Reverse Mergers as an IPO Alternative

Deal Lawyers

APRIL 23, 2024

Despite a bit of a checkered reputation, non-SPAC reverse mergers are still a thing, and this excerpt from a recent WilmerHale memo (p.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

JUNE 13, 2024

Board composition remains a critical issue for public companies as investors and other stakeholders evaluate the skills, qualifications, and background of directors. It is well-known that stock exchange rules generally only require that a company’s board contains a majority of independent directors, with the exception of controlled companies.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

JD Supra: Mergers

MAY 20, 2024

In CQ4-2023, the Restaurant Index grew 3.40%, trailing the S&P 500's 11.31% rise. Annually, 2023 showed gains aligning with the S&P. Despite challenges, brands emphasized global expansion and digital innovation. The industry has continued to adapt, setting a measured outlook into 2024. By: Ankura

Francine Way

JUNE 22, 2020

I learned a few new things in these 2 roles, including how to evaluate a merger opportunity and present it to a corporation’s Board of Directors (BoD). To pick up where we last left off with valuation, I will cover the topic of a Merger Relative Valuation in this blog post and move on to other non-valuation topics from here.

JD Supra: Mergers

JUNE 21, 2024

billion of financing in Q1 2024; the highest level of quarterly issuance since Q2 2020, according to S&P Global. Primary investment grade bond issuance surged in Q1 2024 as investors ramped up exposure to high-quality borrowers in a high interest rate environment. In the US, investment grade corporate borrowers secured US$429.7

Sun Acquisitions

OCTOBER 13, 2023

Mergers and acquisitions (M&A) play a vital role in shaping the business landscape, enabling companies to expand, diversify, and gain a competitive edge. Income-Based Valuation The income-based valuation method focuses on the target company’s ability to generate future cash flows and assesses the present value of these cash flows.

Sun Acquisitions

NOVEMBER 17, 2023

Mergers and acquisitions (M&A) have long been a cornerstone of corporate growth and strategy. It’s the process of determining the financial worth of a business, helping acquirers and sellers establish a fair price and make informed decisions. It ensures a smooth transition and the realization of synergies.

Shearman & Sterling

JANUARY 18, 2023

Zurn of the Delaware Court of Chancery substantially granted plaintiff's motion for summary judgment in an action seeking attorneys' fees. On December 27, 2022, Vice Chancellor Morgan T. Garfield v. Boxed, Inc., 2022-0132-MTZ (Del. Plaintiff, a stockholder of defendant Seven Oaks Acquisition Corp.,

Lake Country Advisors

AUGUST 8, 2024

It’s integral to ensuring that the sale benefits all stakeholders and should be one of your priorities before advertising it to potential buyers. It’s a delicate balancing act, as inaccurate valuations have polarizing consequences. However, company valuation isn’t as simple as slapping a price on your business.

The Harvard Law School Forum

APRIL 25, 2023

and Paul S. Scrivano, Davis Polk & Wardell LLP, on Tuesday, April 25, 2023 Editor's Note: George Bason is partner and Chair of the Mergers and Acquisitions practice, and Andrew Ditchfield and Paul S. Posted by Andrew Ditchfield, George R. Scrivano are partners at Davis Polk & Wardwell LLP. Dougherty , Louis L.

The TRADE

AUGUST 14, 2023

European agency broker and equities research specialist Redburn and US equity brokerage Atlantic Equities have completed the merger of their operations under Redburn’s parent company Rothschild & Co, initially announced on 26 April.

How2Exit

JUNE 16, 2024

E223: The Acquisitions Pilot Project: A Solution For 1st Time Buyers to Buy Lower Markets and Sell A Roll-Up - Watch Here About the Guest(s): Roger Best is a seasoned professional with a diverse background spanning mechanical engineering, law, and private equity.

How2Exit

SEPTEMBER 2, 2024

E241: Diving Deep into SME Acquisitions: Essential Insights, Strategies, and Success Secrets - Watch Here About the Guest(s): Danny O'Neill : Danny O'Neill is a seasoned entrepreneur with a rich background in sales and marketing. Hailing from Scotland with ties to Ireland, Danny has diverse experience in turning around small businesses.

Shearman & Sterling

JANUARY 18, 2023

Zurn of the Delaware Court of Chancery substantially granted plaintiff's motion for summary judgment in an action seeking attorneys' fees. On December 27, 2022, Vice Chancellor Morgan T. Garfield v. Boxed, Inc., 2022-0132-MTZ (Del. Plaintiff, a stockholder of defendant Seven Oaks Acquisition Corp.,

Street of Walls

SEPTEMBER 10, 2012

Sandler O’Neill’s Weekly M&A Trends: The S&P 500 had its best week since early June The S&P 500 rose by 2.2% In 3Q12, the S&P 500 has risen by 5.6% s $2 billion offering of its shares in the A.I.A. in the week and the Russell 2000 growth index rose by 3.7% in the week.

Street of Walls

SEPTEMBER 24, 2012

Sandler O’Neill’s Weekly M&A Trends: Equity markets pulled back modestly on lighter trading volume The S&P 500 declined by 0.4% In 3Q12, the S&P 500 has risen by 7.2% s $102 million offering highlighting the week, returning over 40% on its first day of trading. in the week. Average daily U.S.

The New York Times: Mergers, Acquisitions and Dive

AUGUST 6, 2024

Nearly a quarter-century after Microsoft lost a similar case, a judge’s decision that Google abused a monopoly in internet search is likely to have major ripple effects.

Successful Acquisitions

SEPTEMBER 11, 2023

The Verdict is In on the Sell Side: Business Valuation Basics By Brian Goodhart Valuation is a fundamental aspect of the complex and intricate world of mergers and acquisitions. It’s a balance where numbers meet intuition, and neither aspect should be ignored.

Mergers and Inquisitions

MARCH 8, 2023

As the delivery date approaches, the underlying commodity’s price and its futures price converge. Some IB natural resource groups could potentially work, but if you want to be a trader, you’re still much better off starting in S&T. As a Trader, you might get another base salary bump and a small percentage of your P&L.

Mergers and Inquisitions

JANUARY 3, 2024

My portfolio did “OK” (up 10% for the year), but it greatly underperformed the S&P 500 , which was up 24%. On the other hand, I was only down 9% in 2022 vs. a 19% drop for the S&P, so both the index and my portfolio are now back to “early 2022” numbers. I cut cut my allocations to commodities and real estate.

The Deal

JUNE 22, 2023

Reed and Michael P. Chief legal officer Joshua S. Keeley of longtime counsel Kirkland & Ellis LLP for counsel on the deal. Qatalyst Partners LP is the lead financial adviser to the target and the seller, while Barclays, Citigroup Inc., Evercore Inc., HSBC Securities (USA) Inc., Jefferies LLC and Piper Sandler Cos.

Solganick & Co.

DECEMBER 21, 2023

While overall deal volume dipped slightly compared to the record-breaking highs of 2022, falling by around 5%, the total value of transactions remained surprisingly resilient, hovering near the $400 billion mark, according to data from S&P Global Market Intelligence.

The Harvard Law School Forum

MAY 2, 2023

Persistently high inflation, coupled with the fastest Fed tightening cycle seen since 1988, contributed to making 2022 the worst performing year for the S&P 500 Index since 2008, thrashing growth and technology stocks in particular. [1] stock market in 2022 experienced increased volatility relative to 2021. 6] (more…)

The Harvard Law School Forum

OCTOBER 6, 2022

year-to-date for 2022, the S&P 500 was lower by 16.8% While the market has gained some ground from the lows of summer, as of September 1, 2022, the Dow Jones Industrial Average (“DJIA”) was down 12.9% and the Nasdaq Composite fell by 24.7%. Over the same period, the CBOE Volatility Index (“VIX”) was up over 30.2%. [4].

Sica Fletcher

MAY 13, 2024

The Sica | Fletcher Index is the leading report on mergers and acquisitions within the insurance brokerage sector. The firm was founded in 2014 by Michael Fletcher and Al Sica, two of the industry's leading dealmakers who have advised on over $17.5 billion in insurance agency and brokerage transactions since 2014.

How2Exit

MARCH 13, 2023

One way to ensure that the client is getting the best results from their marketing efforts is to focus on the entire P&L of the company. This means that businesses should be looking at their COGS, distribution, and other factors that go into their P&L to get a better understanding of how the business is running.

Mergers and Inquisitions

JANUARY 31, 2024

They might have separate teams for specific strategies or markets, but everything is run under a single Profit & Loss statement (P&L). There are very few real “requirements” besides the single PM / single P&L one above and the standard Limited Partner / General Partner structure that all hedge funds use.

Sica Fletcher

AUGUST 5, 2024

The Sica | Fletcher Index is the leading report on mergers and acquisitions within the insurance brokerage sector. The firm was founded in 2014 by Michael Fletcher and Al Sica, two of the industry's leading dealmakers who have advised on over $17.5 billion in insurance agency and brokerage transactions since 2014.

Sica Fletcher

AUGUST 5, 2024

The Sica | Fletcher Index is the leading report on mergers and acquisitions within the insurance brokerage sector. The firm was founded in 2014 by Michael Fletcher and Al Sica, two of the industry's leading dealmakers who have advised on over $17.5 billion in insurance agency and brokerage transactions since 2014.

Mergers and Inquisitions

MAY 24, 2023

Part of the issue is that many different strategies fall within the “event-driven” category: merger arbitrage , activist investing , distressed investing, special situations, and more. With this one, you need to look at the entire category , which means merger arbitrage on one end and activist on the other.

Sica Fletcher

FEBRUARY 6, 2024

The Sica | Fletcher Index stands as the leading report on mergers and acquisitions within the insurance brokerage sector. According to S&P Global, Sica | Fletcher ranked as the #1 advisor to the insurance industry for 2017-2023 in terms of total deals advised. Learn more at SicaFletcher.com.

The Deal

JULY 19, 2023

Cox, Andrew P. Denbury chief administrative officer and general counsel James S. Davis Polk advised Exxon on those two deals as well as the 1999 merger that created ExxonMobil. Denbury, a Plano, Texas-based independent energy company, took financial advice from Jonathan W. McDonough at TPH&Co. per Denbury share.

Focus Investment Banking

OCTOBER 23, 2024

gain in the S&P 500 and the 2.6% gains in the S&P 500 and NASDAQ, respectively. This outperformed both the 5.5% gain in the NASDAQ.This period’s gain also brought the year-over-year return for the TBSI to a level that is almost on par with the broader indices.

Mergers and Inquisitions

DECEMBER 6, 2023

Beta-Neutral Portfolios: For example, if the S&P 500 goes up or down by 5%, your team’s portfolio should move by ~0%. Your ability to judge market sentiment is crucial, and you develop more of these skills in S&T and ER. appeared first on Mergers & Inquisitions.

Focus Investment Banking

SEPTEMBER 4, 2024

McGregor advises multi-location tire dealerships on mergers and acquisitions. According to S&P Global, the monetary value of dry powder reached $2.59 Incidentally, S&P Global estimates that Leonard Green & Partners alone was sitting on $15.3 He has worked with many private equity firms.

The Harvard Law School Forum

JUNE 27, 2023

7] A pause may be more beneficial to investors than a direct rate cut would be; the S&P 500 has historically climbed 16.9% This news, coupled with First Republic having a high percentage of uninsured deposits, triggered a run on the bank, causing a liquidity crisis that the bank could not quell. [1] 3] [4] The U.S.

The Harvard Law School Forum

JULY 18, 2023

Majority Action, As You Sow) (more…)

The Harvard Law School Forum

JULY 18, 2023

Majority Action, As You Sow) (more…)

How2Exit

OCTOBER 10, 2023

Ron rn rn rn About The Guest(s): Juan Braschi is the CEO of Boopos, a company that helps talented buyers acquire businesses and provides flexible financing for buying e-commerce and software-as-a-service (SaaS) businesses. We let buyers decide." rn "We're a principal lender, and our contracts are fairly standard."

Focus Investment Banking

JANUARY 18, 2024

The S&P 500 has recently traded near 4800, close to its record at the end of 2021. Kelly Kittrell has more than 30 years of merger & acquisition and corporate finance experience. As 2024 starts, the U.S. stock markets are at or near their all-time highs.

Focus Investment Banking

OCTOBER 23, 2023

One of the most prudent investment strategies for long-term wealth building is to invest in index funds, specifically those tracking broad market benchmarks, like the Vanguard, Schwab or Fidelity S&P 500 index fund. This approach has several advantages: Diversification. Lower costs.

Sica Fletcher

NOVEMBER 9, 2023

The Sica | Fletcher Broker Buyer Index stands as the leading report on mergers and acquisitions within the insurance brokerage sector. According to S&P Global, Sica | Fletcher ranked as the #1 advisor to the insurance industry for 2017-2023 YTD in terms of total deals advised on. Learn more at SicaFletcher.com.

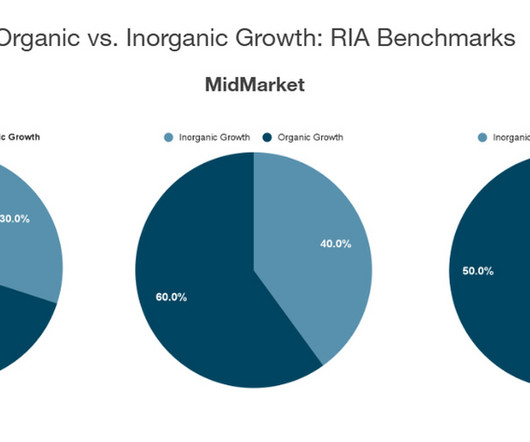

Sica Fletcher

OCTOBER 16, 2024

growth from acquisitions, mergers, or partnerships with other RIAs). As the Baby Boomer Generation enter their golden years, it's very likely that we will see increased valuations in the coming decade as more and more people seek retirement planning services.

Mergers and Inquisitions

FEBRUARY 28, 2024

And the credit rating agencies (S&P, Fitch, Moody’s, and Morningstar DBRS in distant 4 th place) specialize in fixed income research. The legal side is quite important because you must read the debt agreements to understand each issuance’s covenants and other terms. appeared first on Mergers & Inquisitions.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content