Dilemma on Wall Street: Short-Term Gain or Climate Benefit?

The New York Times: Banking

JUNE 20, 2024

Portfolio managers have conflicting incentives as the economic and financial risks from climate change become more apparent but remain imprecise.

The New York Times: Banking

JUNE 20, 2024

Portfolio managers have conflicting incentives as the economic and financial risks from climate change become more apparent but remain imprecise.

Peak Frameworks

MAY 17, 2023

Consider you have ten potential investment opportunities, and you want to diversify your portfolio by selecting three. Using the combination formula , you can calculate the number of different possible portfolios as follows: 10! / (3!(10 10 - 3)!) = 120 different portfolios. Consider an investor with a portfolio of 15 stocks.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Peak Frameworks

SEPTEMBER 12, 2023

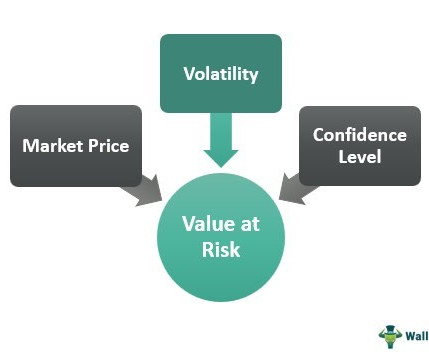

Value at Risk , commonly referred to as VaR, seeks to quantify the maximum potential loss an investment portfolio could face over a specified period for a given confidence interval. The choice depends on the nature of the portfolio and the objectives of the risk management exercise.

Razorpay

DECEMBER 15, 2024

Customized portfolios designed to optimize returns while managing risk. Financial institutions ensure that all client transactions and records are handled with strict confidentiality, protecting clients’ personal and financial information. Flexible credit lines for liquidity needs. Who is a Private Banker?

The TRADE

NOVEMBER 14, 2023

Looking at the specifics of where data is set to facilitate development, 48% of executives confirmed that they expect emerging data analytics to be of most benefit in ‘trading, investment analysis and portfolio management’ within their businesses over the next five years.

Wall Street Mojo

JANUARY 17, 2024

Financial institutions with good credit ratings offer swap facilities to clients and charge fees from brokers. Usually, financial institutions with very high credit worthiness are the ones that offer the swap market to clients who may be investors or other financial institutions. read more of the risk.

The TRADE

OCTOBER 24, 2024

These systems touch upon all elements of the trading lifecycle throughout the front-to-middle-to-back-office including execution, order, risk and portfolio management. For this reason, the system is favoured by institutional investors as opposed to individual ones. Portfolio trading Next up is portfolio trading.

Let's personalize your content