JPMorgan Chase, Wells Fargo and Goldman Sachs Report Big Profits

The New York Times: Banking

JANUARY 15, 2025

The largest banks, including JPMorgan Chase, Wells Fargo and Goldman Sachs, reported bumper profits on Wednesday.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The New York Times: Banking

JANUARY 15, 2025

The largest banks, including JPMorgan Chase, Wells Fargo and Goldman Sachs, reported bumper profits on Wednesday.

The New York Times: Banking

NOVEMBER 4, 2024

When the housing market was flying high, mortgage defaults were almost nonexistent. But now the legal system is struggling to keep up with evictions.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The New York Times: Banking

JULY 14, 2023

billion in profit last quarter, a hefty jump from the same period last year. Three of the biggest banks in the United States made a cumulative $22.3

The New York Times: Banking

JULY 19, 2023

The investment bank reported a profit half as large as its rival Morgan Stanley, to say nothing of larger lenders.

The New York Times: Banking

JUNE 29, 2023

The European Central Bank expects to bring down inflation, with a big caveat: Companies need to let profits fall as they pay for higher wages.

The New York Times: Banking

AUGUST 31, 2023

The huge gain stems from the bank’s acquisition of its rival Credit Suisse this spring for about $3.2 billion, a steep discount that is skewing its quarterly results.

The New York Times: Banking

APRIL 15, 2024

The Wall Street bank recorded nearly $4 billion in profit, beating analyst expectations in a tough quarter for big banks.

Global Banking & Finance

JANUARY 22, 2024

How does the bank make a profit? However, have you ever wondered how these financial institutions actually make a profit? In the complex landscape of finance, banks play a pivotal role in facilitating economic growth by providing a multitude of services.

The New York Times: Banking

MAY 30, 2024

Stock markets in Mumbai have surged as big global investors hope India can become a source of growth. It won’t be so easy.

The New York Times: Banking

OCTOBER 15, 2024

The investment bank earned more than expected in the latest quarter, a theme for other big banks, too.

How2Exit

NOVEMBER 25, 2024

Financial institutions, through methods like industrial revenue bonds and mezzanine loans, present existing CEOs and potential entrepreneurs with creative funding structures to support roll-ups. Executives looking to expand their influence and operational bandwidth should consider the diverse opportunities that roll-ups represent.

The New York Times: Banking

FEBRUARY 1, 2024

For some companies, the new technology is an opportunity to enhance productivity and profit. Will their workers benefit as well?

The New York Times: Banking

FEBRUARY 2, 2025

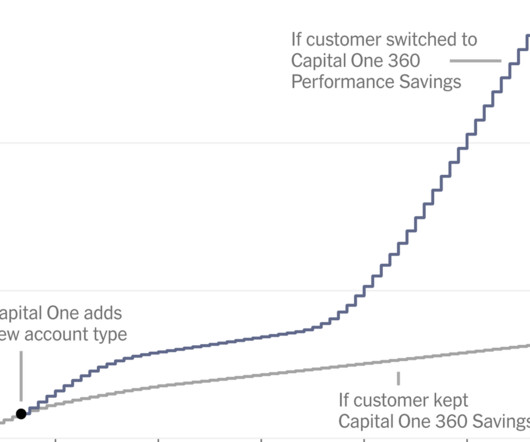

They have no fiduciary duty in many cases and can profit from customers confusion. But wheres the line between unsavory and illegal?

Global Banking & Finance

SEPTEMBER 9, 2024

Increase Resilience Against Third-Party Risk with These 5 Strategies Banks today are embracing Digital Transformation to expand capabilities, maximize profits, and increase customer offerings. However, financial institutions may not be fully aware […] In 2023, 74% of banks were accelerating their digital transformation.

The New York Times: Banking

JULY 14, 2023

It was another quarter of banner financial results for the largest lender in America.

The New York Times: Banking

OCTOBER 11, 2024

JPMorgan Chase, Wells Fargo and BlackRock reported strong quarterly results to kick off earnings season, but concerns linger about the strength of the consumer.

The New York Times: Banking

JULY 15, 2024

The Wall Street investment bank earned $3 billion in the second quarter, more than double the tally from a year earlier.

The New York Times: Banking

JULY 18, 2023

One of the nation’s largest banks reported across-the-board strength in its latest quarter, with sales and earnings that surpassed analysts’ expectations.

The New York Times: Banking

JULY 12, 2024

At Wells Fargo, a core measure of profitability sank. JPMorgan and Wells Fargo reported that overall deposits dropped.

The TRADE

MARCH 5, 2024

Join editor at The TRADE, Annabel Smith, head of trading at Syz Group, Valérie Noël, head of foreign exchange at Fidelity, Nigell Todd, and co-founder of not-for-profit Everyone Matters, Pat Sharman, to delve into the current state of play of gender diversity in capital markets.

Wizenius

MARCH 30, 2023

An Asset Reconstruction Company (ARC) is a specialized financial institution that acquires non-performing assets (NPAs) or distressed assets from banks or financial institutions at a discounted price. Profit sharing : Once the assets are resolved, the ARC shares the profits with its investors.

The New York Times: Banking

JULY 27, 2023

The bank’s latest historical review, done as part of its racial equity pledge, shows indirect ties rather than direct profits.

The New York Times: Banking

JANUARY 12, 2024

JPMorgan Chase, Bank of America and Wells Fargo reported healthy quarterly profits despite having to pay to replenish the industry’s deposit insurance fund.

The New York Times: Banking

AUGUST 31, 2023

The Swiss bank’s sharply discounted takeover of Credit Suisse led to a paper gain that gave it the biggest quarterly profit by a bank in history.

Growth Business

JUNE 29, 2023

The objectives you set for the business will dictate the type of finance you should raise: the two key options being equity (selling shares in your company) and debt (borrowing from a bank or financial institution). If growth and sale are not part of your plan, then an equity raise is not the right choice for you.

The New York Times: Banking

OCTOBER 11, 2024

Profits fell at JPMorgan and Wells Fargo, but the lenders reported results that were largely better than had been expected, a sign that the economy remained solid.

The New York Times: Banking

OCTOBER 17, 2023

The Wall Street bank disclosed $2 billion in quarterly profit, just above expectations and propelling the bank further in its turnaround.

Razorpay

JULY 20, 2023

Cooperative banking refers to a small financial institution started by a group of individuals to address the capital needs of their specific community. Such financial institutions are owned and controlled by their members, and the board members are democratically selected to oversee the operations.

The TRADE

APRIL 29, 2024

SGX FX has unveiled the latest version of its artificial intelligence (AI) tool, giving financial institutions improved access to faster and more informed foreign exchange (FX) trading decisions.

Wall Street Mojo

JANUARY 17, 2024

This differentiation helps identify a company’s profitability Profitability Profitability refers to a company's ability to generate revenue and maximize profit above its expenditure and operational costs. It is measured using specific ratios such as gross profit margin, EBITDA, and net profit margin.

Sun Acquisitions

FEBRUARY 1, 2024

Potential Lower Profit: Sellers might earn less profit over time than an all-cash deal, as they receive payments over an extended period rather than a lump sum upfront. Pros: Reduced Financial Burden: Buyers can share the financial burden with an equity investor, making it easier to afford high-value properties or renovations.

The TRADE

FEBRUARY 29, 2024

Our post-trade business is in the early phase of its next stage of growth, helping financial institutions manage risk and improve capital efficiency across the whole trading book.” He added: “In capital markets, we are collaborating more extensively with Tradeweb, creating new avenues for growth.

The New York Times: Banking

OCTOBER 1, 2023

Rohit Chopra, who leads the Consumer Financial Protection Bureau, says he is simply enforcing the law. Bankers call him reckless — a “regulator gone rogue.”

The TRADE

NOVEMBER 24, 2023

This is why we are seeing more and more financial institutions looking to reconstruct their trades to help authorities assess whether short-selling activities adhere to established rules.” However, on the occasions when executed improperly, it has the potential to disrupt market integrity.

Wall Street Mojo

JANUARY 17, 2024

Financial institutions with good credit ratings offer swap facilities to clients and charge fees from brokers. Usually, financial institutions with very high credit worthiness are the ones that offer the swap market to clients who may be investors or other financial institutions. read more of the risk.

Razorpay

OCTOBER 13, 2023

By expanding the market and tapping into global opportunities, exports can prove to be extremely profitable for businesses. Cross border wire transfers can incur fees depending on the banks or financial institutions involved.

Razorpay

JUNE 8, 2023

A bank is any financial institution that helps people and businesses store, invest and borrow money. They are intermediaries in the transaction and work with large corporations, hedge funds, and other financial institutions. What is Banking? It plays an important role in the movement of money through the economy.

How2Exit

FEBRUARY 23, 2023

Buying an existing business can provide an entrepreneur with a customer base, a proven business model, existing infrastructure, immediate revenue and profits, and experienced employees. An existing business may also be generating revenue and profits, which can provide a source of income and a return on investment.

Peak Frameworks

SEPTEMBER 19, 2023

Cost Savings and Increased Profitability: American Express, by leveraging Six Sigma, was able to save billions of dollars and ensure streamlined operations. However, with the right guidance and resources, these challenges can be overcome, leading to enhanced profitability and efficiency.

Razorpay

MARCH 18, 2024

Corporate Account that supercharges your banking experience The RazorpayX-powered current account is backed by leading financial institutions. Decide on an investment strategy Business owners should formulate a suitable investment strategy for their corporate accounts based on their financial goals.

Razorpay

DECEMBER 1, 2023

Businesses of various types, including sole proprietorships, partnerships, LLCs, corporations, and non-profit organizations, can apply for a merchant account. Eligibility criteria vary, and financial institutions assess factors like credit history, processing volume, industry type, and risk assessment. Card acceptance policy.

Peak Frameworks

SEPTEMBER 12, 2023

Consider profitability, market growth, and the competitive landscape. Some pivotal KPIs include: Assets Under Management (AUM) Growth: Reflects the total market value of assets a financial institution manages on behalf of clients. That’s market segmentation at work.

Razorpay

MAY 17, 2023

Bank reconciliation refers to the process by which the bank account balance of a business entity is reconciled with the amount recorded by financial institutions in the latest bank statement. The main objective of conducting this process is to prepare a statement recording the difference between these two.

Razorpay

AUGUST 11, 2024

A payment network is a system that processes electronic payments between consumers, businesses, and financial institutions. The former include Visa and Mastercard, which allows third-party financial institutions to issue credit cards for online card payment. What is a Payment Network? Frequently Asked Questions (FAQs) 1.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content