Tax Liability Insurance - M&A and Beyond

JD Supra: Mergers

SEPTEMBER 9, 2024

Rather than considering an adjustment to the purchase consideration, negotiating an indemnity/escrow, self-insuring the risk. By: Ankura

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

SEPTEMBER 9, 2024

Rather than considering an adjustment to the purchase consideration, negotiating an indemnity/escrow, self-insuring the risk. By: Ankura

MergersCorp M&A International

JANUARY 9, 2024

Mergers and acquisitions (M&A) transactions can be complex and require careful negotiation to ensure both parties involved in the deal are satisfied with the outcome. With a team of experienced professionals, the company is equipped to handle all aspects of the M&A process, including deal negotiation.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How2Exit

OCTOBER 28, 2024

Strategic Affiliate and Collaborative Marketing : Building relationships with affiliates and utilizing social media for peer-to-peer marketing can profoundly impact a business’s organic growth and profitability. Notable Quotes: "The volume of paperwork tells you the size of the acquisition at the end of the day."

IBG

AUGUST 21, 2023

A powerful tool in negotiating a business’s purchase price, an earnout can bridge the gap between the amount that a buyer is willing to pay and the seller is willing to accept. Utilizing an earnout ensures that the buyer pays only for retained clients/patients and gives the seller incentives to pass all relationships on to the buyer.

Devensoft

AUGUST 22, 2023

Properly valuing a company involved in an M&A transaction allows stakeholders to make informed decisions and negotiate effectively. By utilizing the Enterprise Value Calculator, you gain a powerful tool that incorporates various financial parameters to provide a comprehensive valuation of a target company.

MergersCorp M&A International

NOVEMBER 21, 2024

MergersCorp’s experts utilize rigorous market analysis combined with an understanding of sector-specific dynamics to craft strategies that facilitate successful outcomes for their clients. After closing the deal, the focus shifts to integration—often considered the most critical phase of M&A.

OfficeHours

JUNE 6, 2023

Traditional private equity firms (commonly referred to as LBO private equity) utilize leveraged buyouts to purchase target companies. They may then negotiate with the company to restructure the debt, provide additional capital, or facilitate a turnaround.

Lake Country Advisors

FEBRUARY 16, 2024

Asset valuation plays a pivotal role in determining the overall worth of a business, influencing potential buyers’ decisions and negotiations. This ensures a smoother negotiation process. Their knowledge and experience will be crucial in negotiating legal issues and assuring a legal transaction.

How2Exit

MARCH 24, 2023

By utilizing these methods, you can ensure that the resources that you acquire will be able to help your company to remain successful and grow. By utilizing a quadrant analysis and income analysis, you can narrow down the list of potential acquisitions to those that are most suitable for your company.

How2Exit

SEPTEMBER 26, 2023

These deals offer unique advantages, such as faster transactions, potential tax benefits, and the ability to negotiate favorable terms. This exclusivity can lead to better negotiation opportunities, favorable terms, and the potential for higher returns on investment. rn Why Go Off-Market?

Lake Country Advisors

AUGUST 7, 2023

At Lake Country Advisors, we utilize state-of-the-art assessment methods to accurately evaluate your business, ensuring you get the best possible price. Negotiating the Sale Once potential buyers have expressed interest, the negotiation phase begins. We understand that every business is unique, and our approach reflects this.

Sun Acquisitions

JANUARY 8, 2024

However, navigating the complexities of M&A requires strategic insight, careful negotiation, and a deep understanding of the business landscape. This insight guides decision-making and forms the foundation for negotiations.

How2Exit

SEPTEMBER 9, 2024

They also touch upon the benefits of leveraging joint venture partners, the impact of AI on accounting, and the nuances of negotiating deal structures. Utilizing expert support : Leverage the expertise of specialized professionals in areas where you lack proficiency. So I'd found this local paper advertisement or paper report.

Sun Acquisitions

FEBRUARY 7, 2023

Here are just some of them: Security & Stability Selling a manufacturing business provides long-term security and stability for both parties involved — as long as all details are correctly negotiated beforehand.

Midaxo

DECEMBER 20, 2023

Utilizing machine learning and artificial intelligence algorithms, businesses can extract meaningful insights from the data, enabling informed decision making throughout the M&A process. Data-Driven Decision Making Programmatic M&A relies heavily on data analytics to identify potential targets and assess their viability.

How2Exit

FEBRUARY 25, 2024

Knowlden shares his insights on buying businesses, utilizing seller finance creatively, and constructing advantageous deal structures that benefit all parties involved. rn Buyers in the M&A space must recognize the human element as a crucial aspect of the negotiation process.

Lake Country Advisors

AUGUST 9, 2024

This trust is crucial in negotiations and can lead to a smoother and more prosperous sale process. Strategic Marketing and Finding the Right Buyer Utilizing advanced marketing techniques is vital for reaching both local and global buyers. Create Win-Win Scenarios : Aim for solutions that satisfy both parties’ key interests.

Sun Acquisitions

MAY 1, 2023

Utilize Professional Resources Available: This is the exact time to lean on professionals for expert advice such as M&A advisors, accountants, and attorneys.

Wall Street Mojo

JANUARY 15, 2024

Its purpose is to identify inefficiencies, aiding in targeted improvements within the production process for better resource utilization. It measures how efficiently labor resources are utilized. This determination may stem from meticulous time and motion studies or negotiations with the employees’ union.

Wizenius

JULY 2, 2023

Once the right target is found, negotiations ensue, leading to a mutually beneficial agreement. Throughout the investment journey, PE firms keep a close eye on the Internal Rate of Return (IRR), utilizing sophisticated financial models to predict future returns accurately. 2) Grow The excitement amplifies in the growth phase.

Lake Country Advisors

FEBRUARY 18, 2024

M&A deals involve intricate details concerning financial regulation, due diligence, valuation, and negotiation. The Role of an M&A Advisor An M&A advisor acts as a strategist and negotiator, utilizing their expertise to ensure the client’s interests are paramount throughout the M&A process.

How2Exit

OCTOBER 7, 2024

Meanwhile, the Income Approach involves evaluating a company’s cash flow against perceived risks, utilizing methods like capitalization of earnings and discounted cash flow models. By employing these strategies, buyers move beyond mere negotiation, positioning themselves as savvy operators in an ever-evolving market.

Midaxo

NOVEMBER 9, 2022

Introduction: Streamlining and assessing your pipeline management is non-negotiable if you are a serial acquirer or serious about leveraging M&A for growth or value creation. Conversely, when M&A software — namely pipeline management software — is utilized, the process becomes efficient and proactive.

Lake Country Advisors

NOVEMBER 16, 2023

Utilizing Digital Platforms for Wider Reach Expanding your reach through digital platforms is a crucial strategy in today’s market. Utilize business sale websites to list your business, ensuring that the listing is detailed, accurate, and presents your business in the best light.

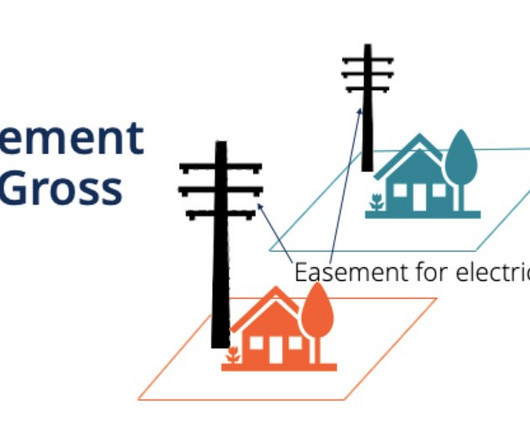

Peak Frameworks

OCTOBER 19, 2023

For example, utility companies may use easement in gross contracts in order to access and service property owned by another company. A classic example is utility companies having right to run power lines or pipelines across properties. Commercial Easement in Gross: This type is linked to entities like corporations or businesses.

Wall Street Mojo

JANUARY 15, 2024

Overcapacity Explained Overcapacity is the imbalance between the production capacity and the actual consumption or utilization of the firm’s capabilities. This could result in increased efficiency and competitiveness for companies that manage to utilize excess capacity effectively.

Razorpay

JUNE 26, 2024

Usage: Typically utilized in high-value transactions or industries with longer sales cycles. Negotiation and Customization: Payment terms can often be negotiated to meet the needs of both parties, ensuring that the agreement supports mutual business goals.

Sun Acquisitions

SEPTEMBER 21, 2023

Establishing an Accurate Valuation Determining the accurate value of your business is critical for attracting potential buyers and negotiating a fair price. Utilize a multi-channel approach to maximize exposure and generate interest.

Growth Business

MAY 30, 2023

Often the work force has a better understanding of processes and protocols than management as they are utilizing them every day and therefore are in a better position to optimize productivity). A more beneficial approach is to consider any ideas that may improve the company’s performance and incorporate these into the overall strategy.

Razorpay

AUGUST 20, 2023

Some of the common fixed costs are employee salaries, interest, rent, insurance, lease, insurance, utility payments, phone service, advertising costs, amortization, and more. Tip 4: Negotiate with leasing business bodies or landlords to fetch lower rent payments. As the name suggests, fixed costs are constant business expenses.

Razorpay

SEPTEMBER 20, 2024

Merchants may also be able to negotiate lower MDR rates with their payment processors. Merchant’s business size and industry Larger businesses negotiate lower rates, while high-risk industries face higher Merchant Discount Rates. MDR National coffee chain: Negotiates rates as low as 1.8%

Razorpay

DECEMBER 16, 2024

For example, a region known for its manufacturing might develop better infrastructure (like transportation or utilities), lowering costs for all producers in the area. Examples include: Infrastructure Development: Improved transportation or utilities reduce logistics and operational costs.

The TRADE

JULY 4, 2023

It would’ve been great to see the EU consolidated tape go one step further to include venue attribution, which would have maximised the utility of the tape. However, the compromise reached in Europe has proved controversial to those that argue it lacks detail around its attribution and revenue sharing model. “It

How2Exit

OCTOBER 2, 2023

This allows you to maximize the utilization of your resources and generate higher profits. Seller financing is a common practice in small business acquisitions, with the terms and conditions negotiated between the buyer and seller. This strategy allows you to eliminate competition and gain a stronger foothold in the market.

How2Exit

JUNE 16, 2024

The conversation offers a deep dive into how Roger utilizes his extensive skill set to navigate the complexities of mergers and acquisitions, making significant strides in this highly lucrative sector. This approach mitigates many of the common fears and barriers that new acquirers face, such as lack of expertise or funding concerns.

Sun Acquisitions

SEPTEMBER 29, 2023

Establishing an Accurate Valuation Determining the accurate value of your business is critical for attracting potential buyers and negotiating a fair price. Utilize a multi-channel approach to maximize exposure and generate interest.

Peak Frameworks

MAY 2, 2024

Navigating Complex Transactions In complex financial transactions, unilateral contracts offer a streamlined approach to agreement formulation, reducing the need for negotiations and simplifying the terms of engagement.

Software Equity Group

FEBRUARY 26, 2024

During negotiations and discussions with advisors or potential buyers, an understanding of key financial and operational metrics is crucial. G&A expenses include rent, utilities, insurance, and office supplies. Familiarize yourself with the terms frequently employed in M&A procedures and negotiations.

Razorpay

DECEMBER 13, 2024

Manage vendor relationships and negotiate contracts for cost optimization. Vendor and Partner Management Building and maintaining strong relationships with vendors, negotiating contracts, and ensuring timely delivery of services are key aspects of the role. Track and report on key operational metrics to senior management.

Lake Country Advisors

MARCH 22, 2024

A straightforward negotiation style considered the norm for a Wisconsin-based manufacturing firm might seem overly aggressive to executives from a company with a more indirect communication approach. Knowing whether to approach a single decision-maker or engage with a group can be essential for successful negotiations.

How2Exit

JUNE 10, 2024

Effective Search Strategy: Utilizing a combination of personal outreach and education programs, Shane efficiently identified and acquired a viable business within a few months. After 30 days of negotiating the letter of intent (LOI) and another 90 days in closing procedures, Shane sealed the deal with an SBA loan.

Lake Country Advisors

JANUARY 3, 2025

Instead of building R&D capabilities from the ground up, buyers can utilize existing resources, reducing costs while boosting productivity. Businesses can achieve long-term growth, profitability, and market leadership by strategically utilizing acquired resources. Maximized resource utilization, enabling higher profit margins.

Lake Country Advisors

JUNE 20, 2024

Buyers must know what they’re getting into and the hidden problems that may derail negotiations. Addressing these areas demonstrates thorough preparation and can help alleviate buyer apprehensions, leading to a smoother negotiation process. Here are some of its examples: Outstanding debts and obligations.

Razorpay

JULY 14, 2024

GST is extra Android Smart POS Android Smart Mini POS Grocery/Supermarket 1.30% 1.30% Utility, Govt., GST is extra. Android Smart POS Android Smart Mini POS Grocery/Supermarket 1.30% 1.30% Utility, Govt., This can translate to lower negotiated transaction fees compared to businesses with lower volume.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content