Tom Lee highlights the top picks in his winning portfolio that are beating the S&P 500

CNBC: Investing

OCTOBER 19, 2023

Tom Lee recently rebalanced his Granny Shots portfolio, which is up 157% since its inception five years ago.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CNBC: Investing

OCTOBER 19, 2023

Tom Lee recently rebalanced his Granny Shots portfolio, which is up 157% since its inception five years ago.

The TRADE

SEPTEMBER 12, 2024

Cboe Global Markets announced that its new Cboe S&P 500 Variance Futures are expected to begin trading on Monday 23 September on the Cboe Futures Exchange. The post Cboe set to launch new Cboe S&P 500 Variance Futures appeared first on The TRADE.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CNBC: Investing

FEBRUARY 13, 2024

The stock market is at such a critical juncture here, and following this morning's hot CPI print, the reaction to this data will likely determine the market trend over the next three-to-five months.

The TRADE

JUNE 23, 2023

The integrated solution from Bloomberg and S&P Global Market Intelligence has launched a new solution to streamline syndicated primary bond market workflows. The solution connects Bloomberg’s fixed income execution management system, TSOX and &P Global Market Intelligence’s InvestorAccess platform.

CNBC: Investing

AUGUST 21, 2024

The VIP basket has outperformed the S&P 500 this year with a gain of 19%, compared to the S&P 500's 17% return.

Peak Frameworks

AUGUST 15, 2023

An investment portfolio is a basket of various types of financial assets owned by an investor. The art of investment revolves around the strategic assembly of financial assets into an investment portfolio. The art of investment revolves around the strategic assembly of financial assets into an investment portfolio.

CNBC: Investing

FEBRUARY 21, 2025

While the S&P 500 is trading near its all-time high, a group of favored stocks among hedge funds is soaring even higher, according to Goldman Sachs.

Global Banking & Finance

DECEMBER 17, 2024

By Tom Westbrook SINGAPORE (Reuters) -Stocks stalled while the dollar drifted higher on Wednesday as investors made last-minute adjustments to portfolios in the countdown to the year’s final salvo of central bank meetings, while news of a potential Nissan-Honda tie-up lifted car stocks.

The TRADE

JANUARY 22, 2025

When Mike called me about the opportunity to join Conversant, he emphasised the firm’s long-term, buy-and-hold strategy, akin to private equity. There’s been a reopening in capital markets. It’s been busy. There’s a very healthy dialogue at all times at both the portfolio-level and the position-level.

The TRADE

MAY 16, 2024

Today, trades are not solely measured by outcome in isolation, but instead, the focus has shifted towards understanding the holistic impact of every transaction on portfolio performance, risk management, and overall market dynamics. However, reservations about its usage still exist among users.

The TRADE

JUNE 28, 2023

Among the key products to now be available to traders and portfolio managers in a modular format is the EMS’ predictive fair value (FV) model. Having in pre-trade a clear fair value of the bond can authorise more duration in the execution of the bond to provide additional alpha for the portfolio manager.”

Mergers and Inquisitions

JANUARY 3, 2024

My portfolio did “OK” (up 10% for the year), but it greatly underperformed the S&P 500 , which was up 24%. On the other hand, I was only down 9% in 2022 vs. a 19% drop for the S&P, so both the index and my portfolio are now back to “early 2022” numbers. and far too little in equities.

Mergers and Inquisitions

JANUARY 31, 2024

They might have separate teams for specific strategies or markets, but everything is run under a single Profit & Loss statement (P&L). There are very few real “requirements” besides the single PM / single P&L one above and the standard Limited Partner / General Partner structure that all hedge funds use.

Mergers and Inquisitions

DECEMBER 6, 2023

Beta-Neutral Portfolios: For example, if the S&P 500 goes up or down by 5%, your team’s portfolio should move by ~0%. Factor Requirements: Some teams also structure their portfolios based on “ factors ,” such as quality, momentum, value, etc., These funds are usually multi-strategy as well.

OfficeHours

OCTOBER 23, 2023

According to S&P Global, the S&P fell 18.11% in 2022 amid surging inflation, rising interest rates, and an overall uncertain global outlook. PE firms achieve this through the operational improvements we’ve mentioned above.

The Deal

AUGUST 15, 2023

’s Competition and Markets Authority continued review of its Activision Blizzard Inc. “Sony is probably the most likely company to go looking for a big publisher,” Neil Barbour of S&P Global Inc. ‘s (SPGI) Kagan said in an email. If Microsoft Corp. MSFT) can navigate the U.K.’s

FineMark

JANUARY 17, 2024

The equity market also noted the Fed’s comments as investors piled back into equities and the S&P 500 finished the year up more than 26%. What’s intriguing about the chart in Figure 2 is how differently equities, as measured by the S&P 500, performed under each period, returning a modest 5.7%

Razorpay

APRIL 10, 2024

Let’s delve into the world of purpose codes and understand their significance. A purpose code is a unique identifier issued by a country’s central bank that is necessary for the successful execution of international payments. So, it’s crucial to understand and use purpose codes correctly.

Francine Way

JULY 8, 2017

Regardless of the base reason(s), the current owners and management of a company looking for a new owner should seek to: Maximize return on investment for current owners. PE Portfolio Companies: strategic-financial buyer, typically focus on adding on to current product / service offering, market geography, or customer types.

Sica Fletcher

JULY 1, 2024

a more diverse portfolio of policies and clients, as well as b.) boost your profits, cut your bottom line), doing so with a brokerage requires paying special attention to the diversity of your policy portfolio. That being said, brokerage owners need to consider a.)

FineMark

OCTOBER 17, 2023

Rather than trying to predict the future, we prefer to construct solid portfolios, focus on longer-term investable themes, and identify third-party manager talent with demonstrable (and persistent) alpha-generation ability. Equities and the S&P 500 At the onset of each new year, like clockwork, we’re asked for our near-term view.

Focus Investment Banking

OCTOBER 23, 2023

One of the most prudent investment strategies for long-term wealth building is to invest in index funds, specifically those tracking broad market benchmarks, like the Vanguard, Schwab or Fidelity S&P 500 index fund. With index funds, you don't need to constantly monitor and adjust your portfolio. Lower costs. Minimal effort.

The TRADE

MAY 1, 2024

It’s about risk management philosophy and methodology,” explains Papanichola. During that period of my training, I was actively taking positions, taking risk, fundamentally managing a portfolio of sorts in macro products.” The traders are now discretionary execution guys and the portfolio managers (PMs) don’t get involved.

Peak Frameworks

AUGUST 15, 2023

The Seven Indicators Stock Price Momentum : The S&P 500 versus its 125-day moving average. It can help inform investment strategies, particularly in relation to market timing, risk management, and portfolio rebalancing. Each indicator is standardized and equally weighted to construct an aggregate, normalized index score.

Solganick & Co.

DECEMBER 21, 2023

While overall deal volume dipped slightly compared to the record-breaking highs of 2022, falling by around 5%, the total value of transactions remained surprisingly resilient, hovering near the $400 billion mark, according to data from S&P Global Market Intelligence.

Peak Frameworks

JUNE 21, 2023

For example, to calculate the average return of an S&P 500 portfolio over the past ten years, we would sum up the returns for each year and then divide by ten. , The Mean The mean, commonly referred to as the average, is obtained by summing up all data points in a dataset and then dividing by the number of data points.

Sica Fletcher

OCTOBER 23, 2024

This method is also less popular than EBITDA but is sometimes used by companies with larger investment portfolios, such as wealth management companies. Founders Michael Fletcher and Al Sica are two of the industry's leading dealmakers who have advised on over $16 billion in insurance agency and brokerage transactions since 2014.

InvestmentBank.com

JANUARY 14, 2021

In September 2020, the National Bureau of Economic Research released a working paper including an industry survey citing 900+ VC firms; this paper revealed a consensus that many portfolio companies were performing quite well in the face of Covid-19 and less than 10% were performing at levels that would raise significant concerns [3] [10].

The TRADE

OCTOBER 9, 2024

Markets are constantly challenging and that’s the key aspect to our role.” If a portfolio manager wants to execute a trade days after such an event, they need to understand that liquidity may be reduced, and they must be confident in their strategy if they’re willing to pay more in the bid-offer spread.” Markets have been tricky.

Mergers and Inquisitions

SEPTEMBER 20, 2023

Firm-Specific and Process Questions – What do you think about our portfolio? So, you could mention a related job, such as strategy, finance, or business development at a portfolio company, and say that you want to return to VC at a higher level eventually. Market and Investment Questions – Which startup would you invest in?

Mergers and Inquisitions

MAY 24, 2023

If you’re working at a special situations fund, you could trade this deal in many ways: Long Jacobs and Short CMS – You believe the company is correct about the deal’s benefits, but you think CMS is overvalued at 11.5x 5) Portfolio Concentration – Many special situations and distressed funds run concentrated portfolios (e.g.,

Mergers and Inquisitions

FEBRUARY 28, 2024

And the credit rating agencies (S&P, Fitch, Moody’s, and Morningstar DBRS in distant 4 th place) specialize in fixed income research. The legal side is quite important because you must read the debt agreements to understand each issuance’s covenants and other terms. a credit rating vs. an investment recommendation).

InvestmentBank.com

MAY 26, 2021

COVID-19’s impact on M&A activity varied across industries, with some reaping the benefits and others not being so lucky. Though far short of 2019’s predictions, this outcome was far better than the 50 to 60% losses experienced in the first half of the year. 2020, January) COVID 19’s Influence on the US PE Market.

Mergers and Inquisitions

JULY 31, 2024

For example, Thoma Bravo and Vista are technology specialists, and while firms such as Leonard Green have industrials-related portfolio companies, they’re better known for their consumer retail deals. Beyond that, we can say a few things about industrials vs. other verticals within PE. Note that not all “large” funds do industrial deals.

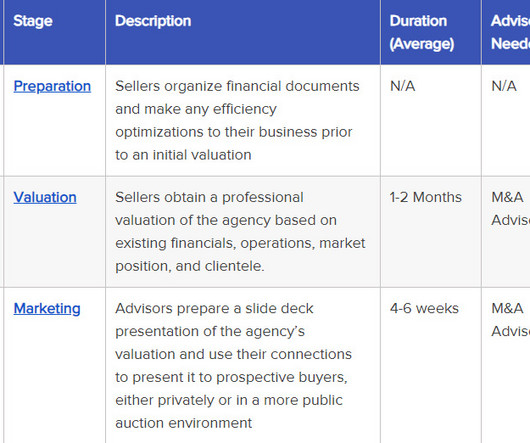

Sica Fletcher

MARCH 26, 2024

Buyers want to acquire your agency and intend to sell it after several years for a profit, typically as part of a larger portfolio of purchased companies (e.g., According to S&P Global, Sica | Fletcher ranked as the #1 advisor to the insurance industry for 2017-2023 YTD in terms of total deals advised on.

Sica Fletcher

JUNE 20, 2024

PE firms rely on leveraged buyouts (LBOs) for the lion's share of their deals, which often involve using the acquired company’s assets as collateral to insure the loan used to purchase it. The following subsections detail those strategies as well as actionable insights and suggestions on what to do in the coming year(s).

The TRADE

OCTOBER 24, 2024

These systems touch upon all elements of the trading lifecycle throughout the front-to-middle-to-back-office including execution, order, risk and portfolio management. The first ETF to launch in the US was the SPDR S&P 500 ETF (SPY) in 1993. Portfolio trading Next up is portfolio trading.

FineMark

JULY 13, 2023

The stark differences in index performance, specifically the effects of mega-cap technology listings and their disproportionately large weights in the S&P 500, are also worth highlighting. Some of this weightiness can be seen in the performance disparity to date between the S&P 500 and the Dow Jones Industrial Average.

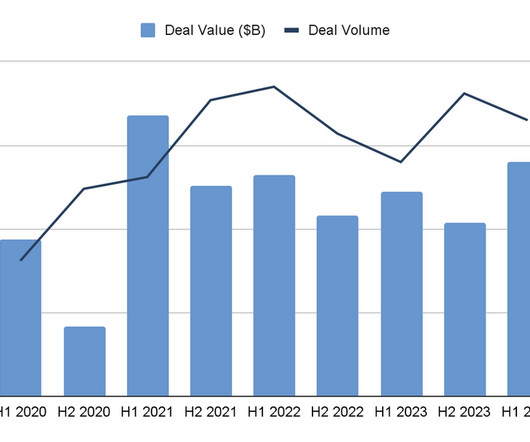

Cooley M&A

JANUARY 20, 2022

While 2020’s M&A landscape was characterized by whiplash volatility from choppy deal activity in the first half of the year to a surge in volume in the second half, that momentum accelerated in 2021, with no signs of slowing down heading into 2022. approved prescription cannabidiol medicine to its portfolio. driven assets.

Mergers and Inquisitions

APRIL 10, 2024

This happened for a few reasons: 1) Soaring Valuations – Many sources say that sports team valuations “outperformed” the S&P 500 over the past 20 years, which is a polite way of saying that many teams are now valued at extremely high multiples. When the fans are passionate, there are infinite ways to milk the brand’s value.

The TRADE

OCTOBER 18, 2023

Developed by the firm’s in-house innovation hub, Cboe Labs, the VIX1D Index measure the expected volatility of the S&P 500 Index over the current trading day. The trading venue also launched its Cboe 1-Day Volatility Index (VIX1D) in April, which seeks to measure single trading day volatility.

Cooley M&A

FEBRUARY 1, 2024

2023’s much-discussed downturn in mergers & acquisitions – with global M&A volume and value down 6% and 17%, respectively, from 2022 – was largely driven by the slowdown in the tech sector, with global tech M&A volumes down 51% year over year, while other sectors saw marked increases. [1] 10] Deal Point Data; Cooley analysis.

Mergers and Inquisitions

APRIL 19, 2023

Diversified Miners – These companies have a wide global portfolio of mines, and they extract, produce, and distribute just about every metal in the two categories above. The metals & mining team’s classification varies based on the bank. Most of the differences emerge on the mining side.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content