Portfolio trading is on the up but only some can make it pay

The TRADE

DECEMBER 14, 2023

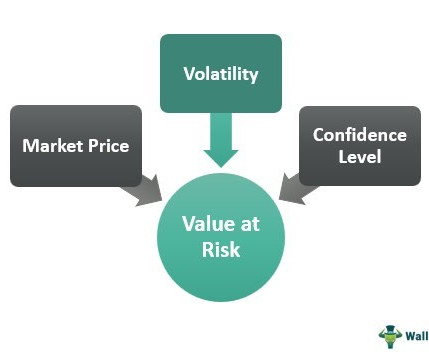

Portfolio trading as a concept has exploded in the last few years, egged on by market conditions and volatility brought on by the pandemic and other macroeconomic factors. However, whether or not all firms are able to monetise the tool by managing risk effectively in today’s environment, is up for debate.

Let's personalize your content