Earnings growth should continue to drive the S&P 500, says UBS

CNBC: Investing

OCTOBER 11, 2024

UBS believes that the S&P 500's profit growth in the third quarter could be between 8% to 10%, excluding the energy sector.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CNBC: Investing

OCTOBER 11, 2024

UBS believes that the S&P 500's profit growth in the third quarter could be between 8% to 10%, excluding the energy sector.

CNBC: Investing

JANUARY 8, 2024

Since bottoming in late October 2023, the "money center" banks reporting this week have outperformed the S&P 500 by an average of nearly 15%. Can this outperformance continue?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CNBC: Investing

MARCH 5, 2024

While the Nasdaq and S&P 500 have been soaring for over four months, cracks are beginning to show in some of the tech darlings. Take Palo Alto Networks (PANW), for instance.

Wall Street Mojo

JANUARY 17, 2024

What Is Profit And Loss Statement? A profit and loss (P&L) statement, sometimes called as an income statement, is a financial report that provides investors and outsiders with a financial overview of a company. Table of contents What Is Profit And Loss Statement? Example How To Read?

Software Equity Group

NOVEMBER 13, 2023

By aligning your company’s strategies and performance with their evolving priorities, you can enhance your appeal in the competitive landscape of software investments and acquisitions. In 2022, investors and buyers were keenly focused on gross revenue retention (GRR) and gross profit margin (GPM) as top metrics to target.

Lake Country Advisors

AUGUST 8, 2024

Accurate and appropriate valuation is one of the pillars of maximizing the profits from a business sale. It’s integral to ensuring that the sale benefits all stakeholders and should be one of your priorities before advertising it to potential buyers. Example Scenario: Suppose you want to value a technology company, TechCo.

Focus Investment Banking

MARCH 10, 2025

Corporate structure Whether youre a C-Corp or S-Corp can affect taxes at sale. Shifting focus to profitable, reliable customers strengthens cash flowwhat buyers ultimately value. Set Fair Market Rent If you own the property, charge the business a market-rate rent to reflect true profitability.

How2Exit

OCTOBER 6, 2022

Gross Margin: Gross Margin is one of the most important lines on your P&L and is the way buyers measure how efficiently your MSP makes money. It’s the best starting point toward achieving an optimal net profit. And unlike standard IT services businesses, buyers of MSPs expect annual growth to exceed 15%.

TKO Miller

AUGUST 30, 2023

The S&P 500 Index is up 16.5% Polypropylene prices are down 15% and polyethylene prices have dropped almost 8% over the last year, resulting in improved profitability for both flexible and rigid packaging. Packaging Trends Q2 M&A Update U.S.

Francine Way

JUNE 22, 2020

A discussion of the target’s financials typically starts with the P/L or Income Statement, followed by the Balance Sheet, and then the Cash Flow Statement. In discussing the P/L, I typically comment on: Revenue - by lines of business, whether they appear to be gross or net, and if there is any meaningful customer concentration.

Mergers and Inquisitions

MARCH 8, 2023

Commodity Hedge Fund Definition: A commodity hedge fund buys and sells futures contracts and other derivatives based on mining, energy, power, and agricultural products and earns profits via fundamental and technical analysis; the trading may be systematic, discretionary, or both. If you deliver 5,000 bushels, that’s a profit of $5,000.

Francine Way

JUNE 28, 2020

The Financial Update section typically starts with the presentation of the consolidated P/L (or income statement). When presenting the consolidated P/L, it is always helpful to note if specific items in the P/L are trending towards favorable or unfavorable, and if appropriate, the causes of these trends.

How2Exit

JUNE 16, 2024

E223: The Acquisitions Pilot Project: A Solution For 1st Time Buyers to Buy Lower Markets and Sell A Roll-Up - Watch Here About the Guest(s): Roger Best is a seasoned professional with a diverse background spanning mechanical engineering, law, and private equity.

How2Exit

FEBRUARY 25, 2023

These websites are often listed online on websites such as Flippa, where it’s possible to find great deals. It’s also possible to find websites that have been neglected and are not generating much revenue but could be turned around with some work. This can provide a significant boost to a website’s bottom line.

How2Exit

MARCH 20, 2023

He and his partners look for businesses that have been in operation for at least five years, show a profit, and have some systemization around them. Concept 2: Off-Market Deals Can Be Lucrative One of the most profitable strategies for businesses looking to acquire or merge with another company is to look for off-market deals.

How2Exit

SEPTEMBER 2, 2024

E241: Diving Deep into SME Acquisitions: Essential Insights, Strategies, and Success Secrets - Watch Here About the Guest(s): Danny O'Neill : Danny O'Neill is a seasoned entrepreneur with a rich background in sales and marketing. And profitability in M&A is super important." Cash is what kills companies.

How2Exit

OCTOBER 3, 2022

As the founder/owner of a Managed Services Provider (MSP), it’s important to know the value drivers that should inspire your business strategies -- whether you plan to sell today or in the future. It’s the best starting point toward achieving an optimal net profit.

Wizenius

APRIL 1, 2023

1) Apple: In 2013, Apple issued a $17 billion bond to return cash to shareholders and avoid repatriating overseas profits and incurring taxes. Apple's credit rating was AA+ from S&P and Aa1 from Moody's, which allowed it to borrow at a low interest rate. Ford's WACC at the time was around 9.7%.

How2Exit

OCTOBER 7, 2024

E247: Why Accurate Financials are Key to Success in Buying, Selling, and Valuing Businesses - Watch Here About the Guest(s): Ryan Hutchins is an accomplished entrepreneur and expert in the field of mergers and acquisitions. A QOE engagement, he explains, "provides a pure deep dive beyond what you read in a P&L or a tax return."

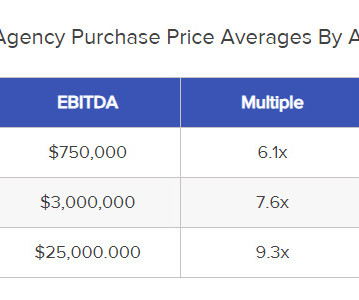

Sica Fletcher

APRIL 30, 2024

Preparing for an Insurance Agency Valuation Because the valuation process is really about determining the profitability of your insurance agency, any and all efforts should be made prior to the valuation to reduce costs and generate revenue. This figure is often averaged by calculating EBITDA over the course of several years.

Software Equity Group

FEBRUARY 26, 2024

Being aware of these terms and their implications can significantly enhance your ability to navigate negotiations, make informed business decisions, and demonstrate a comprehensive understanding of your company’s value. FCF: Free Cash Flow The amount of cash a company generates after deducting any capital expenditures.

Successful Acquisitions

SEPTEMBER 11, 2023

It’s a balance where numbers meet intuition, and neither aspect should be ignored. Purposes of Valuation Before diving into the nuts and bolts of valuation, it’s crucial to understand its purposes. It’s where the art of valuation truly comes into play.

The TRADE

DECEMBER 29, 2023

Firstly, with more data freely available in data networks it will become easier for buy- and sell-side firms to interact and collaborate, using data to make decisions about who they trade with and how they execute trades most effectively and profitably.

How2Exit

MARCH 13, 2023

He notes that he wished he had more time to prove the profitability of his business before the acquisition. This means that the business should be profitable and that the market should be favorable. Concept 2: Prepare For Acquisition Carefully Johnston's story also serves as a warning to those looking to be acquired.

Wall Street Mojo

JANUARY 15, 2024

For example, AIS may be a very simple ledger for various accounting, costing, and financial reports like Statement of Profit and Loss, Balance Sheet, etc. There are various elements that are used in the process, including employee data, taxation related and customer satisfaction related information, revenues , profits or expenses.

Mergers and Inquisitions

JANUARY 31, 2024

They might have separate teams for specific strategies or markets, but everything is run under a single Profit & Loss statement (P&L). There are very few real “requirements” besides the single PM / single P&L one above and the standard Limited Partner / General Partner structure that all hedge funds use.

How2Exit

MARCH 31, 2024

b' E199: Franchising: Unveiling the Wealth-Building Power of Franchising with Ralph Yarusso - Watch Here rn rn About the Guest(s): rn Ralph Yarusso brings a wealth of experience to the table, with a diverse background that began in military service. rn System support is vast in franchising.

Focus Investment Banking

OCTOBER 23, 2023

In the commercial tire business, the quest for profitability can sometimes feel like a struggle. Consider this scenario: after years of hard work and dedication, your tire business has grown, but its profit margins remain in the 3% to 4% range. This approach has several advantages: Diversification. Lower costs.

Sica Fletcher

MAY 15, 2024

This removes the effects of non-cash expenses on the agency, thus isolating the agency’s profitability because they can be different under the buyer’s management. In addition, third-party M&A institutions like S&P Global Data or Statista can provide more generalized data.

MergersCorp M&A International

NOVEMBER 1, 2024

Net Income and Profit Margins: Net income provides insight into the profitability of the business. Key metrics used include Price/Earnings (P/E) ratios, Price/AUM ratios, and enterprise value ratios (EV/EBITDA). By analyzing valuations of similar organizations, one can derive a contextual estimate of the AMC’s worth.

Sica Fletcher

APRIL 2, 2024

PE firms have taken up a larger space in the total number of insurance M&A acquirers, making the profit motive for acquiring a small agency a bigger factor influencing insurance M&A deals in the current market. Agency vs. Company: Which Is The Better Insurance M&A Deal?

Wall Street Mojo

JANUARY 15, 2024

This indicator was introduced by Tushar Chande and Stanley Kroll, two Canadian bankers, and technical analysts ; they first mentioned it in the book The New Technical Trader: Boost Your Profit by Plugging into the Latest Indicators , which came out in 1994. The indicator can be used in stocks , currencies, derivatives , and commodities.

Sica Fletcher

MAY 8, 2024

This will give you time to make necessary changes to the operational structure to make your agency more profitable, thus increasing the probability of a higher payout when it goes to market. Beyond proof of sustained profitability when analyzing these documents, look for: Liquid Assets. What Documents Do I Need? Let’s Talk.

How2Exit

MARCH 23, 2023

This could include the buyer's desired revenue, growth rate, and profit margins. Ad backs are expenses or benefits that the seller should add back to the profit and loss statement to increase the sale price of the business. Without accurate financials, it’s impossible to get an accurate evaluation of the business.

Sica Fletcher

JUNE 14, 2024

Determine EBITDA Earnings before interest, taxes, depreciation, and amortization (EBITDA) is used as a measure of the profitability of an insurance agency while adding back interest, taxes, depreciation, and amortization - all of which will vary depending on the circumstances of the new owner.

Sica Fletcher

SEPTEMBER 17, 2024

This valuation model is used largely in M&A settings to determine the value of a company as it would appear to a prospective buyer by adding interest, taxes, depreciation, and amortization costs back into the business’s profits, since these elements will be fundamentally different post-closing.

Software Equity Group

MARCH 13, 2023

On the surface, things looked rough: the Dow Jones, S&P 500, and the NASDAQ all finished the year with significant losses, with tech stocks hit particularly hard. Median EV/TTM Revenue Multiple Down from 2021’s high of 7.3x, 2022’s median EV/Revenue multiple of 5.6x was only a slight decline from 2020’s 5.7x

Software Equity Group

MAY 7, 2024

Learn more about the external influences shaping your SaaS company’s valuation multiple below. #1. Also of note, ERP / Business Management saw stable M&A volume in 2023, which mirrors its consistent growth and steady valuations in the public markets and further demonstrates the category’s mission-critical nature. #2.

Software Equity Group

MAY 8, 2024

Learn more about the external influences shaping your SaaS company’s valuation multiple below. #1. Also of note, ERP / Business Management saw stable M&A volume in 2023, which mirrors its consistent growth and steady valuations in the public markets and further demonstrates the category’s mission-critical nature. #2.

How2Exit

OCTOBER 10, 2023

Ron rn rn rn About The Guest(s): Juan Braschi is the CEO of Boopos, a company that helps talented buyers acquire businesses and provides flexible financing for buying e-commerce and software-as-a-service (SaaS) businesses. They assess the quality of revenues and financial metrics to determine the viability of the business.

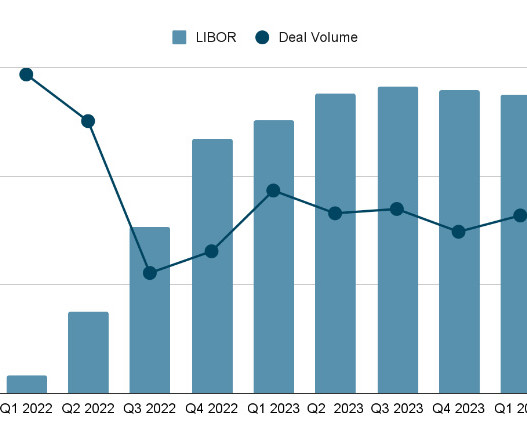

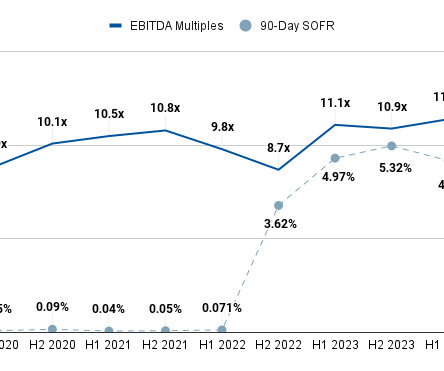

Sica Fletcher

MARCH 8, 2024

Small to Midsize Brokerages Are Becoming More Valuable Projections indicate that interest rates are likely to decrease in 2024, which will make larger brokerages a profitable option for acquirers again. If they do, then we can expect to see valuations and, by extent, EBITDA multiples for insurance agencies rise.

Sica Fletcher

MARCH 12, 2024

Insurance Agency Valuation: The Core Methods EBITDA An EBITDA ( earnings before interest, taxes, depreciation, and amortization ) valuation is a projection of a company’s profits that also includes the agency’s potential for overall profitability. SaaS, tech), those with very high projected growth rates, or for early-stage agencies.

Mergers and Inquisitions

DECEMBER 6, 2023

Beta-Neutral Portfolios: For example, if the S&P 500 goes up or down by 5%, your team’s portfolio should move by ~0%. Your ability to judge market sentiment is crucial, and you develop more of these skills in S&T and ER. Most funds run market-neutral strategies to achieve this (more on hedge fund strategies ).

Sica Fletcher

JULY 11, 2024

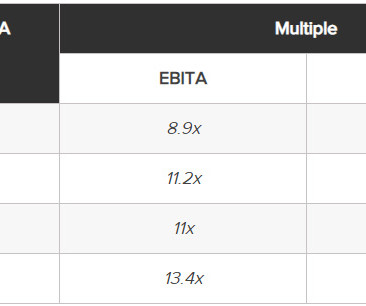

Insurance Brokerage M&A Multiples, 2024 The following sections offer additional context for the data in the table above by outlining the current insurance brokerage M&A market and providing insights from our team to make selling your brokerage smoother and more profitable once you get started.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content