Closing with Confidence: Representations and Warranties Insurance in M&A

JD Supra: Mergers

SEPTEMBER 5, 2024

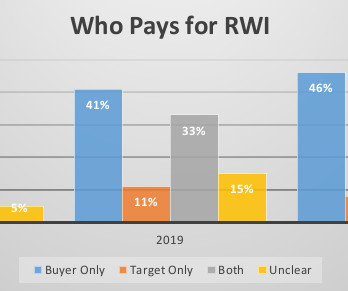

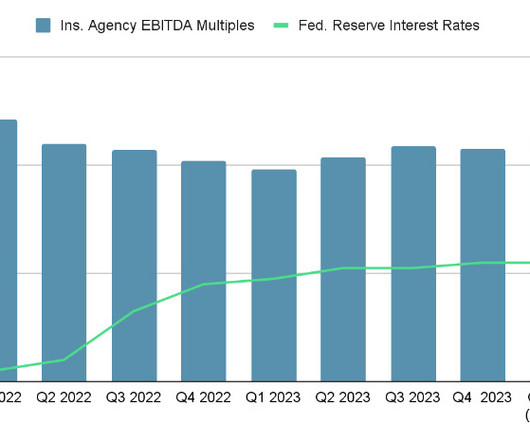

Representations and warranties insurance (RWI) has become an increasingly common feature in mergers and acquisitions (M&A) transactions, serving as a risk management tool for both buyers and sellers.

Let's personalize your content