These are the 10 most overvalued stocks in the S&P 500

CNBC: Investing

APRIL 18, 2024

CNBC Pro screened FactSet data for stocks in the S&P 500 that have the largest premium valuation compared to their recent history.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CNBC: Investing

APRIL 18, 2024

CNBC Pro screened FactSet data for stocks in the S&P 500 that have the largest premium valuation compared to their recent history.

CNBC: Investing

FEBRUARY 28, 2024

The S&P 500 today is higher quality and has lower earnings volatility than in prior decades, making it a "different animal," BofA's Savita Subramanian said.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CNBC: Investing

DECEMBER 16, 2024

There are still stock market bargains to be found heading into 2025, despite the S&P 500's lofty valuation.

Francine Way

JULY 11, 2017

Just as any home appraiser or credit officer does before going through the analytical exercise to produce a score for a home or a borrower, valuation professionals go through several steps of preparation before the actual exercise of producing a number that can be used as a value of a company.

Francine Way

JUNE 22, 2020

To pick up where we last left off with valuation, I will cover the topic of a Merger Relative Valuation in this blog post and move on to other non-valuation topics from here. A discussion of the target’s financials typically starts with the P/L or Income Statement, followed by the Balance Sheet, and then the Cash Flow Statement.

The TRADE

JULY 9, 2024

Market data provider QUODD has enhanced its QX digital platform by including more comprehensive bond data from S&P Global Market Intelligence. S&P Global Market Intelligence provides the QX digital platform independent pricing and liquidity data for bonds to support back-office processing.

Francine Way

JULY 12, 2017

As I mentioned in my last post, Discounted Cash Flow (DCF) is a valuation method that uses free cash flow projections, a discount rate, and a growth rate to find the present value estimate of a potential investment. Calculate the Equity Value and the per-share Equity Value - this number would serve as the base case share price valuation.

CNBC: Investing

SEPTEMBER 13, 2023

CNBC Pro looked for stocks with both the largest valuation premium in the S&P 500 and that fewer than 50% of analysts covering them rate a buy.

Deal Lawyers

APRIL 23, 2024

Despite a bit of a checkered reputation, non-SPAC reverse mergers are still a thing, and this excerpt from a recent WilmerHale memo (p. 14) says that there’s been an uptick in these deals and that, for some companies, they are an attractive alternative to an IPO: The trend of declining public company valuations (including a […]

Sun Acquisitions

OCTOBER 13, 2023

Valuation lies at the heart of every successful M&A transaction, providing a framework to determine the worth of a target company. Valuation techniques in M&A involve a comprehensive assessment of financial, operational, and market factors. Discounted Cash Flow (DCF) analysis is a commonly used income-based valuation technique.

Successful Acquisitions

SEPTEMBER 11, 2023

The Verdict is In on the Sell Side: Business Valuation Basics By Brian Goodhart Valuation is a fundamental aspect of the complex and intricate world of mergers and acquisitions. Today, we will delve into the intricate art and science of valuation, exploring its various components and purposes.

Lake Country Advisors

AUGUST 8, 2024

Accurate and appropriate valuation is one of the pillars of maximizing the profits from a business sale. It’s integral to ensuring that the sale benefits all stakeholders and should be one of your priorities before advertising it to potential buyers.

Sun Acquisitions

NOVEMBER 17, 2023

Valuation is the process of determining the worth of a business, and it plays a pivotal role in M&A transactions. Why Market Value Matters in M&A Valuation is the cornerstone of any M&A transaction. Why Market Value Matters in M&A Valuation is the cornerstone of any M&A transaction.

CNBC: Investing

MARCH 20, 2025

CNBC Pro used LSEG data to find widely-recommended companies in the S&P 500 that are cheap, based on where their stocks have changed hands in the past.

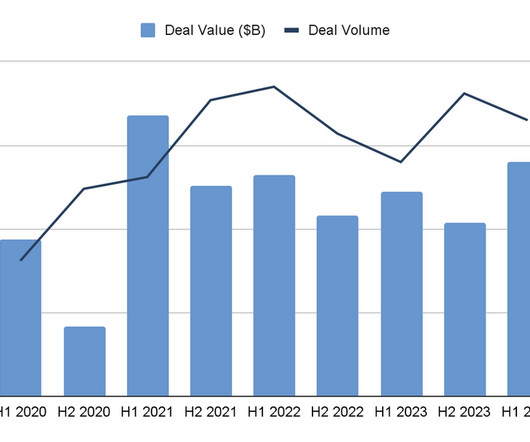

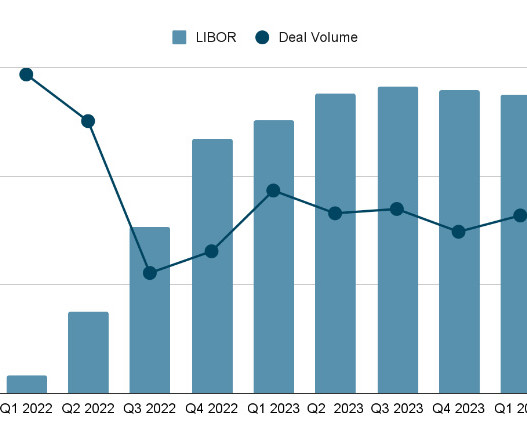

Sica Fletcher

JUNE 11, 2024

The following report contains our projections for Q3 2024 insurance broker valuation multiples. Insurance Broker Valuation Multiples: Q3 2024 Projections Using these numbers as a baseline, let’s examine the insurance industry more closely to identify influential factors behind its specific changes. as of H1 2024.

Sica Fletcher

OCTOBER 16, 2024

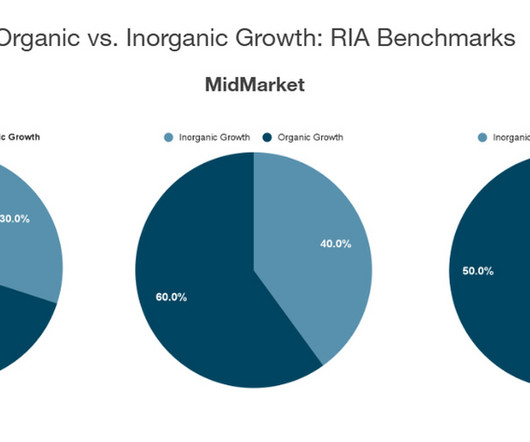

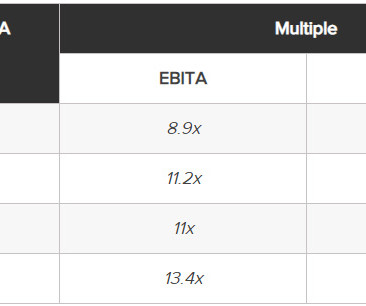

The following article examines valuation multiples for registered investment advisor (RIA) firms as of 2024, based on data gathered from our SF Index and available third-party sources. How these client demographics affect RIA valuations really depends on what the buyer is looking for, as indicated by the table below.

Software Equity Group

MAY 7, 2024

But what are the key influences shaping valuation multiples in today’s M&A deals? As you contemplate your exit strategy, it becomes increasingly crucial to understand the external factors driving the valuation of your SaaS company. It’s important to remember that no key metric exists in a vacuum.

Software Equity Group

MAY 8, 2024

But what are the key influences shaping valuation multiples in today’s M&A deals? As you contemplate your exit strategy, it becomes increasingly crucial to understand the external factors driving the valuation of your SaaS company. It’s important to remember that no key metric exists in a vacuum.

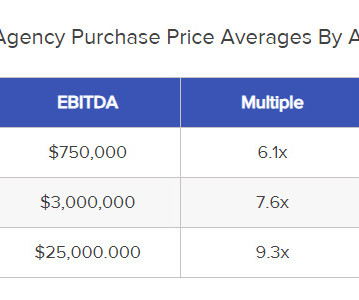

Sica Fletcher

MARCH 12, 2024

As one of the most active M&A firms in the insurance sector, we are frequently asked how insurance agency valuations work. This article discusses the fundamentals of insurance agency valuations, plus a few lesser-known factors that play into these processes before we give an overview of the insurance M&A market in 2024.

TKO Miller

AUGUST 30, 2023

middle market valuation multiples and deal volume are down slightly through Q2 of 2023. The S&P 500 Index is up 16.5% this year through June 2023, but middle market valuations are down approximately 8% based on the TKO Miller analysis. Packaging Trends Q2 M&A Update U.S.

Sica Fletcher

MARCH 14, 2024

Insurance agency valuation is a critical component of running an M&A deal, but executing this multi-step process well requires a great deal of specialized education and experience. In addition, getting the valuation process started demands a hefty bill and entails poring over extensive documentation for several weeks.

How2Exit

OCTOBER 6, 2022

Revenue Growth: While demonstrated revenue growth and a solid pipeline will lend itself to higher valuations, the quality of that revenue growth is also important. Gross Margin: Gross Margin is one of the most important lines on your P&L and is the way buyers measure how efficiently your MSP makes money.

Mergers and Inquisitions

MAY 3, 2023

To be fair, in some industries – like commercial banks and insurance within FIG – the DDM is a core valuation methodology. In other words, you profit based on the company’s dividend s and the potential increases in its stock price over time. The post The Dividend Discount Model (DDM): The Black Sheep of Valuation?

Focus Investment Banking

MARCH 10, 2025

Corporate structure Whether youre a C-Corp or S-Corp can affect taxes at sale. Optimize Working Capital (One Year Ahead) What It Is: Net Working Capital (NWC) is Current assets minus current liabilities (A/R + Inventory A/P + Accrued Expenses), excluding cash, which you keep (in a typical cash-free, debt-free transaction).

Sica Fletcher

APRIL 30, 2024

This article presents a step-by-step guide on how to value an insurance agency - both in the sense of how a valuation agency/M&A advisor goes about valuation, and also in terms of what insurance agency owners can do to maximize their valuation prior to running an M&A deal.

Wall Street Mojo

JANUARY 17, 2024

A profit and loss (P&L) statement, sometimes called as an income statement, is a financial report that provides investors and outsiders with a financial overview of a company. The P&L outcome plotted on a trendline assists investors in understanding the organization’s performance over time.

Wizenius

APRIL 8, 2023

Equity Value (today) = Equity Value at end of forecast period/ (1+Target rate of Return)^n 4) Because this is the valuation of the start-up before the VC invests his/her money in the business it is known as Pre-Money Valuation of the start-up 5) VC investors receive an equity share of the business in exchange for their investments.

Sica Fletcher

JUNE 14, 2024

M&A professionals prefer it over other valuation methods for this reason, because it provides buyers with a clearer picture of how much the agency is worth to them. While valuation multiples – especially for private companies – have been a hidden source of information for decades, it has become more transparent in the last few years.

How2Exit

OCTOBER 3, 2022

As the founder/owner of a Managed Services Provider (MSP), it’s important to know the value drivers that should inspire your business strategies -- whether you plan to sell today or in the future. It’s the best starting point toward achieving an optimal net profit. Within the MSP space, data security remains white hot.

Sica Fletcher

FEBRUARY 8, 2024

S&P Global’s 2023 Market Intelligence League Table Released NEW YORK, NY - February 8, 2024 - Sica | Fletcher, a premier financial advisory firm, retains its commanding presence in the #1 spot on S&P Global’s Market Intelligence League Table, a position the firm has held quarter-over-quarter since 2017.

Sica Fletcher

OCTOBER 23, 2024

Who Performs A Valuation? RIA valuations are typically performed by one of three parties: The M&A Advisor A Third-Party Specialist The Seller Themselves Although many sellers attempt to perform their own valuations, we strongly recommend against this.

Sica Fletcher

SEPTEMBER 17, 2024

When insurance agency sellers have already met with prospective buyers, they may have been offered a valuation based on their “adjusted EBITDA.” The following article provides a brief overview of EBITDA and adjusted EBITDA valuations for insurance agencies. What Is EBITDA? What Is Adjusted EBITDA?

Wizenius

JUNE 12, 2023

Identify companies with similar risk profiles and revenue volatility and analyze their valuation multiples, such as price-to-earnings (P/E) ratio or enterprise value-to-EBITDA (EV/EBITDA) ratio. Apply these multiples to the subject company's financial metrics to derive a valuation range. Thanks, Pratik S

MergersCorp M&A International

NOVEMBER 1, 2024

A common approach to valuation is to consider the fee structure: AMCs may charge a percentage of AUM (often ranging from 0.5% Valuation Methods When it comes to the actual valuation, several methods can be employed: Comparable Company Analysis (Comps): This method involves comparing the AMC to similar firms in the industry.

Focus Investment Banking

JULY 16, 2024

This was despite a strong overall market that pushed the S&P 500 up 3.9% However, this performance once again lags the broader indices by a fairly wide margin, as both the S&P 500 and NASDAQ gained more than 20% over the past year. and the NASDAQ up 8.3% over the same three-month time frame.

How2Exit

MARCH 23, 2023

It is also important to have an accurate valuation of the business and to be aware of any liabilities or assets that could affect the sale. For example, if the seller owns an e-commerce business with a majority of its sales coming from FBA, they may have a subscription to Jungle Scout or Helium 10 which can be added back to the P&L.

Mergers and Inquisitions

MARCH 8, 2023

As the delivery date approaches, the underlying commodity’s price and its futures price converge. The Skills Required for Commodity Trading You do not use traditional financial statement analysis or valuation in commodity trading because the underlying asset is a futures contract , not a stock.

Mergers and Inquisitions

JANUARY 31, 2024

They might have separate teams for specific strategies or markets, but everything is run under a single Profit & Loss statement (P&L). There are very few real “requirements” besides the single PM / single P&L one above and the standard Limited Partner / General Partner structure that all hedge funds use.

Sica Fletcher

APRIL 2, 2024

Insurance M&A Deal Valuation, 2024 Starting out in 2024, EBITDA and revenue multiples are in a good place, experiencing modest YoY growth despite the economic downturn of the last 18 months. In deals with the highest earnout, business owners turn to a specialized M&A advisory firm to handle negotiations and oversee valuations.

Wall Street Mojo

JANUARY 15, 2024

Financial Modeling & Valuation Courses Bundle (25+ Hours Video Series) –>> If you want to learn Financial Modeling & Valuation professionally , then do check this Financial Modeling & Valuation Course Bundle ( 25+ hours of video tutorials with step by step McDonald’s Financial Model ).

Wall Street Mojo

JANUARY 15, 2024

About Loan [P*R*(1+R)^N]/[(1+R)^N-1] Wherein, P is the loan amount R is the rate of interest per annum N is the number of period or frequency wherein loan amount is to be paid Loan Amount (P) The loan Amount $ ROI per annum (R) Rate of Interest per annum % No. How to Calculate? Each of such points cost 1% of the loan amount.

Sica Fletcher

MARCH 8, 2024

Starting in H2 2022, the insurance M&A market has seen a notably difficult 18-month period, afflicted with high interest rates, lowered deal volumes, and lowered valuations. If they do, then we can expect to see valuations and, by extent, EBITDA multiples for insurance agencies rise. Learn more at , ,, SicaFletcher.com.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content