Chancery Finds Defendants Liable for Fraud Based on the Failure to Disclose Internal Billing Practices

JD Supra: Mergers

JANUARY 2, 2024

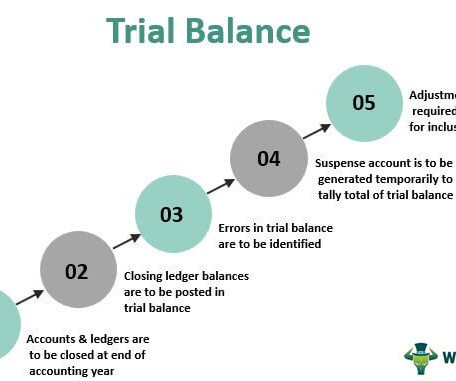

The seller’s management had been recording internal software use as revenue in its unaudited financial statements but never disclosed this practice to the buyer in the sale’s process. 2020-1000-LWW (Del. 2, 2023) - This decision arose out of the sale of the company Cloud Jumper to NetApp, Inc.

Let's personalize your content