Retail Banking vs Corporate Banking

Razorpay

MAY 23, 2023

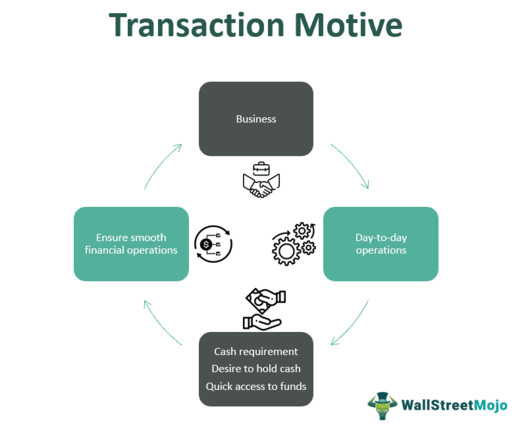

Regular retail banks provide financial services to individuals but are not equipped to service businesses. Corporate banking provides businesses financial services like account holding, loans, capital, vendor management, and more. Corporate banking and retail banking might provide similar services but are vastly different.

Let's personalize your content