12 Concepts We Can Learn About Going From 0 to LOI From How2Exit's Interview W/ Daniel Sweet

How2Exit

AUGUST 22, 2023

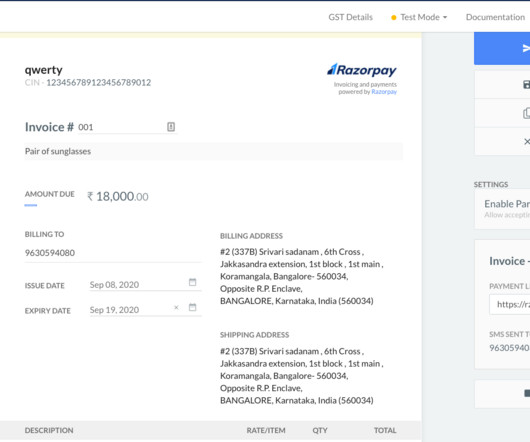

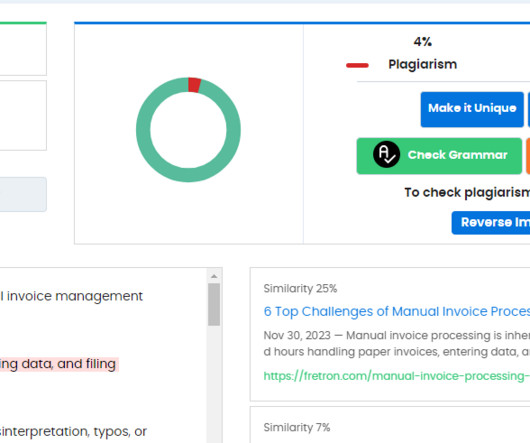

rn Concept 4: Financial Analysis Is Crucial rn One of the key takeaways from the podcast is the importance of financial analysis in the process of acquiring businesses. This highlights the need for financial analysis to separate fact from fiction and make informed decisions.

Let's personalize your content