audit, and taxation, which are highly valuable in investment banking.

Wizenius

JULY 12, 2023

Thanks, Pratik S Unlock the Secrets of Investment Banking and Financial Modeling - Enroll in Wizenius Investment Banking Course Today! Master the art of investment banking and financial modeling with our comprehensive online course. Take your career to new heights in the dynamic world of finance.

Wizenius

JULY 2, 2023

Thanks, Pratik S Unlock the Secrets of Investment Banking and Financial Modeling - Enroll in Wizenius Investment Banking Course Today! Master the art of investment banking and financial modeling with our comprehensive online course. Take your career to new heights in the dynamic world of finance.

MergersCorp M&A International

FEBRUARY 22, 2024

Their team includes financial analysts, investment bankers, and industry specialists, all of whom collaborate to develop tailored restructuring strategies that meet the unique needs and goals of each client.

Wizenius

JULY 9, 2023

Thanks, Pratik S Unlock the Secrets of Investment Banking and Financial Modeling - Enroll in Wizenius Investment Banking Course Today! Master the art of investment banking and financial modeling with our comprehensive online course. Take your career to new heights in the dynamic world of finance.

How2Exit

AUGUST 5, 2024

” Their integrated efforts span financial analysis, legal documentation, operational assessments, and marketing strategies, ensuring holistic and well-informed decision-making processes. “We collaborate a lot and we discuss and debate a lot,” Costandi noted. “We overlap a lot.

How2Exit

JULY 22, 2024

Nate has a diverse global team managing operations and has a strong background in e-commerce, logistics, and financial analysis. Recently, he co-founded NTMK Logistics, a freight forwarding business.

Wizenius

JUNE 23, 2023

Thanks, Pratik S , Unlock the Secrets of Investment Banking and Financial Modeling - Enroll in Wizenius Investment Banking Course Today! Master the art of investment banking and financial modeling with our comprehensive online course. Take your career to new heights in the dynamic world of finance.

Successful Acquisitions

FEBRUARY 7, 2023

. “ Brian’s career in finance began in the “ com” era working with several venture-backed firms before spending several years with The Vanguard Group where he led a team of financial analysts managing the budgeting process and conducting financial analysis on a variety of technology initiatives.

Wizenius

JUNE 25, 2023

Thanks, Pratik S , Unlock the Secrets of Investment Banking and Financial Modeling - Enroll in Wizenius Investment Banking Course Today! Master the art of investment banking and financial modeling with our comprehensive online course. Take your career to new heights in the dynamic world of finance.

Wizenius

JUNE 25, 2023

Thanks, Pratik S , Unlock the Secrets of Investment Banking and Financial Modeling - Enroll in Wizenius Investment Banking Course Today! Master the art of investment banking and financial modeling with our comprehensive online course. Take your career to new heights in the dynamic world of finance.

How2Exit

DECEMBER 22, 2023

This showcases the potential for significant financial gains through small business acquisition, but it also underscores the importance of conducting thorough financial analysis before making a purchase. What the hell was I doing for the last decade before I decided to buy a business?"

Sun Acquisitions

MARCH 27, 2023

Brokers use various tools and processes involving market research, financial analysis, and industry benchmarks to develop a comprehensive understanding of the business and its position in the market.

How2Exit

FEBRUARY 27, 2023

It also provides tools to help sellers prepare their businesses for sale, such as financial analysis and market research. It also provides resources to help advisors and brokers with the sale process, such as market research and financial analysis.

Wizenius

JULY 17, 2023

Our investment banking course online provides in-depth knowledge of financial analysis, M&A, valuation techniques, and advanced Excel modelling. With our course, you'll master the art of investment banking and financial modelling, setting yourself up for success in the dynamic world of finance.

Wizenius

JUNE 5, 2023

Highlight any involvement in M&A transactions, such as due diligence, financial analysis, deal structuring, or client advisory. Financial Modelling: Proficiency in financial modelling is highly valued in the investment banking industry.

Peak Frameworks

MAY 17, 2023

A case in point is Microsoft Corporation's transition to a subscription model, which provides a steady stream of recurring revenue, enhancing its financial stability. Conclusion Revenue, the 'top line' of a company's income statement, plays a pivotal role in business decision-making and financial analysis.

How2Exit

OCTOBER 11, 2023

Laurie emphasizes the need for accurate and reliable financial statements, as potential buyers rely on these numbers to assess the business's profitability and potential return on investment. By presenting clean and transparent financials, business owners can instill confidence in potential buyers and maximize the value of their businesses.

Sun Acquisitions

FEBRUARY 26, 2024

Due Diligence: Paving the Way for a Smooth Integration The success of an M&A transaction hinges on thorough due diligence involving financial analysis, risk assessment, and evaluation of the cultural fit between entities.

MergersCorp M&A International

FEBRUARY 13, 2024

However, navigating the intricacies of M&A requires significant expertise and knowledge in areas such as financial analysis, strategic planning, and negotiation tactics. This is where MergersCorp M&A International comes into play.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content